The cryptocurrency market is presently witnessing robust price movements, leading to significant portfolio increases for top crypto tokens. As Bitcoin (BTC) maintains a stable position above the $66K mark, experts suggest a positive trajectory for these tokens in the near future.

However, not all sectors of the market are experiencing the same level of buoyancy. Solana-based memecoins, such as dogwifhat (WIF) and BOOK OF MEME (BOME), have shown signs of a decline.

Both WIF and BOME have witnessed a decrease in value over the past 24 hours. WIF fell by 4.01%, while BOME dropped by 6.05%. This shift reflects a reduction in buying interest within the memecoin segment of the cryptocurrency market.

WIF Token Price Action

Ranked as the 41st largest cryptocurrency by market capitalization, the dogwifhat (WIF) token has seen a decline. Over the last 24 hours, its market value has decreased by 4.13%, bringing its valuation down to $2,838,673,268. Additionally, its trading volume has decreased by 43.34%, totaling $551,782,383, which suggests a reduction in investor interest and activity surrounding the WIF token.

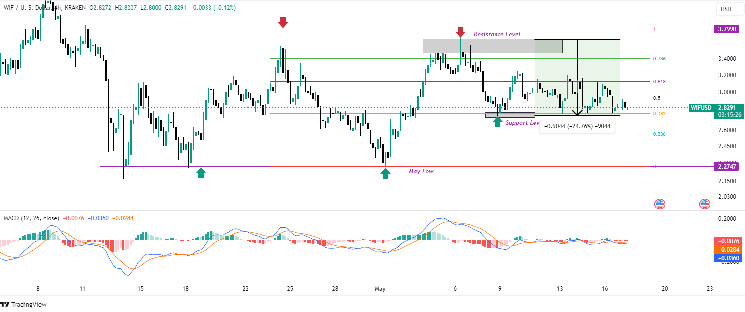

On the 4-hour chart, the WIF token has shown a significant downturn, losing over 24% since the onset of bearish sentiment. Currently, the token is trading at a support level of $2.748. If this support holds, there could be a potential for a price rally.

WIF/USD 4-Hour Chart (Source: Tradingview)

The WIF token might then challenge the 61.8% Fibonacci retracement level, which is acting as its low-level resistance. A successful move above this level could set the stage for further gains, possibly reaching the key resistance at $3.47.

Conversely, if the WIF token fails to maintain its current support level and closes below it, a further decline is expected. The token may seek lower support at the 23.6% Fibonacci level, aiming to stabilize around the lows of May. This scenario would underscore the bearish pressures facing the memecoin, indicating deeper market retractions as it searches for new support levels.

BOME Token Price Action

The BOME token has experienced a significant downturn in trading volume over the last 24 hours, with figures dropping to $461,268,359—a 46.99% decrease. This marked reduction highlights waning investor interest and activity, potentially signaling a shift in market sentiment or dwindling confidence in this particular cryptocurrency.

Looking at the technical charts, the BOME token currently hovers around the 50% Fibonacci retracement level on the 4-hour chart. A breach below this point could lead to further price declines, targeting the next support at the 38.2% Fibonacci level. If this level fails to hold, it may prompt the price to dip to as low as $0.00828, setting the stage for a possible reevaluation before any bullish attempts are made.

BOME/USD 4-Hour Chart (Source: Tradingview)

Conversely, if the 50% Fibonacci level proves to be a strong resistance point, it could serve as a launchpad for the BOME token prices to rally. Overcoming this barrier might propel the token toward the 61.8% Fibonacci level. Piercing this resistance frontier may herald the commencement of a bullish era, targeting a formidable resistance level at $0.01865.

From an analytical standpoint, The Moving Average Convergence Divergence (MACD) indicator for both WIF and BOME suggests a weakening of bullish momentum. Moreover, the MACD line, positioned at $0.00022, is nearing a crossover with the signal line, which often precedes a short-term market correction.

Further, the MACD histogram outlines a sequence of contracting green bars nearing the zero line, indicating that buying pressure is diminishing and the potential for a bearish crossover is rising.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here