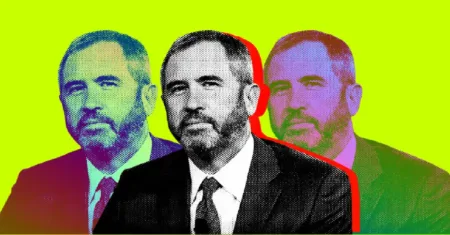

Ripple CEO Brad Garlinghouse expresses frustration over the SEC’s stringent crypto regulatory approach after the agency sued Cumberland for operating as an unregistered securities dealer.

In an X post yesterday, the Ripple CEO called the public’s attention to fresh comments from SEC commissioner Mark Uyeda, who criticized the agency’s approach to the crypto industry as a disaster.

SEC Commissioner Calls Agency Crypto Regulation a Disaster

Speaking in an interview on FOX Business, Uyeda said the SEC has been implementing its crypto policies through enforcement actions. However, the regulator has also failed to provide the industry with the needed guidance. He noted that while most crypto regulations are enacted through court verdicts, there have been different and inconsistent rulings.

“[There has been] broad frustrations with the fact that we [the SEC] have not provided guidance as to what you can and cannot do, and if you’re involved in some sort of securities offering, how you register as a broker-dealer, or as an exchange,” Uyeda remarked.

Ripple CEO Reacts

Commenting, Garlinghouse noted that people inside the SEC are also criticizing the commission’s crypto regulatory approach. He suggested that Uyeda’s commentary came at the same time the commission charged Cumberland with violating federal securities law.

“This circus needs to stop,” Garlinghouse echoed.

Cumberland Slams SEC After Its Lawsuit

Yesterday, the SEC alleged that Cumberland operated as an unregistered securities dealer, violating federal registration requirements. It claimed that Cumberland sold $2 billion worth of crypto assets through third-party crypto exchanges since 2018.

Per the lawsuit, the SEC labeled five cryptos Cumberland handles as securities. They include Cardano (ADA), Algorand (ALGO), Solana (SOL), Polygon (MATIC), and Filecoin (FIL).

Responding, Cumberland criticized the SEC, emphasizing that the regulator’s “enforcement-first approach” stifles innovation and prevents legitimate businesses from dealing in digital assets.

pic.twitter.com/xlz9ECFDYe

— Cumberland (@CumberlandSays) October 10, 2024

The company mentioned the bi-partisan criticism of the SEC, with the House Financial Service Committee calling the commission a “rogue agency” for failing to work with Congress.

Cumberland revealed that it has taken several measures to comply with the SEC’s requirements, including acquiring a registered broker-dealer in 2019. Despite these efforts, the SEC limited the broker-dealer to trade only Bitcoin (BTC) and Ethereum (ETH).

Notably, Cumberland said it will not change its business operations regardless of the SEC’s recent action.

Paradigm Exec Reveals SEC Chair Secret, Garlinghouse Reacts

The SEC’s latest action against Cumberland triggered reactions from top crypto stakeholders, including Justin Slaughter of Paradigm.

Reacting, Slaughter said it would be pleasing to see SEC Chair Gary Gensler reveal his hidden agenda against crypto. According to Slaughter, Gensler privately says he aims to destroy the crypto industry to protect traditional financial markets.

He suggested that Gensler is confident in betting on the SEC’s regulatory powers at the Supreme Court while singing Frank Loesser’s “Luck Be a Lady Tonight.”

Interestingly, Ripple’s CEO reacted to Slaughter’s comment with two loudspeaker emojis. Garlinghouse’s reaction is his way of calling people’s attention to Slaughter’s post, as he agrees with the perspective.

📣📣 https://t.co/f0vZ8NMHFL

— Brad Garlinghouse (@bgarlinghouse) October 10, 2024

Read the full article here