The soon-to-be 47th president of the United States, Donald John Trump, is already mapping out his economic dream team, and Federal Reserve Chair Jerome Powell is not part of it.

Trump is reportedly looking to replace Powell when his term ends in 2026, and the name at the top of his list is Kevin Warsh.

Warsh is a former Fed governor and Wall Street heavyweight, and he met with Trump this week at Mar-a-Lago. According to insiders, the plan would position Warsh as Treasury Secretary first, then move him into the Fed’s top spot.

The arrangement isn’t final, but Warsh is one of the leading contenders. Other names being considered for high-level economic roles include Marc Rowan, CEO of Apollo Global Management, and hedge fund manager Scott Bessent.

One scenario involves Bessent running the National Economic Council before taking over as Treasury Secretary, leaving Warsh free to step into Powell’s shoes at the Fed.

“President-Elect Trump is making decisions on who will serve in his second administration,” said Karoline Leavitt, a spokeswoman for Trump’s transition team. “Those decisions will continue to be announced by him when they are made.”

Trump vs. Powell: The history and the stakes

Trump and Powell have a complicated history. Back in 2018, he nominated Powell to lead the Fed, but it didn’t take long for their relationship to implode. Trump wanted aggressive rate cuts to stimulate growth, but Powell refused to play along.

The clashes became public, with Trump calling out Powell repeatedly on Twitter and in speeches. Powell, in turn, stuck to his guns, emphasizing the Fed’s independence.

Now, Trump is coming back with a vengeance. He has big plans for the economy, including tax cuts, massive infrastructure spending, and an even tougher stance on trade tariffs. These are likely to ignite inflation, and Trump will want a Fed chair who’s willing to cut rates at the drop of a hat. That person isn’t Powell.

Economists warn that another round of Trump-Powell battles is inevitable if Powell stays on. Joseph LaVorgna, Trump’s former chief economist, said the potential for conflict is super high.

“When they don’t know what to do, oftentimes they don’t do anything,” he said, referring to the Fed. “That may be a problem if the president feels like rates should be lowered.”

For Powell, the challenge will be navigating Trump’s expansionary fiscal policies without losing control of inflation. During Trump’s first term, inflation was low, and Fed rate hikes stayed modest. This time, it’s a different ballgame. Inflation is already running hot, and Powell’s options for keeping it in check are limited.

Kevin Warsh: Trump’s Fed favorite

Kevin Warsh is no stranger to the Fed, having served as a governor during the 2008 financial crisis. Warsh has a reputation for being market-savvy and politically shrewd, which makes him an appealing choice for Trump.

Warsh also shares Trump’s preference for lower interest rates and less regulation, aligning perfectly with the president’s economic goals.

If Warsh takes over at the Fed, expect a major change in policy. Powell has prioritized fighting inflation, even if it means keeping rates high for longer. Warsh, on the other hand, would likely focus on stimulating growth, even at the risk of letting inflation creep higher.

Markets brace for impact

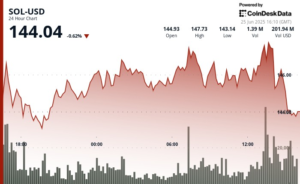

Wall Street is already watching the Fed closely, and Trump’s plans are adding to the uncertainty. Futures traders have been revising their expectations for interest rate cuts, with the odds of a December cut now at 50%, down from near certainty just a week ago.

Projections for additional cuts through 2025 have also dropped, reflecting the market’s growing nervousness about inflation and the Fed’s next moves.

Fed Governor Michelle Bowman isn’t helping calm those nerves. This week, she said progress on lowering inflation has “stalled,” a clear signal that she’s not in favor of cutting rates anytime soon. Investors are now bracing for more volatility as the Fed weighs its options.

Joseph Brusuelas, chief economist at RSM, said the tension between the White House and the Fed is only going to escalate. “All roads lead to tensions between the White House and the Fed,” he said. “It won’t just be the White House. It will be Treasury, it’ll be Commerce, and the Fed all intersecting.”

The stakes couldn’t be higher. Trump’s economic agenda depends on the Fed’s cooperation—or at least its lack of resistance. For the Fed, the challenge is finding the right balance between growth and inflation.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap

Read the full article here