Bitcoin is about to retest its previous ATH as bullish momentum pushes above $105,000 for the second time within the last 7 days.

The king of the crypto world just concluded a bullish week during which it rallied by slightly over 18% from weekly low to weekly high.

The last time that Bitcoin was this high was exactly 4 weeks ago during the third week of December.

Price ended up peaking at $108,363 and this latest rally not only threatens to retest that price but also potentially venture into price discovery.

Bitcoin price action / source: TradingView

Its RSI indicated that there was room for more upside. However, there are only two major plausible outcomes considering the timing of this rally.

The new week could either come with more demand to fuel the bullish momentum, or a double top followed by a bearish outcome.

How Will President Trump’s Inauguration Influence Bitcoin Price Action?

The U.S elections and particularly their outcome had a bullish impact on BTC price action. It is unsurprising that the cryptocurrency has been rallying in the days leading up to his inauguration.

It is possible that the inauguration may turn out to be a sell the news type of scenario, in which case a double top would occur.

Such events are quite common where demand builds up in the days leading up to highly anticipated event, followed by sell pressure after the event.

On other hand, it could also trigger more liquidity inflows. This outcome would particularly be plausible if Trump follows through with the plan to issue executive order for the creation of a strategic Bitcoin reserve.

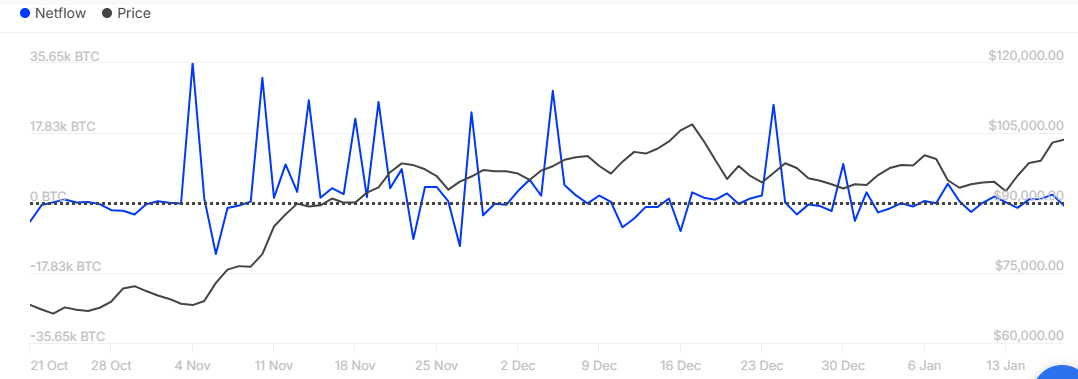

The latest demand wave fueling Bitcoin’s rally last week did not have as much whale activity as the November and December uptick.

This was evident by the subdued nature of large holder netflows in the last 3 weeks.

Bitcoin large holder flows / source: IntoTheBlock

The relatively lower whale participation confirms that it is currently not experiencing as much excitement as in November despite its upside.

Nevertheless, demand in the derivatives segment was slightly higher at $68.17 billion compared to its $68.13 December peak.

Exchange Flows Cool Off as Uncertainty Creeps In

BTC’s bullish price action was backed by heavy exchange outflows. The latter bounced from as low as 8680 BTC on 12 January to 66,547 BTC as of 17 January.

Inflows peaked at 51,279 BTC which was significantly lower than outflows, hence price maintained upside.

Bitcoin exchange flows / Source: CryptoQuant

Exchange flows cooled down considerably in the last 2 days but despite this, price held on to recent gains. However, this could be about to change as Exchange inflows outperform inflows.

Exchange inflows peaked at 16,810 BTC at the time of observation while exchange outflows were lower at 15,675 BTC. This suggests that sell pressure could be building up.

Higher exchange outflows could signal high chances of a selloff this coming week.

However, it is important to acknowledge that the inauguration and subsequent crypto-related developments could potentially act as a catalyst. It will be interesting to see how things will play out in the coming days.

Read the full article here