Solana is once again capturing the attention of the crypto community by surpassing Ethereum in weekly decentralized exchange (DEX) volume.

The latest on-chain data shows that Solana’s DEX volume has surged by over 45.74% in the past week, with $7.87 billion processed during this time.

Moreover, the data indicates that Solana processed $1.116 billion in DEX volume over the last 24 hours, a figure it has maintained consistently since September 27. On September 26, the DEX volume for that day reached a monthly high of $1.34 billion.

Solana DEX weekly record

This signals a renewed momentum for the Solana blockchain, which is known for its high-speed, low-cost transactions.

Solana Sees Higher Spike than Ethereum

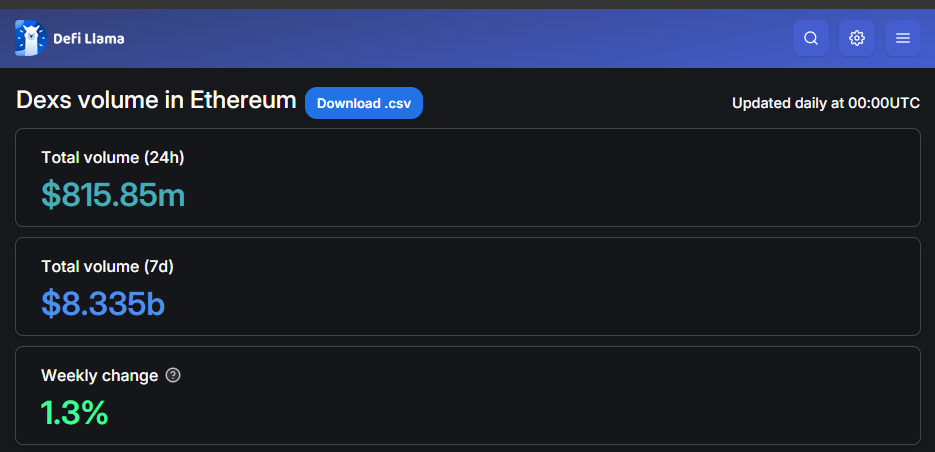

In contrast, Ethereum’s DEX volume growth over the past week was significantly lower, increasing by only 1.3% compared to Solana’s impressive 45% surge. As of today, Ethereum’s DEX volume stands at $1.02 billion, a notable improvement from the $815 million recorded in previous days.

While Solana has seen a consistent spike in DEX volume over the last seven days, its cumulative figure remains slightly below that of Ethereum, which is at $8.335 billion, despite its relatively flat growth.

Ethereum DEX weekly record

This disparity can be attributed to Ethereum’s average daily DEX volume exceeding $1 billion, along with its larger pool of decentralized exchanges, as it remains the leader in decentralized finance. Thus, it typically maintains its usual trend.

On the other hand, Solana has seen below $1 billion in average daily volume until this recent spike, which has now put it back in competition with Ethereum.

Solana DEXs Contributing to Uptick

Also, Solana has fewer DEX platforms compared to Ethereum. Leading the pack is Raydium, which experienced a 90% uptick in weekly volume, processing $3.74 billion. Orca follows closely, recording an 18% increase in weekly volume and processing $2.69 billion over the last week.

Other Solana-based DEXs contributing to the network’s metrics include Phoenix, with $783 million in volume, and Lifinity, with $590 million in volume.

Meanwhile, in the Ethereum ecosystem, Uniswap leads with $5.4 billion in volume over the past week, although this figure represents a substantial 4.5% drop during the same period.

Read the full article here