Stellar (XLM) is trading at its lowest levels in a month, down 14% over the last 30 days and 5% in the past 24 hours following the escalation of the Israel-Iran conflict. The recent drop has pushed several technical indicators into bearish territory, with the price hovering near critical support levels.

A newly formed death cross and rising ADX suggest downward momentum remains in control, while RSI shows only a slight rebound from oversold conditions. With sentiment shaken and XLM under pressure, the coming days will be pivotal in determining whether a breakdown or reversal takes hold.

Stellar RSI Rebounds Slightly but Remains Near Oversold Territory

Stellar’s Relative Strength Index (RSI) is currently at 32.63, a slight recovery from yesterday’s 26.93 reading but still well below the 69.20 level seen just two days ago.

This sharp swing reflects a rapid shift in market sentiment, with XLM moving from near-overbought territory to the edge of being oversold in less than 48 hours.

The rebound from sub-30 levels suggests that some buying interest has returned, but the broader trend remains weak, and momentum is still fragile.

RSI is a momentum oscillator that measures the speed and magnitude of price changes on a scale from 0 to 100. Readings above 70 typically indicate an asset is overbought and may be due for a correction, while values below 30 suggest it’s oversold and may be primed for a bounce.

With XLM’s RSI now hovering just above the oversold threshold, it signals that selling pressure has cooled slightly, but buyers have yet to fully regain control.

If the RSI continues rising and crosses above 40, it could be an early sign of trend reversal, but caution remains warranted for now.

XLM ADX Rises as Bearish Momentum Remains in Control

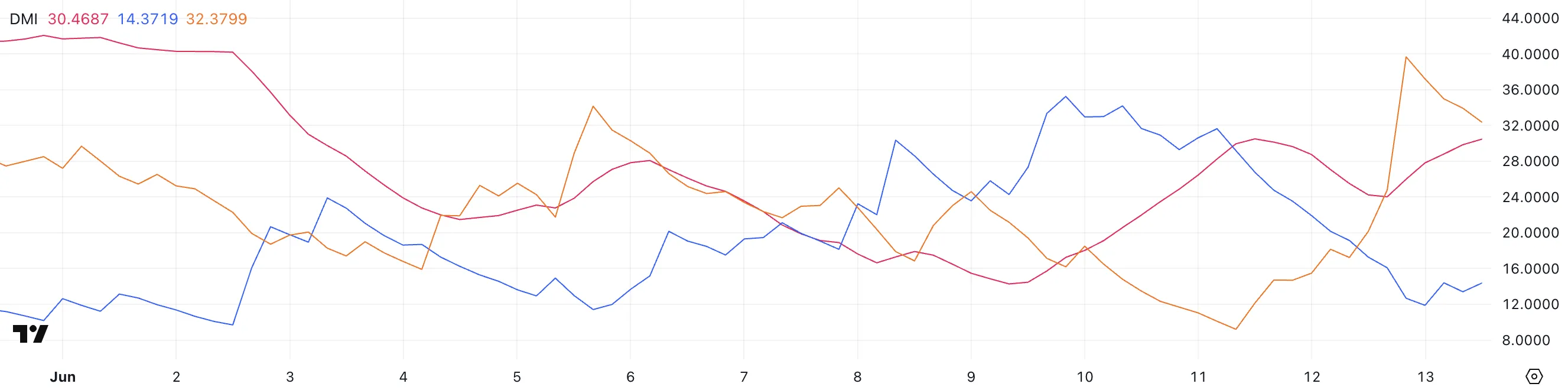

Stellar’s Directional Movement Index (DMI) shows an ADX reading of 30.46, up from 24 earlier today and nearly back to the 30.5 level it held two days ago.

This suggests that the strength of the current trend—whether up or down—is intensifying again after a brief dip in momentum. The +DI, which tracks bullish pressure, sits at 14.37, up from 11.88 earlier but still far below the 31.63 seen two days ago.

Meanwhile, the -DI, which measures bearish pressure, is at 32.37—down from yesterday’s 39.67 but still much higher than the 9.2 recorded two days ago.

The ADX gauges trend strength regardless of direction, with values above 25 typically indicating a strong trend. The widening gap between -DI and +DI signals that bearish momentum is still dominant, even as the intensity of that pressure has slightly eased.

With -DI firmly above +DI and ADX rising, Stellar appears to be in a strengthening downtrend, though the slight uptick in +DI could suggest the earliest signs of buyers stepping in.

Unless bullish momentum increases meaningfully, XLM may remain under pressure in the short term.

Stellar Nears Breakdown as Death Cross Pressures Price

Stellar’s EMA lines recently formed a death cross, a bearish signal that occurs when the short-term moving average crosses below the long-term one.

Stellar price is now trading near $0.26, and if the downtrend continues, it could test the key support at $0.252. A break below this level would push the price under $0.25 for the first time since April 20, reinforcing bearish momentum.

This technical setup reflects the pressure the asset has faced following weeks of weakening momentum.

However, indicators like the RSI and DMI suggest the worst may be behind.

If buying interest builds and the price breaks above the $0.276 resistance, XLM could rally toward $0.285 and $0.293.

In a stronger uptrend, the next target would be $0.31, though that would require sustained bullish volume.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here