Ethereum’s price action has been consolidating in a structured range, implying an accumulation phase. The price has been choppy, failing to break above key resistance levels.

This behavior aligns with market participants accumulating their positions instead of immediately pushing the price higher or lower.

Each Gap Zone available to the market below the price range at which it is found suggests a potential liquidity target.

These gaps tend historically to be gravitated to by price. They represent areas of unfilled liquidity in which buyers and sellers alike may step up with large orders.

Ethereum’s price finds itself near this zone as things stand. If it moves lower into this region, it could build strong liquidity here to trap the short sellers and force liquidations, leading to a swift, bullish reversal.

Open Interest Rises, Indicating Traders Are Actively Opening New Positions

A deeper look into the market reveals a surge in Open Interest. Charts highlight a steady rise in Open Interest.

– Advertisement –

This indicates that new capital flows into Ethereum’s derivatives market despite its sideways price movement.

The New Position zone marked in the chart shows a clear uptrend in Open Interest.

This suggests that traders actively engage with the market, anticipating a breakout or preparing for a reversal.

This increase in Open Interest strongly indicates heightened speculative activity. This is as more market participants enter positions, potentially leading to increased volatility shortly.

ETH Open Interest Charts | Source: CryptoQuant

Typically, a rise in Open Interest without a corresponding price breakout implies that market participants are positioning themselves in anticipation of a more significant move.

An upward breakout could follow if most of these positions are leveraged longs. Conversely, a short squeeze may be on the horizon if short positions dominate.

This forces bearish traders to cover their positions at higher prices, further fueling an upward rally.

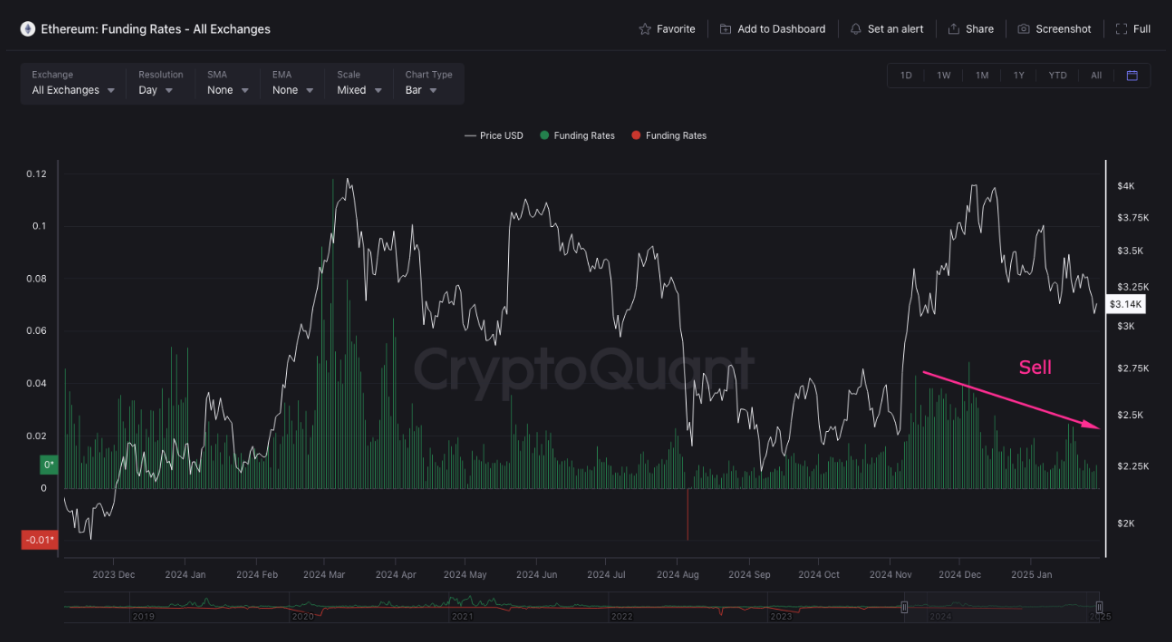

Funding Rates Show Increasing Short Positions, Hinting at Potential Reversals For Ethereum Price

To be sure, increased open interest reflects the influx of capital into Ethereum’s market. Funding rates charts show that funding rates have been declining.

This means more people are opening up short positions, expecting the price to drop.

In the futures market, funding rates will be essential as they denote the friction between long and short positions. Short traders pay a fee to long traders at negative funding rates.

It’s a familiar dynamic that can go before blasting off on what would be a short squeeze.

This is when a short rally you couldn’t see coming drives short sellers to close their positions, exacerbating the wicked move higher.

ETH Funding Rates Chart | Source: CryptoQuant

The conditions are currently ripe for such a squeeze in the market. The chart shows that declining funding rates in the Sell Zone suggest shorts are building up.

A liquidation cascade could unfold if Ethereum’s price falls into the Gap Zone. This is as short sellers’ stop-loss orders are acted upon, sending the price soaring significantly.

A High-Liquidity Trap for Shorts?

In its current market structure, Ethereum is poised explicitly for a Potential Price Reversal driven by the accumulation of liquidity in the Gap Zone.

This combination of sideways price movement, an increase in Open Interest, and decreasing Funding Rates indicates derivatives traders are preparing for a strongly directional move.

This is despite the current bearish sentiment of derivatives traders.

ETH Open Interest Charts | Source: CryptoQuant

If Ethereum falls to the Gap Zone, this would be an ideal entry-level for aggressive buyers, as larger liquidity in this region would become a good support level.

If we bounce from this level, many short positions will be invalidated. This facilitates movement quite rapidly when pushed by liquidations.

Read the full article here