Key points:

-

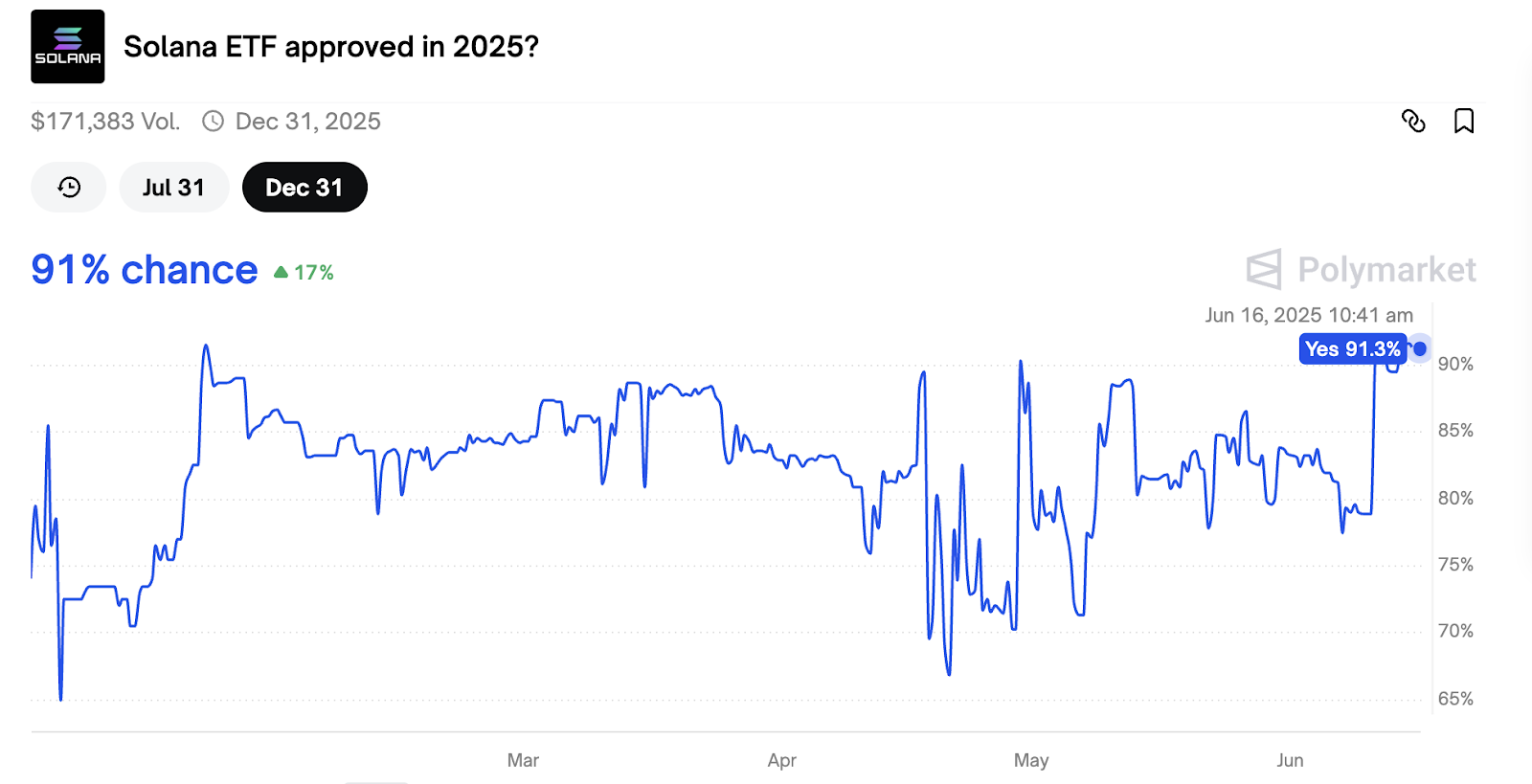

Spot Solana ETF approval odds jump to 91% on Polymarket.

-

SOL futures open interest is up 22% in a month, signaling strong institutional interest.

-

A SOL price bull flag is in play on the daily chart, targeting $315.

Solana’s native token, SOL (SOL), displayed strength on June 16, climbing 9.5% to trade at $157 from a low of $144 on June 15. Its daily trading volume has jumped by 100% over the last 24 hours to $4.5 billion, reinforcing the intensity of the demand-side activity.

Solana ETF approval odds jump above 90%

Speculation around a potential spot Solana exchange-traded fund (ETF) for SOL in the United States remains the most significant catalyst behind SOL’s rally today. Bloomberg analysts said that the US Securities and Exchange Commission could “act early” on Solana and staking ETF filings, placing the approval odds at 90%.

Meanwhile, approval odds on Polymarket have jumped to 91% on June 16 from 77.5% less than 10 days ago.

This increased optimism came after seven asset managers, including VanEck, Grayscale, 21Shares, Bitwise, Canary Capital, and Franklin, filed their S-1 forms for Solana ETFs with the SEC, signaling progress in the approval process.

Related: How to stake Solana (SOL) in 2025: A step-by-step guide for beginners

Additionally, Invesco and Galaxy Digital have announced intentions to launch a Solana ETF Trust in Delaware, adding to the robust institutional interest.

🚨 BREAKING: Invesco Galaxy $SOL ETF registered in Delaware. pic.twitter.com/sPHvREErYi

— Cointelegraph (@Cointelegraph) June 13, 2025

Approval of these funds could unlock institutional capital, amplify demand for SOL and potentially drive prices to new all-time highs, with some analysts predicting targets as high as $1,300.

Solana Open Interest nears all-time highs

An increase in open long positions in the futures market preceded SOL’s rally to $157 today.

On June 12, total open interest on SOL futures reached 45.87 million SOL, the highest in over two years and up 22% over the last 30 days. The OI remains high at 43.86 million SOL at the time of writing on June 16.

In dollar terms, this represents $6.86 billion in futures positions, ranking third in the cryptocurrency market and over 71% higher than the demand for XRP derivatives.

The growing OI indicates strong institutional participation and leveraged bets on SOL’s price trajectory, with a long/short ratio skewed toward bullish positions on exchanges like Binance.

While this heightened activity introduces liquidation risks, it underscores rising confidence in Solana’s upside potential, amplifying today’s price momentum.

SOL price bull-flag hints at $315

SOL price has formed a bull flag chart pattern on the daily chart, as shown below.

A bull flag pattern is a bullish setup that forms after the price consolidates inside a down-sloping range following a sharp price rise.

Bull flags typically resolve after the price breaks above the upper trendline and rises by as much as the previous uptrend’s height. This puts the upper target for SOL price at $315, or a 100% increase from the current price.

The daily RSI increased to 50 on June 16 from 38 two days ago, indicating increasing bullish momentum.

As Cointelegraph reported, the SOL/USD pair must first flip the 50-day simple moving average at $161 (which coincides with the flag’s upper boundary) into new support to ensure a sustained recovery.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here