Solana continues to build momentum in 2025, with the blockchain recording over $1 billion in application revenue for two consecutive quarters.

The Solana Foundation’s latest Network Health Report, published on June 20, highlights the blockchain’s accelerating economic performance. According to the report, improvements in protocol efficiency, developer engagement, and validator incentives support this growth.

Solana Quietly Becomes a Top-Grossing Blockchain Thanks to Meme Coins

The report showed that Solana app revenue reached its highest point in January 2025, generating over $806 million in a single month.

This was followed by $376 million in February, pushing the network’s total app revenue for that quarter past the billion-dollar mark.

A significant factor behind this surge is that the blockchain network has become a hub for meme coin trading. Meme coin launchpad platforms like Pump.fun have emerged as dominant forces within the ecosystem.

Beyond that, the launch of viral political tokens such as the Trump and Melania meme coins helped drive user activity and fees across the network.

According to the report, these tokens didn’t just trend socially—they spurred real fees, contributing significantly to the network’s GDP-style app revenue metric.

Considering this, the fees from decentralized exchanges and other on-chain services have become a core indicator of Solana’s economic activity.

This growing revenue incentivizes developers to stay on Solana. It also enables the network to reinvest in critical infrastructure, allowing the ecosystem to evolve with user needs.

Solana Outpaces Ethereum by 7,000% in TPS

The report also highlighted the blockchain’s dominance in developer attraction.

In 2024, it was the top blockchain for new developers, maintaining over 3,200 monthly active contributors and posting an 83% year-over-year growth in developer engagement.

Solana’s stability has played a key role in driving this trend. The network has maintained 100% uptime for over 16 consecutive months. This includes the period of record-setting daily trading volume, which reached $39 billion in January 2025.

Meanwhile, the network’s key technical enhancements have also reduced average relay times to under 400 milliseconds, a significant leap from previous years.

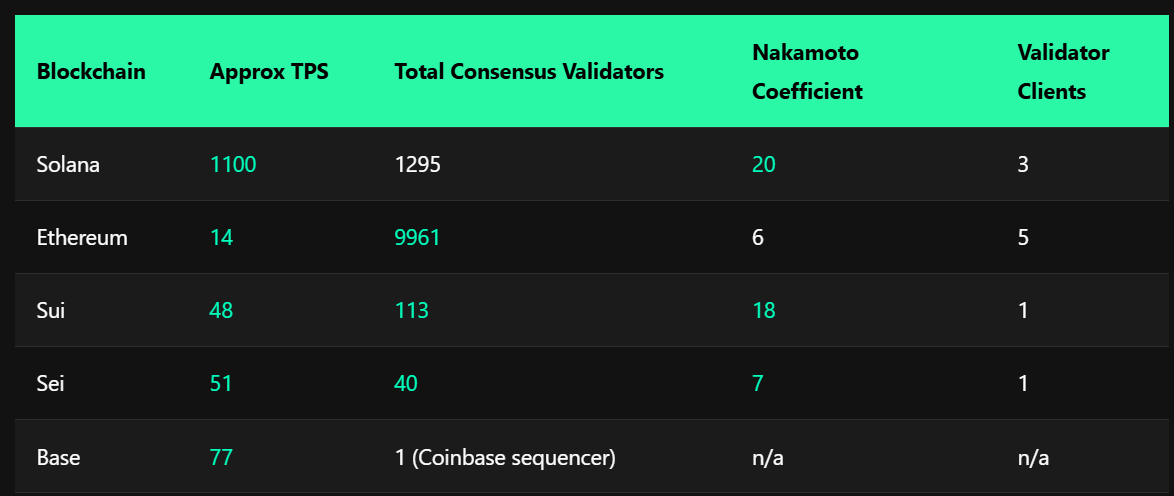

Transaction throughput remains a standout metric, with Solana processing around 1,100 transactions per second—far outpacing Ethereum’s average of 14 TPS.

Validator rewards have followed suit, with real economic value (REV) hitting a record $56.9 million on January 19.

The average quarterly REV now stands at $800 million, while the break-even staking threshold has dropped from 50,000 SOL in 2022 to just 16,000 SOL this year.

Overall, Solana’s steady gains in performance, developer retention, and revenue generation point to a network on the rise. Together, these improvements suggest it is evolving into one of the most sustainable ecosystems in the industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here