The Real-World Assets (RWA) sector has seen explosive growth in recent months, with both its total market cap and trading volume surging at an unprecedented pace. In the last three months, RWA coins’ market cap jumped 144% to $62.7 billion, while the total value of tokenized real-world assets reached $17.3 billion, up 13% in the same period.

This rapid expansion has been fueled by increasing institutional adoption and a more favorable regulatory environment in the US following Donald Trump’s election. As capital flows into RWA projects, both major tokens and emerging players are benefiting from renewed market enthusiasm.

RWA Coins Market Cap Surged 144% In the Last 3 Months

The total market cap of RWA cryptos has surged to $62.7 billion, marking a 54% increase over the past year.

However, the most striking growth has come in the last three months, with the market cap jumping from $25.7 billion on November 4, 2024—an impressive 144% rise.

RWA Coins Market Cap in the Past Three Months. Source: CoinGecko

One key factor driving this surge is the shifting regulatory ecosystem in the US following Donald Trump’s election. His administration has signaled a more crypto-friendly stance, fostering optimism among institutional investors and blockchain projects tied to real-world asset tokenization.

With expectations of reduced regulatory hurdles and clearer guidelines, the RWA sector has experienced a renewed wave of capital inflows, accelerating its growth at an unprecedented pace.

Real-World Assets Leaders Are Up In The Last Seven Days

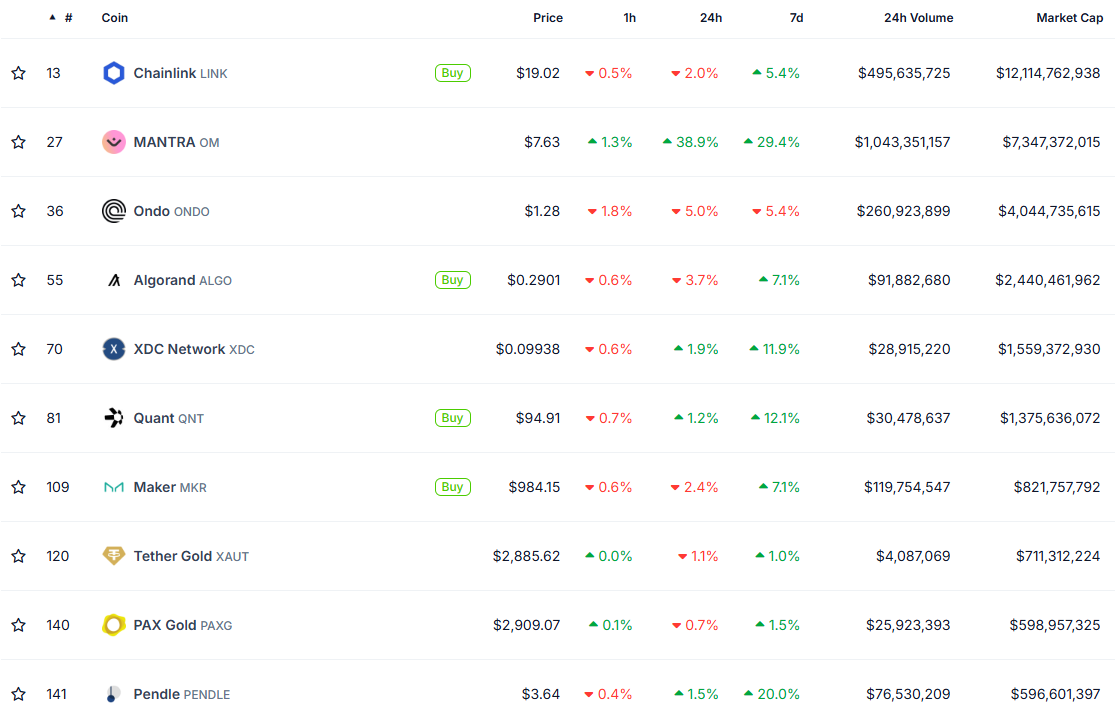

Most of the biggest Real-World Assets tokens have continued their strong uptrend, with only ONDO showing a decline in the past seven days.

Despite this short-term dip, ONDO remains up an impressive 382% over the last year, solidifying its position as one of the top-performing assets in the sector.

While ONDO lags in the weekly timeframe, other major RWA players have maintained their momentum, pushing the overall market higher.

Top 10 RWA Tokens by Market Cap. Source: CoinGecko

Mantra has climbed nearly 30% in the last week, while Injective (INJ) has gained more than 16%, reflecting sustained investor interest in the sector.

Beyond these leading names, smaller RWA projects have also seen explosive moves, with PinLink surging 86% and XVS rising 77%.

