XRP traded at $2.25 on June 4, 2025, with a market capitalization of $131 billion and a 24-hour trading volume of $2.26 billion. The intraday price ranged between $2.23 and $2.28, suggesting constrained volatility ahead of a potential breakout.

XRP

The 1-hour candlestick chart for XRP displays a tight consolidation pattern between $2.24 and $2.26, with immediate support around $2.185 and resistance near $2.283. Volume surges on green candles indicate increasing buyer interest, which reinforces the potential for an upward scalp breakout. Recommended trading strategy in this timeframe involves scalping entries around $2.24, setting a stop-loss below $2.22, and targeting profits at $2.28 and $2.30–$2.32. Market participants should monitor for a breakout above $2.283, which could validate a continuation of the short-term bullish momentum.

XRP/USDC 1-hour chart on June 4, 2025.

The 4-hour chart reflects a mid-term recovery structure, characterized by higher lows forming since May 31. XRP found solid support between $2.08 and $2.12, while moderate volume increases on bullish candles affirm growing market confidence. A dip-buying strategy near $2.20–$2.22 appears attractive as long as prices remain above the recent higher low. If this structure holds, traders may look for profit-taking at $2.28, with a breakout extending gains toward the $2.30–$2.35 range. A breakdown below $2.20 would weaken this outlook, shifting short-term sentiment to neutral or bearish.

XRP/USDC 4-hour chart on June 4, 2025.

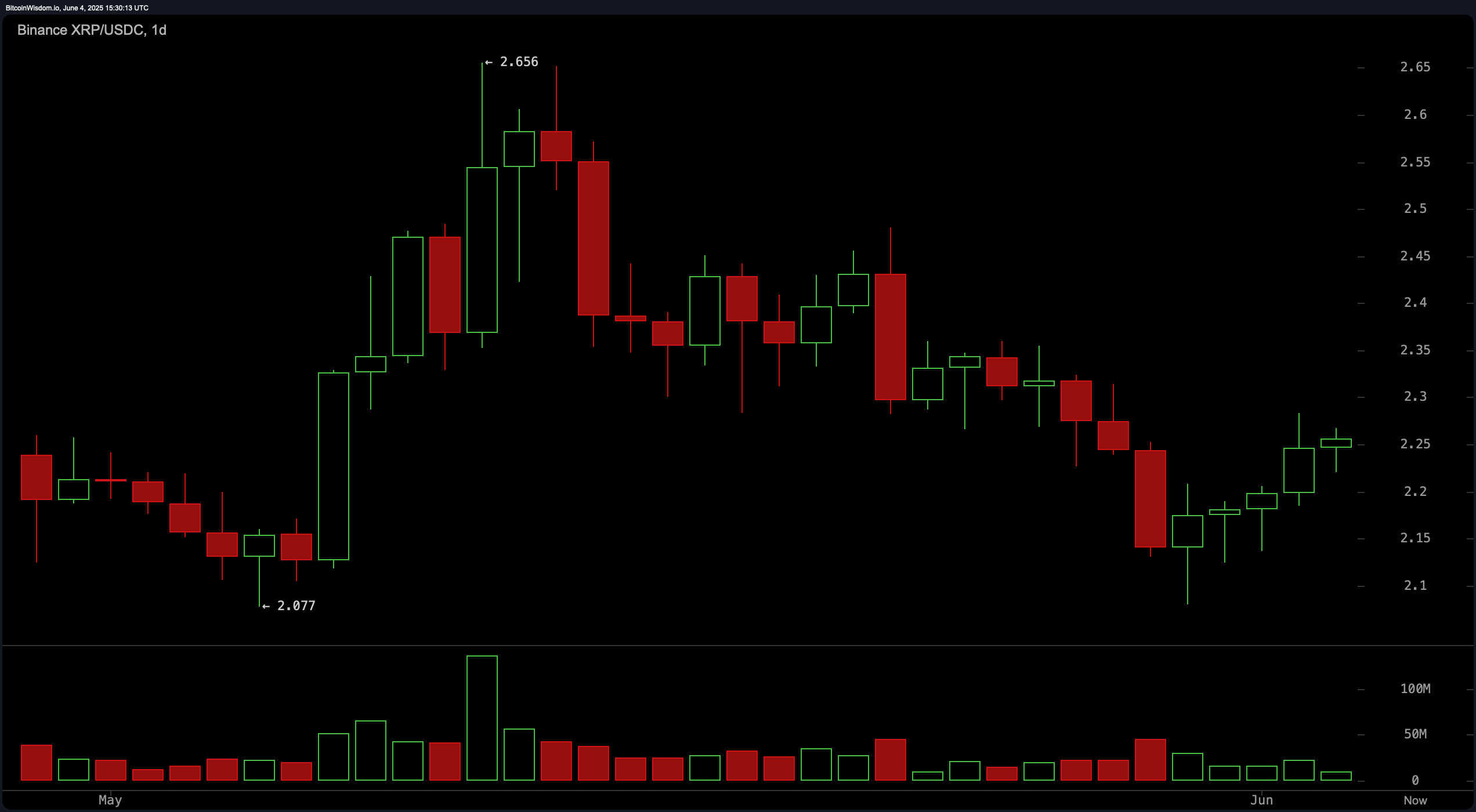

On the daily chart, XRP continues to show signs of macro caution despite a recent bullish reversal from a descending trendline. Support near $2.08 has proven resilient, while resistance stands around $2.65. The price trend has been marked by lower highs and lower lows since the recent peak, but a spike in buying volume following a sharp drop suggests early-stage accumulation. Key entry zones span from $2.15 to $2.22, with upside targets at $2.35 and $2.50 if bullish momentum continues. However, maintaining a tight stop-loss under $2.10 is advised given prevailing macro uncertainties.

XRP/USDC 1-day chart on June 4, 2025.

The oscillator suite presents a largely neutral stance with exceptions. The relative strength index (RSI) at 48.13, Stochastic at 38.32, commodity channel index (CCI) at -49.94, average directional index (ADX) at 16.94, and Awesome oscillator at -0.11816 all suggest market indecision. However, the momentum indicator at -0.08642 signals a mild negative pressure, corroborated by the moving average convergence divergence (MACD) level of -0.02589, which also issues a bearish signal. These divergences hint at a mixed market mood that could shift based on macroeconomic drivers or technical breakouts.

The moving averages (MAs) point to a split narrative across timeframes. The 10-period Exponential Moving Average (EMA) and 10-period Simple Moving Average (SMA) are both bullish at $2.24465 and $2.23449, respectively. In contrast, the 20, 30, 50, and 200-period SMAs—spanning up to $2.32760—are bearish, indicating longer-term resistance. Notably, the 100-period SMA at $2.25320 and the 200-period EMA at $2.08041 suggest latent bullish potential if key resistances are overcome. Traders should weigh these indicators against price action and volume before entering medium- or long-term positions.

Bull Verdict:

XRP’s current technical setup suggests a bullish undercurrent, particularly on the shorter timeframes where volume and structure support a continuation of upward momentum. If key levels such as $2.28 and $2.35 are broken with volume confirmation, the path toward $2.50 becomes technically viable. This scenario favors a bullish outlook, provided support at $2.20 and $2.08 remains intact.

Bear Verdict:

Despite intraday strength and short-term recoveries, XRP faces broader resistance and conflicting momentum signals, particularly from longer-term moving averages and oscillators issuing sell signals. A failure to break above $2.28 or a drop below $2.20 could invalidate bullish setups and reinforce the macro downtrend. Until XRP reclaims $2.50 with conviction, bearish caution remains warranted.

Read the full article here