Stellar (XLM) has experienced a significant surge in volume, reaching its highest levels since May 2021. This uptick coincides with Ripple’s (XRP) unexpected rally to $1 on Saturday, November 16.

XLM’s price also has risen by 30% in the last 24 hours, imitating XRP’s impressive performance. But why is this so? This analysis reveals everything that has to do with this closely-tied movement.

Stellar History with Ripple Remains in Effect

According to data from Santiment, XLM’s trading volume has surged to $2.96 billion as of this writing. This rise in volume clearly indicates growing buying pressure on the altcoin and a noticeable increase in market interest.

The last time XLM experienced such high volume levels was during the 2021 bull market, a period when cryptocurrency assets saw market-wide rallies.

This spike in volume suggests that investors are becoming more confident in XLM’s potential, especially given XRP’s recent surge. Historically, both altcoins have shared a strong correlation, majorly due to two reasons.

Stellar Volume. Source: Santiment

Firstly, Jed McCaleb, the former co-founder of Ripple, went on to co-found Stellar. The two projects share a strong connection, particularly in their focus on blockchain-based cross-border payments, making Stellar’s fundamentals closely aligned with Ripple’s.

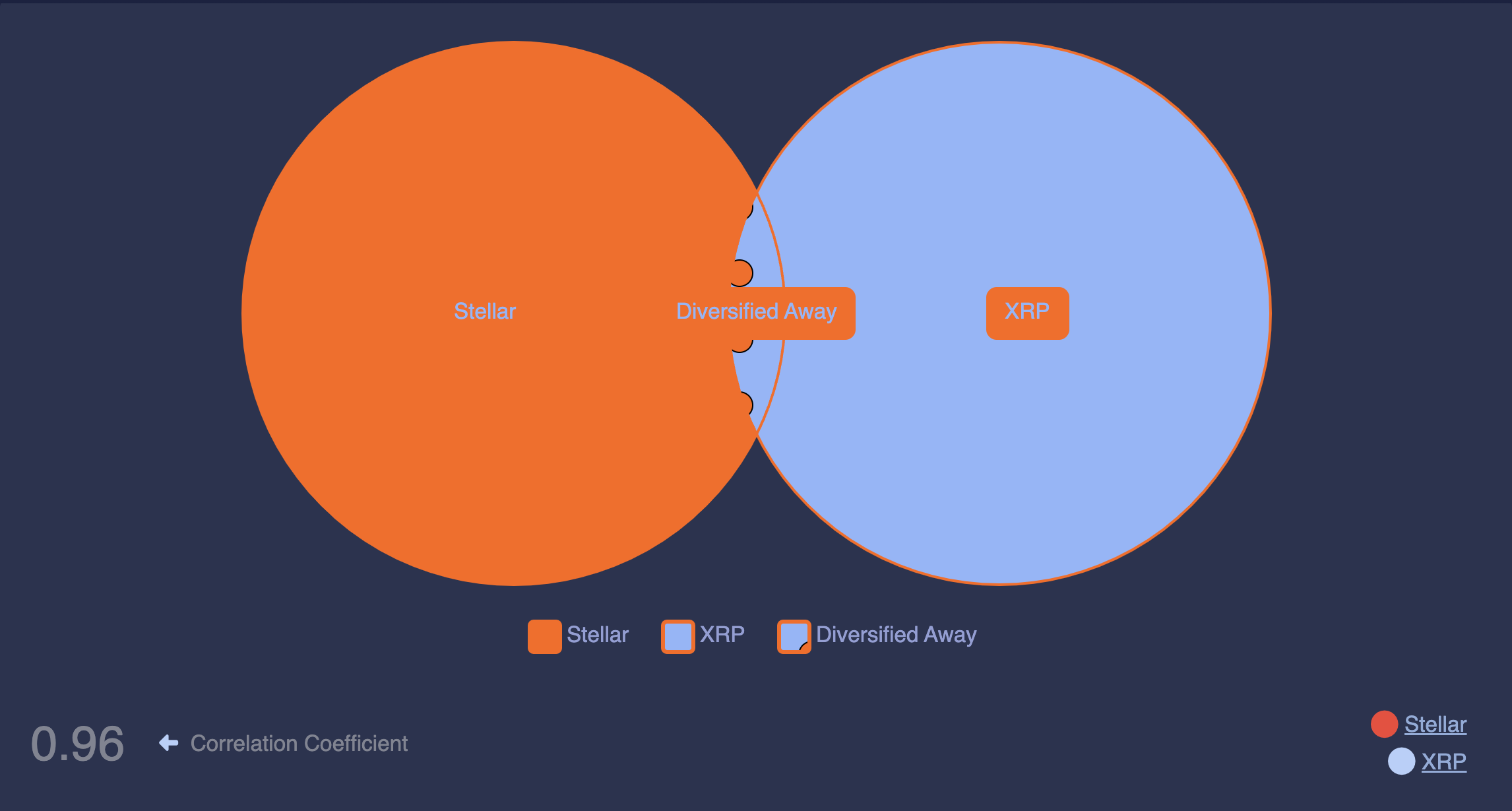

As a result, XRP and XLM prices often move in together. Macroaxis data supports this, showing a 90-day correlation coefficient of 0.96. To put this into perspective, the coefficient ranges from -1 to +1. Values closer to -1 suggest a weak correlation, while those nearing +1 indicate a strong link between the assets.

Stellar and Ripple Price Correlation. Source: Macroaxis

Besides the XLM volume, the altcoin’s Open Interest (OI) is also another metric that experiences a notable hike. High OI indicates that capital is flowing into the market, with new positions being established, reflecting a strong bullish sentiment.

On the other hand, a low OI suggests otherwise. According to Santiment, XLM’s OI has risen to $75.05 million — the highest level since Ripple’s partial win over the US in July 2023. Should the value continue to increase, then XLM’s price might also rise above $0.20.

Stellar Open Interest. Source: Santiment

XLM Price Prediction: Possible Move to $0.24

On the daily chart, XLM’s price initially rallied to $0.22, but it faced rejection at that point. Despite the slight retracement, the altcoin’s value remains above the Ichimoku Cloud. The Ichimoku Cloud is a technical indicator that measures support and resistance and identifies trend direction.

When the cloud is above the price, the trend is downward, indicating a high level of resistance. But in XLM’s case, the cloud is below the value, suggesting strong support that could push the price higher.

Stellar Daily Analysis. Source: TradingView

If this remains the case and XLM’s volume continues to rise, then the altcoin could hit $0.24. However, if holders decide to book profits, this might not happen. Instead, XLM’s price could drop to $0.16.

Read the full article here