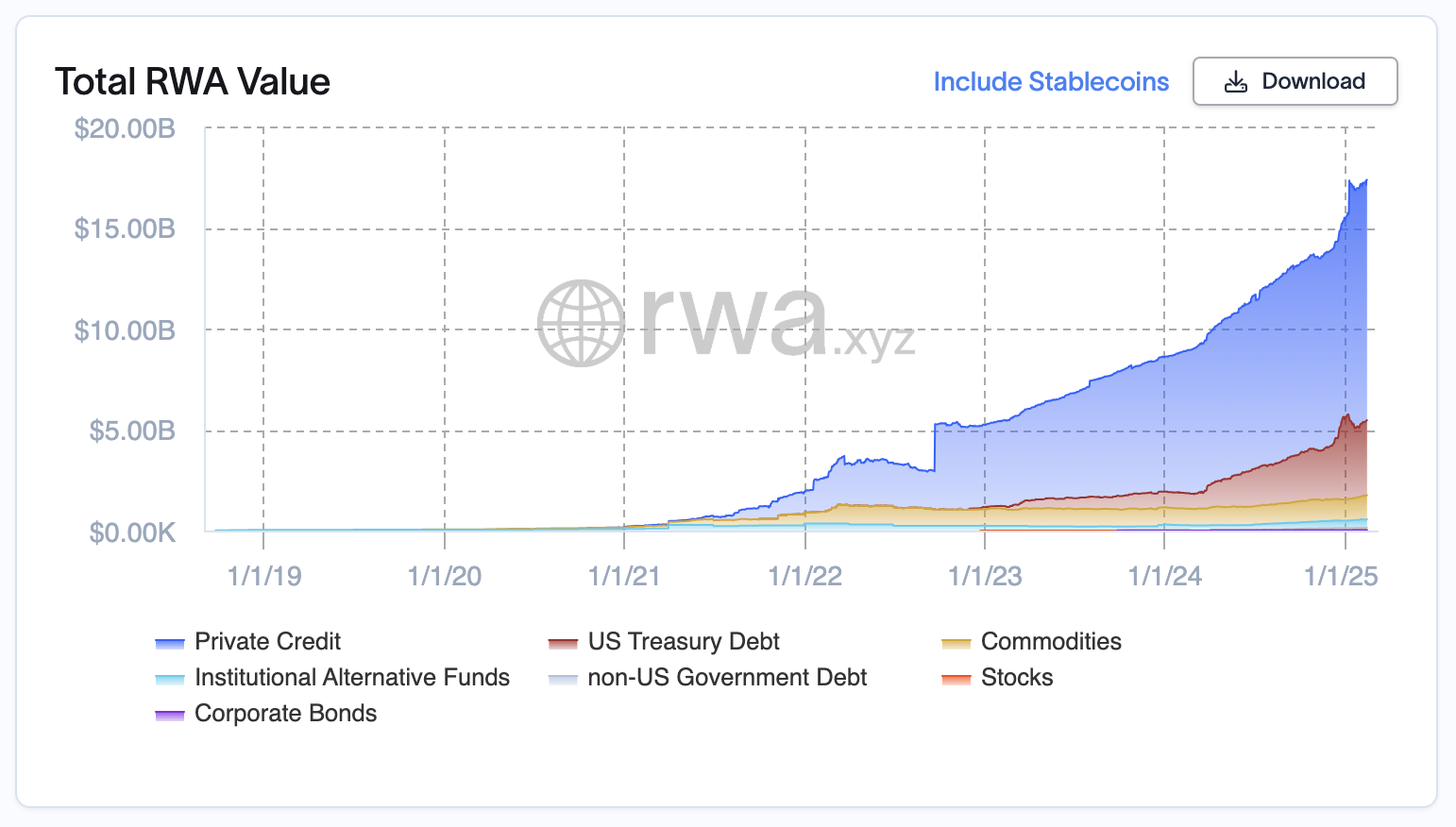

Total RWA Value Surged In the Last Months

The total value of real-world assets (RWA) has reached $17.3 billion, marking a 13% increase in just the last three months and a 96% surge over the past year.

The steady rise in RWA value reflects growing confidence in the sector, driven by both institutional participation and expanding use cases.

Total RWA Value. Source: rwa.xyz.

Currently, Private Credit dominates the RWA market, accounting for $11.9 billion of the total value. It is followed by US Treasury Debt at $3.7 billion and Commodities at $1.2 billion.

The concentration in Private Credit suggests that investors see tokenization as a more efficient way to access yield. At the same time, US Treasury Debt’s presence highlights the demand for on-chain exposure to low-risk government securities.

Read the full article here