Solana’s (SOL) price action from a 16-hour perspective saw a breakout from a descending trendline that had defined price resistance since late January 2025.

Initially, SOL experienced substantial resistance at around $244, where the price consistently found sellers, leading to a steady decline.

This resistance has now been broken through. The key support during this period was around the $175 zone, serving as a base whenever the price of SOL retracted.

This recent breakout around $190 indicated a potential reversal of the bearish trend that had dominated the previous weeks.

SOL/USD 16-hour chart | Source: Trading View

Currently, with the breakout, the next significant levels to watch are the immediate resistance around $206.50, followed by $212.50.

A successful breach of these levels could propel SOL towards $244. Conversely, failure to maintain this momentum could see the price retest the breakout point at $190.

It would potentially fall back to the key support at $172.50 if bearish pressures resume.

This suggested a shift in market sentiment, potentially attracting more buyers if SOL can sustain price levels above the trendline.

The price action breaking from the descending trendline traditionally suggested increased buying interest, possibly leading to higher price levels if sustained.

However, the converse would imply that the breakout might not have enough volume or buyer interest to maintain its trajectory, leading to a fallback to lower support zones.

How Will Pumpfun’s Cash Out Affect Solana Price?

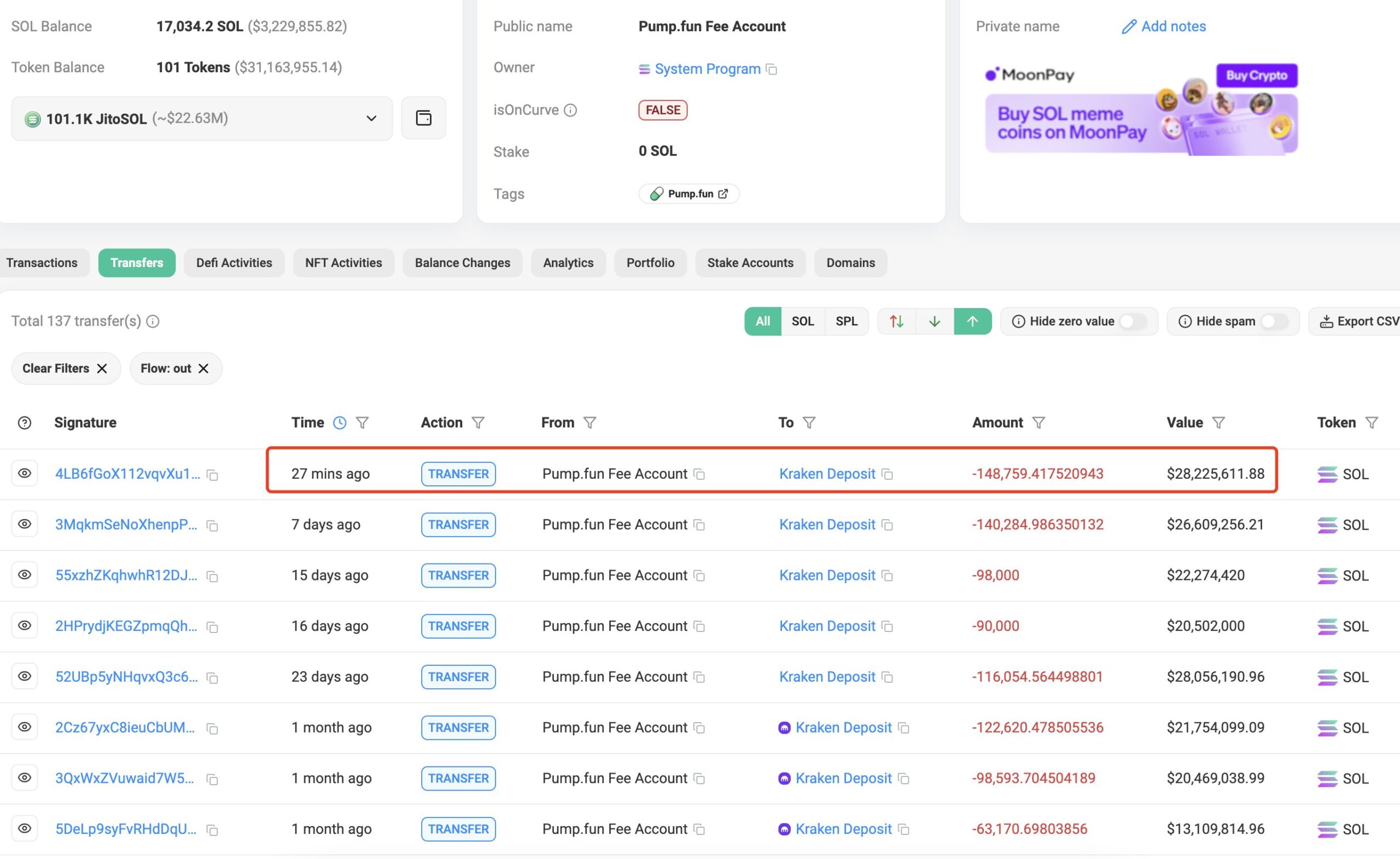

As price breaks out from a downtrend, it faces Pumpfun’s recent large deposits of Solana to Kraken that could impact SOL’s market dynamics negatively.

By transferring 148,759 SOL worth $28.22 Million to Kraken, and with cumulative deposits totaling 2,280,377 SOL worth approximately $462 Million, Pumpfun appears to be leveraging Kraken’s liquidity to facilitate large-scale trades or secure profits.

This activity could be driven by several reasons: capitalizing on arbitrage opportunities, managing liquidity to sustain platform operations, or possibly preparing for larger financial moves like hedging against market volatility.

The sales of 264,373 SOL for $41.64 Million USDC indicate a revenue-generating strategy through market trades.

The transactions not only reflect on Pumpfun’s operational strategies but also influence Solana price by potentially increasing supply pressure on the market, thereby affecting Solana’s valuation and investor sentiment.

Pumpfun wallet activity | Source: Lookonchain

This massive cash-out of SOL tokens by Pumpfun, converting 264,373 SOL into $41.64M USDC, sends ripples through the trader community, impacting sentiment towards Solana.

Such large-scale transactions often signal a bearish sentiment as major holders liquidate positions, potentially leading to price instability.

Traders and investors might perceive these moves as a lack of confidence in Solana’s short-term price prospects, prompting a cautious approach or triggering a sell-off.

However, this activity also reflects enough liquidity and could attract attention to Solana as an active and relatively safer trading environment.

Ultimately, while immediate effects might skew negative, the demonstration of high liquidity and active financial management could stabilize or even uplift SOL’s valuation as market dynamics evolve.

Read the full article here