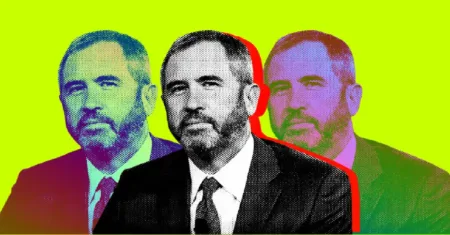

On October 9, the U.S. Securities and Exchange Commission (SEC) commissioner Mark Uyeda opined that the agency’s approach to the crypto industry has been a disaster.

Uyeda criticized what he sees as ‘enforcing policy without providing clear guidance’, an approach that has bogged down the industry in lawsuits while engendering an atmosphere of uncertainty for investors, when speaking in an interview on Fox Business.

I think our policies and our approach over the last several years have been just really a disaster for the whole industry.

Commissioner Uyeda is right: The SEC’s crypto policies have been a disaster for the whole industry. pic.twitter.com/DNwpuVlJwU

— Cam – Crypto DeGen (@CryptoNews_eth) October 10, 2024

Analysts as well as crypto founders argue that this combination is causing growth in the sector to needlessly stall.

Per Finbold Research, the number of cryptocurrency-related cases has skyrocketed, with a notable fourfold increase quarter-over-quarter (QoQ) when comparing Q2 and Q3 2024.

SEC and Gensler stifling innovation

The commissioner’s stance is far from isolated. Billionaire, founder of Cost Plus Drugs, and minority owner of the Dallas Mavericks Mark Cuban went as far as saying that the actions of chairman Gary Gensler could cost democrats the presidency — repeatedly calling for the firing of Gensler, while also jokingly putting himself forward for the role in a potential Harris administration.

The criticism levied by Uyeda, who has been much more supportive of advancing crypto accessibility, even voting to approve Bitcoin (BTC) ETFs shines a spotlight on a growing divide within the government agency as to how the burgeoning new digital asset economy should be overseen and supported.

Such sentiments are echoed by many industry leaders — Ripple CEO Brad Garlinghouse and Gemini co-founders Cameron and Tyler Winklevoss continually argue that the SEC’s lack of regulatory clarity is a major roadblock — causing both needless compliance challenges and driving companies in the sector to move abroad.

Finding the right balance of regulation

It should be noted that while it’s all too easy to point a finger at the SEC, regulations are necessary, and the agency’s mandate to oversee the industry to protect investors is both taken seriously and does give results — on occasion.

The body’s actions against Silvergate Capital on account of lapses in monitoring FTX, or against Terraform Labs for the estimated loss of $40 billion when TerraUSD and Luna collapsed in 2022 come to mind.

Major crypto firms like Coinbase and Crypto.com have filed lawsuits against the SEC, contending that the agency is exceeding its authority and unfairly categorizing digital assets as securities.

While Uyeda is skeptical and does not consider these specific lawsuits to be material enough, he has noted that the agency’s lack of thorough interpretative guidance is the main cause of broader frustrations.

Read the full article here