Scroll’s SCR token is down by 32% in just over 24 hours following its launch.

Total value locked on the network has declined 24% in the past week as investors vent their frustration about token supply.

The top 10 airdrop recipients received 11.7% of the total drop.

After more than a year of hype and expectation, layer-2 network Scroll’s governance token launch is beginning to fall short of expectations after being plagued by token allocation issues.

One day after debuting at $1.40, SCR is now trading 32% lower at $0.94 with its market cap shrinking to below $180 million. The plunge has seen the token drop out of the 250 largest tokens on CoinMarketCap despite Scroll being heralded as the “turtle that wins the Ethereum scaling race.”

Poor token performance isn’t always representative of a failing project – a number of recently-released tokens fail to impress during the opening period of price discovery – but it’s worth noting that total value locked (TVL) on Scroll has fallen by 23% in the past week after hitting a peak of $1 billion, DefiLlama data shows.

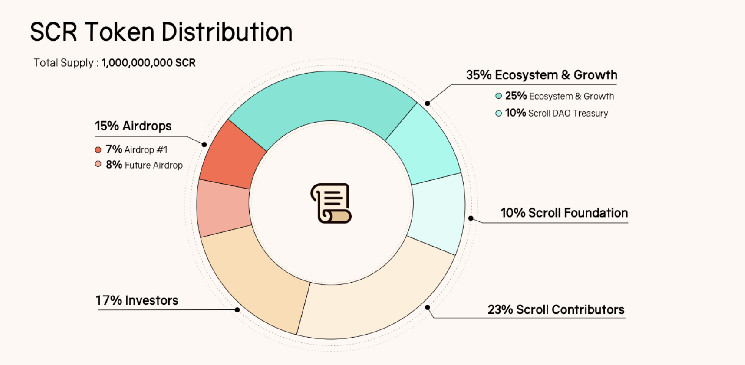

Scroll’s issues appear to stem from the token allocation and distribution. In the lead up to SCR’s release, users expressed their frustration at Scroll’s decision to set aside 5.5% of the supply to the Binance Launchpool and just 7% for the initial airdrop. That frustration was compounded this week after it emerged that Scroll’s refusal to put an airdrop cap in place meant that a handful of whales scooped up the majority of available tokens.

According to Andrew10Gwei on X, the top 10 wallets will receive 11.7% of the airdrop and the top 100 will receive 34.4%. This typically means that the token will struggle to sustain a price rally as investor demand can’t keep up with the pace of selling from whales that received a hefty airdrop.

Scroll ran its airdrop campaign by rewarding early adopters and users with “marks” that could eventually be converted into an airdrop. This method has been relatively common in crypto over the past few years and is often referred to as “points farming.”

But the omission of fixed allocation bands or a maximum cap has spoiled the equilibrium of token supply, it now faces a difficult short-term future as the whales need to be convinced not to sell whilst prospective investors need to believe that it’s an asset that has future upside.

Points farming is fickle by nature – investors will often use a project to meet the airdrop criteria then move their capital to farm another airdrop on another protocol. While this gives projects an initial boost in activity, it can have a negative long-term impact as there is no incentive to hold the token after an airdrop is distributed .

Scroll’s team did not immediately respond to CoinDesk’s request for comment on a maximum airdrop cap.

Read the full article here