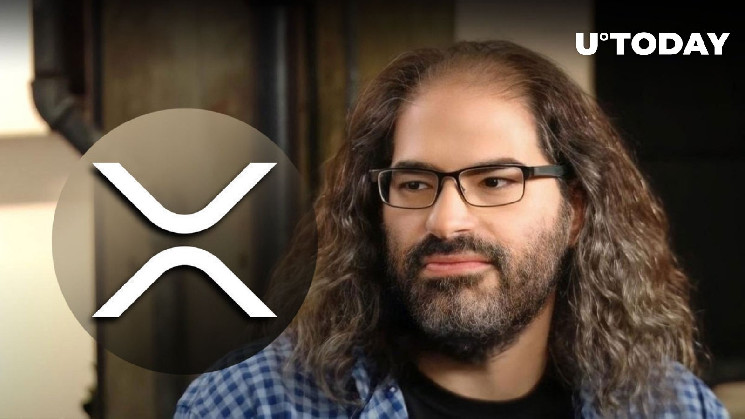

In a recent turn of events, Ripple CTO David Schwartz has stepped forward to highlight XRP’s 1,500% growth over the last seven years. This statement was made in response to a user who claimed to have incurred a loss on their seven-year XRP holding.

In response to the user’s claim, Schwartz remarked that XRP would have traded at around $0.033 exactly seven years ago. He pointed out that if an investor had held onto their XRP assets over this period, they would have witnessed growth of 1,500%, with an annual percentage yield (APY) of 47%.

Seven years ago was 4/19/2017. XRP was $.033 on 4/19/2017. That is a 1500% increase equivalent to an APY of 47%.

— David “JoelKatz” Schwartz (@JoelKatz) April 20, 2024

“Seven years ago was 4/19/2017. XRP was $.033 on 4/19/2017. That is a 1500% increase equivalent to an APY of 47%,” Schwartz responded.

The user’s claim of buying XRP for the past seven years turned out to be partly untrue, as he later clarified that he bought XRP in January 2018, right after its drop from all-time highs of $3.84.

XRP, the seventh largest crypto asset by market capitalization, has mainly underperformed in recent years, as it is among the few cryptocurrencies that did not attain all-time highs during previous and current bull cycles.

The SEC lawsuit filed against Ripple in December 2020, combined with the 2022 bear market, lowered XRP’s value. Since its peak in January 2018, XRP has dropped more than three-quarters of its market value, disappointing investors and enthusiasts. At its current price, XRP has dropped 86.51% from its all-time high of $3.84 set on Jan. 4, 2018.

Despite challenges such as regulatory scrutiny and market volatility, XRP has weathered the storm and remains among the top 10 cryptocurrencies by market capitalization.

The spotlight on XRP’s 1,500% growth by the Ripple CTO might not be a succinct reflection of its past success but it may be a beacon of its potential. At the time of writing, XRP had gained 3.12% in the previous 24 hours to $0.5172, outperforming the top 10 cryptocurrencies in terms of daily gains.

Read the full article here