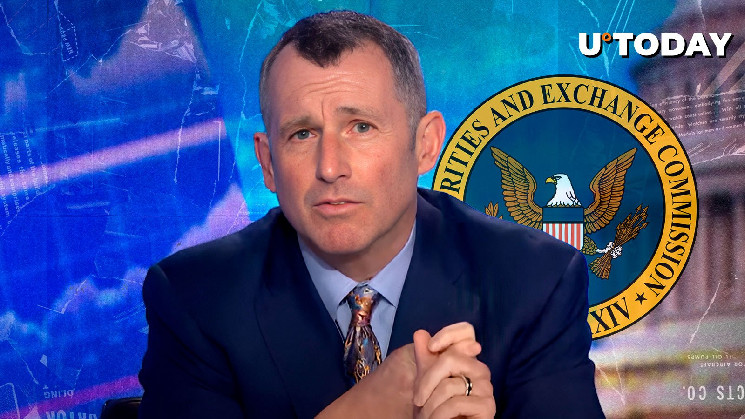

Former SEC official John Reed Stark believes that the U.S. Securities and Exchange Commission is “done.” “FYI, stick a fork in the SEC, it’s done,” he said.

According to Stark, the SEC is not going to bring virtually any cases against the cryptocurrency industry in the coming years.

Meanwhile, Stuart Alderoty, Ripple’s chief legal officer, has urged Gensler to step down voluntarily:

“Gensler and his anti-crypto minions should voluntarily stand down, or as John explains, the SEC’s new Chair (when appointed) will use the agency’s internal mechanisms to remove them,” he said.

Gensler, who has been vilified by the cryptocurrency community, is expected by step down in early 2025 by Hogan. However, it is worth noting that his five-year term is expected to end on June 5.

According to Stark, Gensler cannot be forced to go. “This is an independent agency, and these commissioners have terms…You can’t just fire them because you don’t agree with them politically,” he said. However, it is likely that the SEC boss will voluntarily resign in the near future.

As reported by U.Today, Dan Gallagher, Robinhood’s top lawyer, is currently the top candidate to replace Gensler. Commissioner Hester Peirce will likely be appointed as an interim SEC boss.

What will happen to Ripple and Coinbase lawsuits?

According to legal expert Jeremy Hogan, the new SEC head will likely send out “marching orders” that all non-fraud cryptocurrency cases need to be dropped. He has predicted that the ongoing cases will be either settled or dropped.

The Ripple case will be settled for the judgment amount of $125 million. The Coinbase case will be simply dismissed. “This will take some time. Not January, but perhaps before summer,” Hogan cautioned.

Read the full article here