- SUI surpassed its previous all-time high, reaching $5.20, a 20% increase in 24 hours.

- The total value locked (TVL) for SUI reached a record high of $1.96 billion.

As 2024 came to a close with some disappointment for Ethereum enthusiasts, who hoped for its price to reach new highs alongside Bitcoin’s rally, other Layer 1 blockchains are beginning to take the spotlight. Among them, Solana (SOL) and SUI (SUI) are gaining significant attention for their impressive performance in the crypto market.

While Bitcoin touched $98K at the start of 2025, SUI’s native token has surged, breaking its previous all-time high of $4.98, set just weeks ago on December 16, 2024. The current all-time high stands at $5.20, marking a 20% increase in just 24 hours.

Additionally, the daily trading volume skyrocketed by 150%, reaching $2.08 billion. Along with this surge, SUI’s daily trading volume has skyrocketed by 150%, reaching $2.08 billion. These gains have allowed SUI to climb into the 12th spot in the crypto rankings, surpassing Toncoin (TON) and Chainlink (LINK), with a market cap of $15.22 billion.

This rally in SUI price follows a significant spike in open interest, which climbed 40% to hit a record $1.05 billion, according to data from Coinglass. Further, the total value locked in SUI has soared to an all-time high of $1.96 billion, as per DefiLlama data.

(Source: DefiLlama)

This surge in open interest and TVL has acted as a trigger point, fueling further bullish momentum and drawing increased investor attention. Speculation in the market is rising, with many wondering if SUI’s price will hit the $10 mark in the coming days.

Can SUI Maintain Its Bullish Momentum? Key Levels to Watch

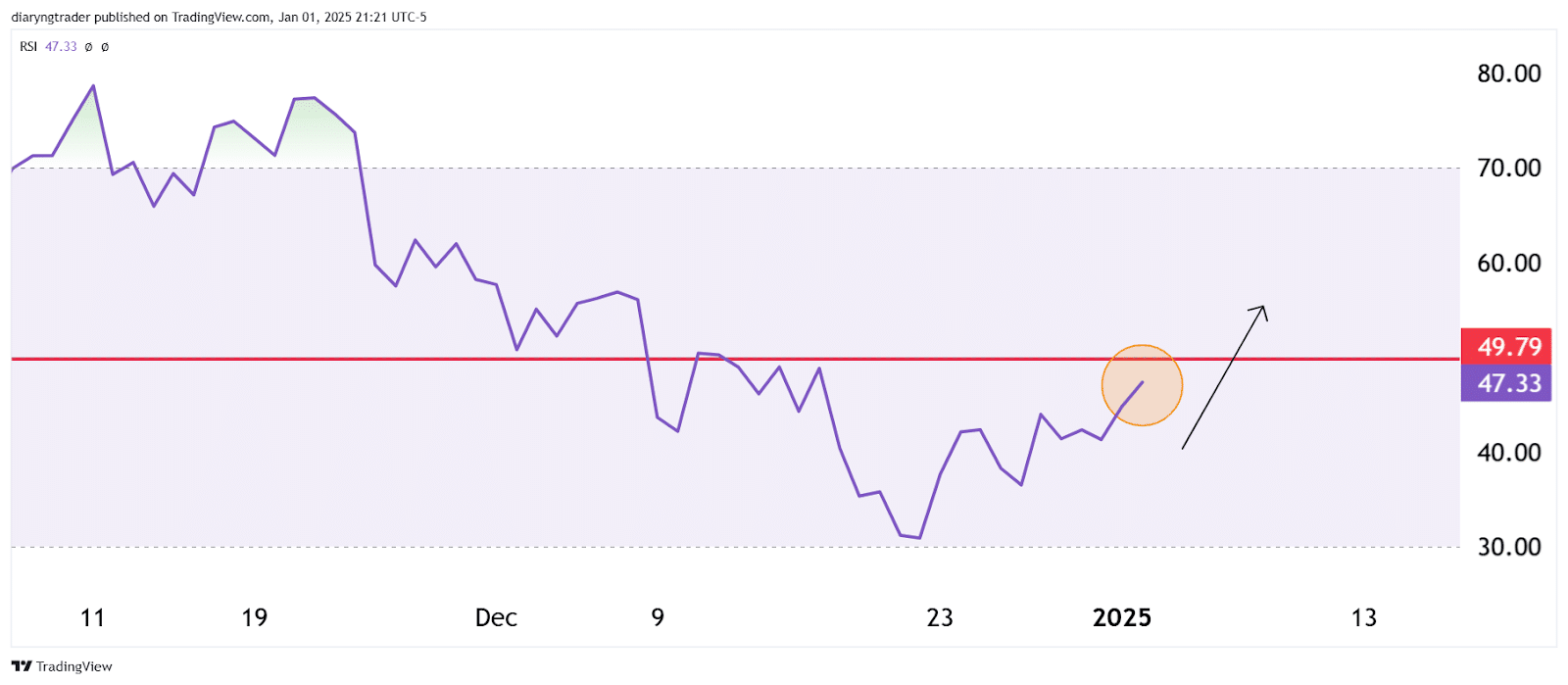

Technical indicators also show strong bullish momentum for SUI. Its price is trading well above the Ichimoku Cloud on the 4-hour SUI/USDT chart, signaling potential for further upward movement. Further, the MACD above the signal line confirms this momentum.

SUI Price Chart (Source: TradingView)

Looking ahead, an RSI of 75 on the 4-hour time frame indicates that SUI is currently in an overbought zone—signaling strong bullish momentum with buyers dominating the market. However, being in the overbought zone suggests a potential for consolidation or a slight correction soon.

- Immediate Resistance: $5.30—the first key level to watch for a potential breakout.

- Short-Term Target: $5.50—a significant resistance level that could act as a psychological barrier before further upside.

- Extended Target: $5.80—a possible area of strong bullish continuation, potentially targeting higher market sentiment.

- Support Levels (if correction occurs): $4.90—a critical support level that could help maintain upward momentum.

- Secondary support level: $4.70, which could provide a solid base for potential consolidation.

Finally, if $5.10 acts as a strong support, we could see a bounce off the support for further upside. The $4.90 and $4.70 levels could create double bottom formations if the price revisits these levels and then moves higher.

Read the full article here