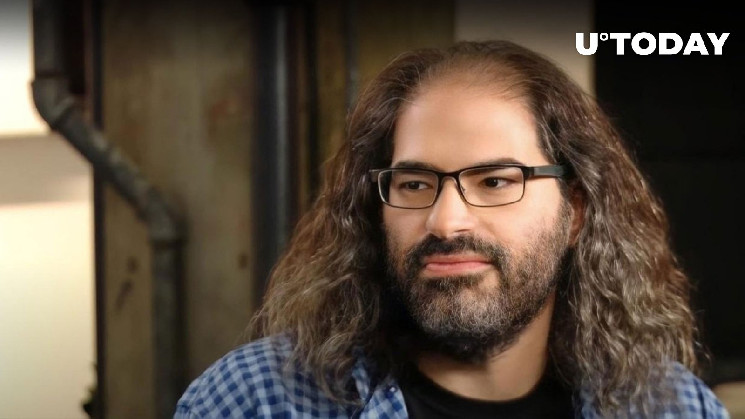

A big name in crypto, Ripple’s CTO David Schwartz, chimed in on the whole “where to keep your crypto” debate. While he did not outright diss platforms like Coinbase, he did remind everyone that if an exchange goes belly-up, your crypto might be going with it.

This all started with someone asking about FDIC insurance for their USD on Coinbase. Schwartz explained that FDIC only protects your cash if the bank fails, not the exchange itself. Basically, if Coinbase goes bust and the bank does not have enough to cover everyone, you are out of luck.

I have no particular reason to think it’s not safe to keep crypto at Coinbase. But, as with other centralized exchanges, if they screw up enough, your funds will be lost. For many, it’s still better than self-custody because the odds that they’ll mess up are higher.

— David “JoelKatz” Schwartz (@JoelKatz) July 15, 2024

Things got a bit more interesting when someone mentioned the possibility of Coinbase using FDIC-insured banks to hold users’ USD separately. In theory, this could keep your cash safe even if Coinbase itself hits a rough patch. Schwartz agreed it could work but stressed that Coinbase would need to keep good records to make sure everyone gets their fair share if a bank does fail.

The whole thing highlights that keeping your crypto safe can be tricky. Platforms like Coinbase are convenient, but there are still risks involved. So, before you park all your coins on an exchange, it might be wise to do a little research and understand what could happen if things go south.

Read the full article here