Solana (SOL) has faced a turbulent market in recent weeks, with its price struggling to recover despite several attempts to break through resistance levels.

Throughout June, the altcoin’s efforts to secure upward momentum have been repeatedly thwarted by weak market conditions. Despite this, Solana holders have refrained from selling, showcasing strong investor confidence.

Solana Investors Stick To Accumulation

Solana’s market sentiment remains strong, with exchange net position changes indicating a trend of accumulation among investors. In nearly three months, there has been only one instance where selling surpassed accumulation.

This accumulation trend also highlights a shift in investor behavior, with many choosing to hold rather than liquidate their positions. Such a stance indicates confidence in the long-term prospects of Solana, suggesting that SOL could see a recovery once market conditions improve.

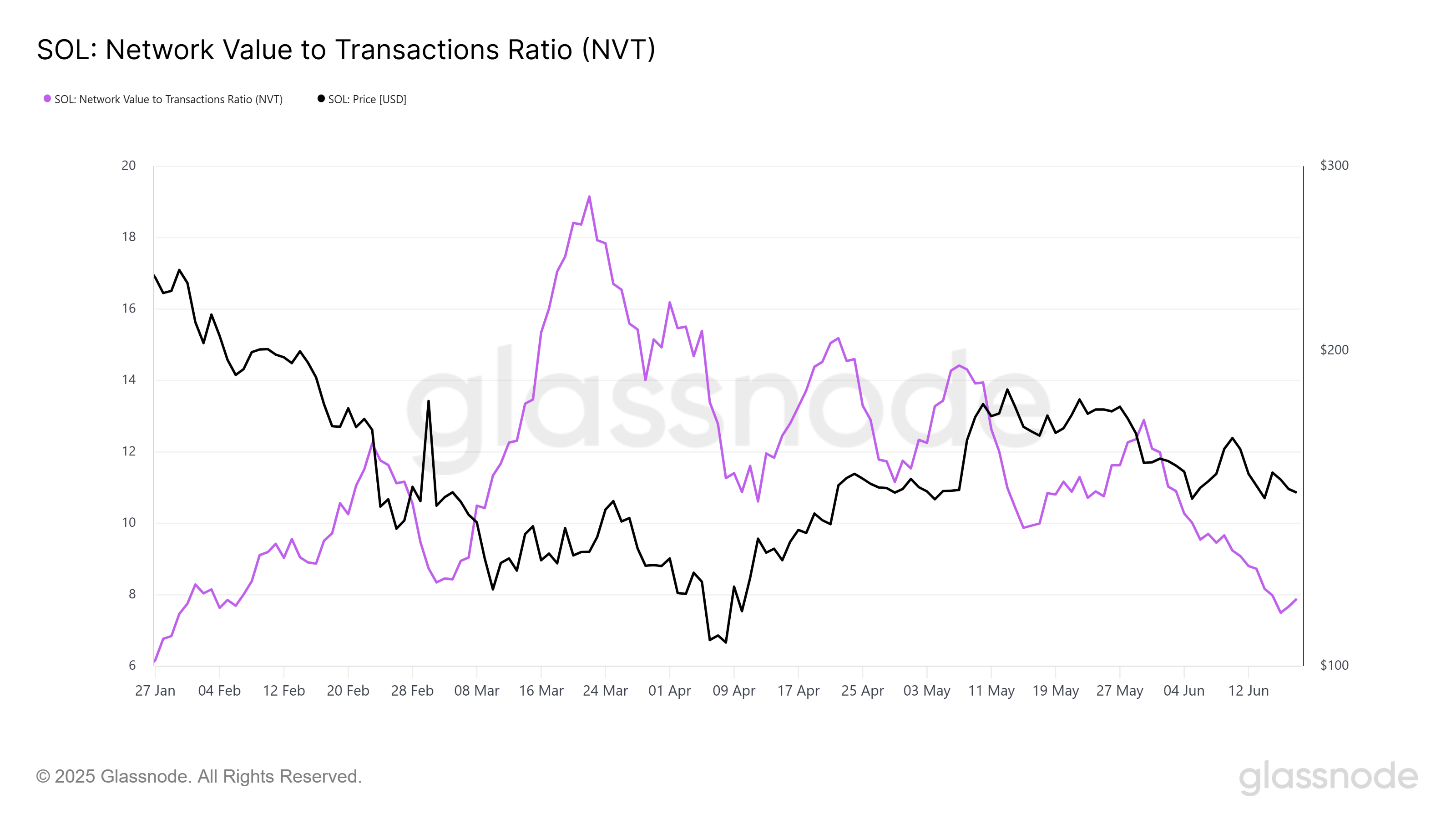

The overall macro momentum for Solana appears promising, with the Network Value to Transactions (NVT) ratio showing a downward trend. A declining NVT ratio signals that the network value is aligning with transaction activity, meaning that the asset is not overheated.

As Solana’s NVT ratio declines, it could help the asset recover from its recent price challenges. A lower NVT ratio typically points to the potential for price growth, as it suggests that the network’s value and user activity are balanced.

SOL Price Awaits Bounce Back

Solana’s price is currently holding at $146, staying above the critical support level of $144. This support has been crucial in preventing a sharp decline this month. The continued ability to hold above $144 signals that SOL has some bullish momentum despite the broader market challenges.

The bullish signals emerging from Solana at this time suggest a potential price rise. If SOL successfully bounces off the $144 support, it could aim for the $152 resistance, with a clear path to $161.

However, if the bullish momentum fades and bearish pressures increase, Solana could see a drop below the $144 support level. In this case, the price could slide to $136, invalidating the current bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here