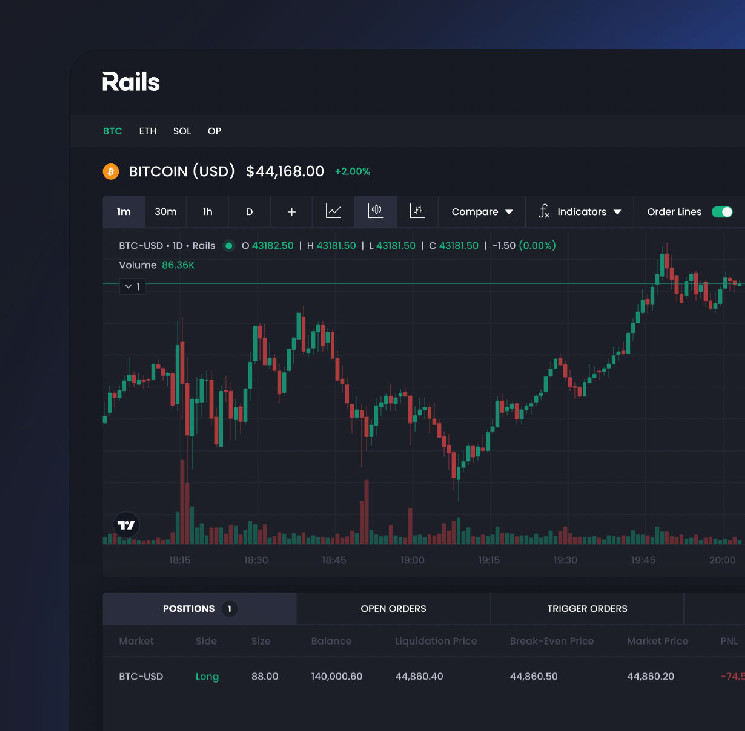

Rails, the self-custodial crypto perpetuals exchange, is pioneering a groundbreaking approach to crypto trading. By leveraging audited smart contracts on the blockchain and employing zero-knowledge proofs, Rails ensures that users have full control over their funds, thereby eliminating the risk of fraud and theft.

—

Unlike platforms that swing to extremes of centralization or decentralization, Rails strikes a balance, offering a solution that prioritizes both efficient trading and user ownership. This innovative approach has garnered significant attention, leading to a recent funding round of $6.2 million from Slow Ventures, Round13 Capital, and CMCC Global.

Rails’ unique selling point lies in its self-custodial feature, allowing users to maintain complete control of their funds through audited smart contracts on the blockchain. This approach mitigates the risk of fraud and theft while ensuring transparency and security in crypto trading.

Sam Lessin, General Partner at Slow Ventures, expressed confidence in Rails, stating, “Rails has built the best solution from a product and technical standpoint, complemented by a highly experienced management team.” The platform’s emphasis on user trust and security has resonated with traders seeking a reliable alternative to centralized exchanges.

“I was a power user of FTX, both professionally and personally. I knew that a replacement was desperately needed but also recognized that we must ensure the trust, security, and safety of our users’ funds through self-custody,” said Satraj Bambra, Co-Founder and CEO of Rails.

“We utilize a centralized order book to drive the best execution combined with a decentralized solution for self-custody on the blockchain. This ensures that traders always have full control over their funds, without sacrificing speed or efficiency.”

Satraj Bambra, Co-Founder & CEO of Rails

The founding team behind Rails boasts decades of combined experience in the crypto and tech industries. Satraj Bambra, a Managing Partner at Round13 Capital, brings invaluable product and trading expertise, while co-founder Megha Bambra’s technical prowess stems from her tenure at Grindr and StellarX.

Rick Marini, co-founder, President & COO, brings decades of operating expertise as a successful 3x founder, and highly accomplished Silicon Valley investor, with a strong track record in crypto investments since 2014. Rick recently took Grindr public on the NYSE, as COO, with a market cap of $2 billion.

Join the Waitlist

As Rails prepares to launch its platform, traders can join the waitlist to experience the future of crypto perpetuals trading firsthand. With Rails at the helm, the crypto trading landscape is set to undergo a transformative shift towards transparency, security, and user empowerment.

Read the full article here