Key takeaways:

-

SOL’s futures open interest surged to a 2-year high, reflecting growing institutional interest.

-

Rising competition from other blockchains and neutral funding rates continue to dampen SOL’s bullish momentum.

Solana’s SOL (SOL) failed to hold its bullish momentum after gaining 10% between Monday and Thursday. The cryptocurrency has shown weakness after testing the $180 level several times in May, but traders’ growing interest in leveraged positions could open the path to $200 and beyond.

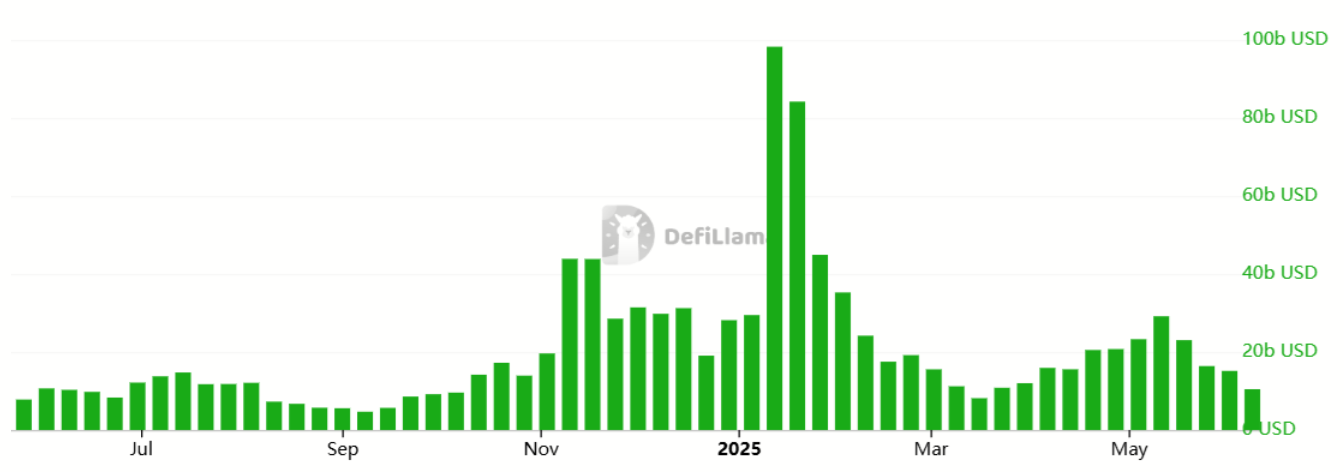

On Wednesday, total open interest on SOL futures reached 46.2 million SOL, the highest in over two years and up 22% from the previous month. Demand from buyers is always matched by sellers, but the rise in activity signals increased participation from institutional investors.

With $7.4 billion in open futures positions, SOL is drawing more attention from savvy market participants. This creates more opportunities for arbitrage strategies like the “carry trade,” where investors buy SOL on the spot market and sell the futures contract. A liquid and active derivatives market supports these trades.

Even with these developments, many SOL investors are likely disappointed. The current $155 level remains well below the $294 all-time high. Meanwhile, the total crypto market cap is just 12% below its record. The sharp drop in Solana network activity has led investors to lower expectations for future SOL gains, making a return to $200 less likely.

Decentralized exchange (DEX) activity on Solana dropped to $10.5 billion per week, down from $29.2 billion just 30 days earlier. More notably, the 50% DEX market share peak in early January proved unsustainable, especially as trading volumes rose on BNB Chain and Hyperliquid became the clear leader in perpetual futures.

Unlike the Ethereum ecosystem, which involves more friction due to its reliance on layer-2 scaling solutions, BNB Chain competes directly with Solana by offering low fees and integrated tools for token launches. Its seamless connection with the Binance exchange also gives BNB Chain a clear edge in user experience.

SOL funding neutral as competition weakens investor confidence

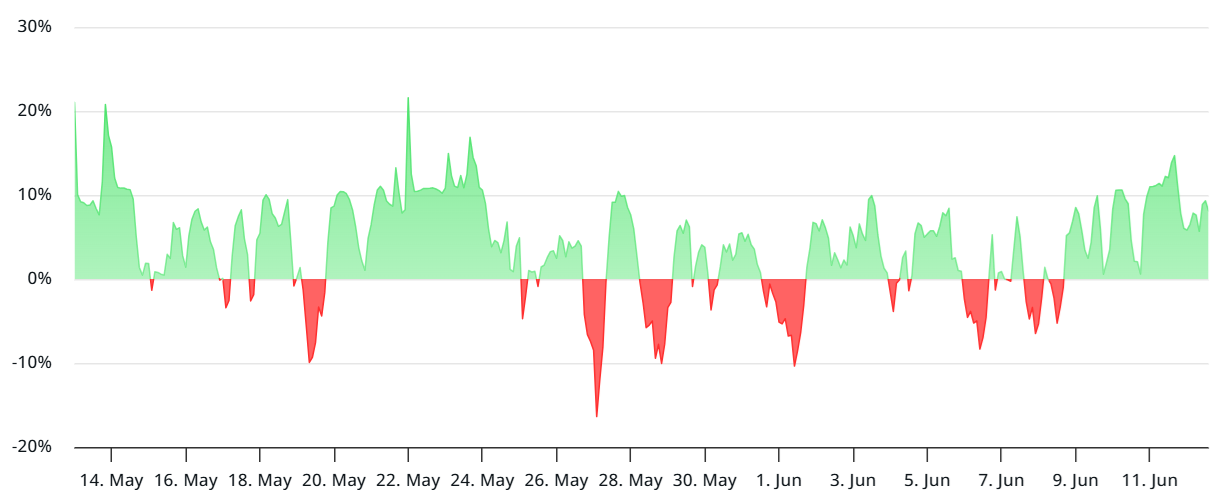

To assess whether traders are turning bearish on SOL due to its recent underperformance and rising competition, it’s useful to examine perpetual futures funding rates. In a neutral market, funding should range between 5% and 15% annually, signaling that buyers (longs) are paying a premium to hold their positions.

The funding rate for SOL has fluctuated between neutral and slightly bearish levels, clearly moving away from the negative 7% seen on Saturday. More importantly, SOL futures have failed to hold above the 15% annualized funding threshold over the past 30 days, indicating a lack of strong bullish sentiment.

Related: DeFi Development to refile $1B Solana plan after SEC filing snag

Speculation around a potential spot exchange-traded fund (ETF) for SOL in the United States remains the most significant short-term price catalyst. Bloomberg analysts are confident that the US Securities and Exchange Commission will approve ETFs for Litecoin (LTC), SOL, and XRP by the end of the year.

At the moment, there is no clear sign that SOL is on track to reach $200, especially given the neutral funding rates in perpetual futures. Additionally, rising competition among decentralized applications has likely played a major role in weakening investor expectations for SOL.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Read the full article here