Pepe (PEPE) has recorded an impressive price surge over the past day amid inflated whale activity.

PEPE is up by 18.5% in the past 24 hours and is trading at $0.0000080 at the time of writing. The meme coin’s market cap increased to $3.31 billion, making it the 37th-largest digital asset at the reporting time.

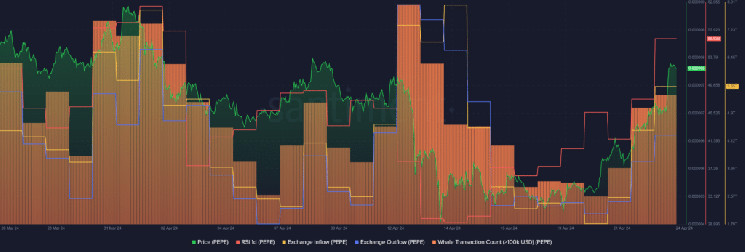

PEPE price, RSI, whale activity and exchange activity – April 24 | Source: Santiment

Moreover, the PEPE daily trading volume rallied by 62%, reaching $1.64 billion. Data shows that 46.8% of the meme coin’s trading activity, over $768 million, comes from the Binance crypto exchange.

On April 11, Coinbase announced to list the Pepe perpetual futures contract on its platform, but had to delay the operation due to “technical reasons” on April 18. After a five-day pause on April 23, the exchange announced the 1000PEPE-PERP contract was available for non-U.S. residents.

You might also like: Capital inflows into spot Bitcoin ETFs reach $62m

Our 1000PEPE-PERP market is now in full-trading mode on Coinbase International Exchange and Coinbase Advanced. Limit, market, stop, and stop limit orders are all now available. pic.twitter.com/hO32wARVFu

— Coinbase International Exchange 🛡️ (@CoinbaseIntExch) April 23, 2024

According to data provided by Santiment, the number of whale transactions consisting of at least $100,000 worth of PEPE increased by 11% over the past day — rising from 246 to 273 unique transactions.

The meme coin’s Relative Strength Index (RSI) also increased from 46 to 56 in the past 24 hours, per Santiment. This movement shows that PEPE is slightly overheated and overvalued at this price point and a moderately higher price volatility would be expected.

An RSI of lower than 50 could potentially mean that PEPE might be in good condition for a further price rally.

Data from the market intelligence platform shows that Pepe’s exchange activity has also increased. Per Santiment, 5.65 trillion PEPE tokens entered the exchanges in the past 24 hours while 4.87 trillion coins flowed out of the exchange in the same timeframe.

The 780 billion PEPE net inflow into the exchanges shows that some investors might be looking for short-term profits until further market movements.

Read more: SEC delays Franklin Templeton spot Ethereum ETF

Read the full article here