Data tracked by 21.co shows $1.08 billion in Treasury notes has been tokenized through public blockchains.

The tally has risen nearly 10-fold since January 2023 amid elevated interest rates worldwide.

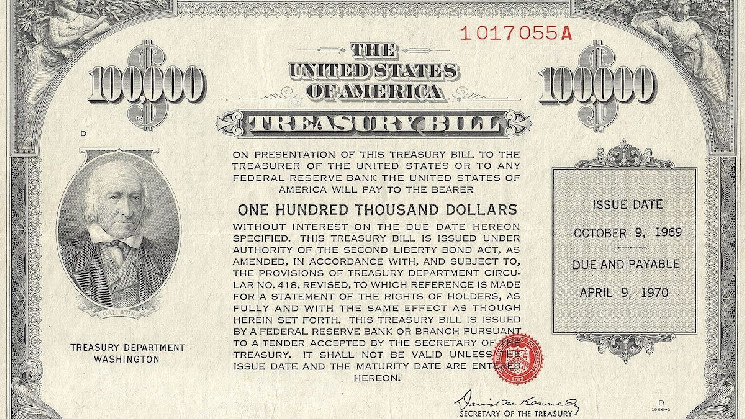

The market for tokenized U.S. Treasury debt is booming.

The market value of Treasury notes tokenized through public blockchains like Ethereum, Polygon, Valanche, Stellar and others has crossed above $1 billion for the first time, data tracked by Tom Wan, an analyst at crypto firm 21.co, show.

Tokenized Treasuries are digital representations of U.S. government bonds that can be traded as tokens on the blockchain. The market value has risen nearly 10-fold since January last year and 18% since traditional finance giant BlackRock announced Etheruem-based tokenized fund BUIDL on March 20.

As of writing, BUILD is the second-largest such fund, with a tokenized value of $245 million, trailing only Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (FOBXX) – one share of which is represented by the BENJI token – which led the pack with $360.2 million in deposits.

“Just happened, $1B Total Tokenized U.S. Treasuries on Public Blockchains. Blackrock’s BUIDL increased by 400% from 40M to 240M supply in a week,” Wan posted on X. “OndoFinance is now the largest holder of BUIDL, holding 38% of the total supply. Now Ondo’s OUSG is fully backed by BUIDL.”

The rapid rise in Treasury yields in the past two years has fueled demand for their tokenized versions. The 10-year yield, the so-called risk-free rate, has risen to 4.22% from 1.69% since March 2022, denting the appeal of lending and borrowing the dollar-pegged stablecoins in the decentralized finance market.

Investing in tokenized Treasuries can help crypto investors diversify their portfolio, allowing them to settle transactions on any given day.

“The beauty of tokenization, [is] you can settle the transaction 24/7,” Wan said.

Read the full article here