A recent report from Coin Metrics highlights how post-election trading in bitcoin (BTC) has reached unprecedented levels, with the options market indicating strong investor optimism.

Coin Metrics Study Shows Increased Call Option Interest

Coin Metrics’ analysis provides a detailed look at bitcoin’s rally following the recent U.S. election, which saw unprecedented trading volumes and new all-time highs for BTC. According to the report, bitcoin’s price rose from $67,000 to nearly $90,000 within days, driven by heightened open interest in options markets.

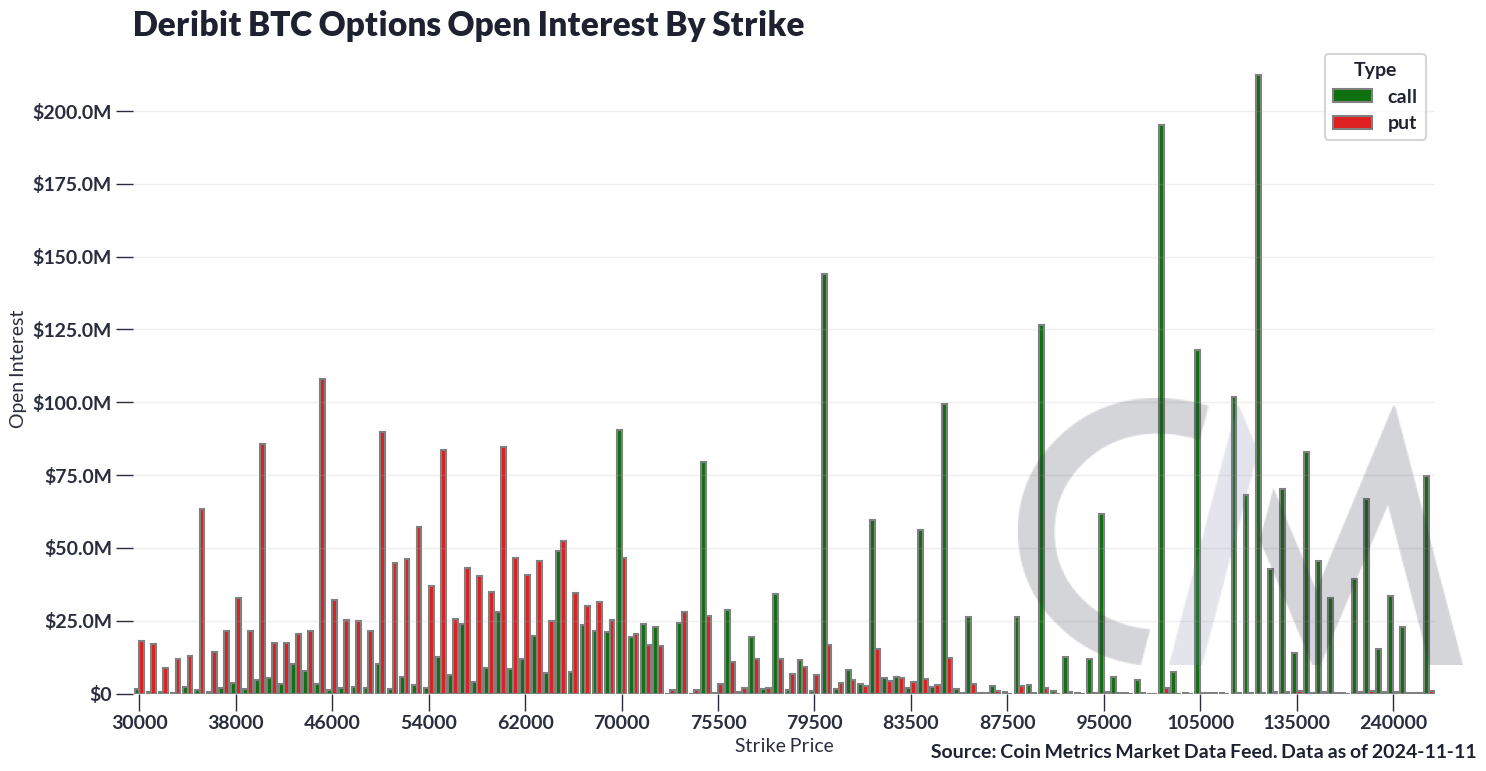

This increased activity in call options, particularly at higher price levels, signals a prevailing bullish sentiment. Analysts at Coin Metrics note that the dramatic rise in open interest aligns with increased confidence in bitcoin’s regulatory future, following extensive campaign discourse surrounding digital asset regulation.

Source: Coin Metrics Market Data Feed

The Coin Metrics study also explores the role of implied volatility (IV) as a metric reflecting market sentiment. Analysts observed a spike in bitcoin‘s implied volatility leading up to Election Day, reflecting general market uncertainty, which then sharply declined once the election results were confirmed.

This reduction in IV indicated a decrease in perceived risk, which Coin Metrics attributes to traders’ optimistic outlook on regulatory clarity following the election. According to the report, the temporary increase in IV and subsequent drop mirrors the market’s broader sentiment shifts as election results unfolded.

Source: Coin Metrics Market Data Feed

Options market data in the Coin Metrics report shows a distinctive skew toward call options expiring over the next several months at strike prices between $90,000 and $120,000. This positioning, according to Coin Metrics researchers, suggests that options traders expect bitcoin to appreciate further in the medium term.

Elevated call option interest in this price range reflects a significant shift toward bullishness among traders, reinforcing the view that participants are preparing for potential upward price movements in the coming months. Coin Metrics’ report concludes that the recent election’s impact on bitcoin markets is likely twofold: an immediate response to perceived regulatory clarity and a sustained bullish outlook as traders position for future price increases.

Analysts emphasize that while enthusiasm around the election has fueled a price surge, it remains uncertain if this momentum will hold. The options market data, however, suggests a potentially sustained interest in BTC price growth, as market participants continue to watch regulatory developments closely.

Read the full article here