SUI price is trading at $2.8 amid a broader market retracement, but analysts and on-chain data suggest the token is forming a potential reversal pattern.

With stablecoin transaction volume hitting a new high and outperforming Solana last week, SUI coin may be positioned for renewed bullish momentum if current support levels hold.

SUI Price Tests Key Support Zone

SUI price current structure is pulling back toward a critical Fibonacci support zone. Analyst Man of Bitcoin has identified a 1-2 setup, which could mean that the asset is at a corrective stage before a possible impulsive leg up.

His chart indicated the price scaling into an area of $2.62 and 1.87, with the end of invalidation at 1.718.

Source: Man of Bitcoin, X

This pattern finds support at several Fibonacci retracement levels, especially 0.618 to 0.786 bands commonly seen as high-probability bounce zones. SUI coin price is already reaching that low volatility, volume compression area, indicating possible accumulation.

Nevertheless, failure to break below the $1.718 makes the structure stable. Should the support hold, then the next wave could aim at levels closer to $3.40 and maybe beyond.

The current trend in prices mirrors the first quarter of 2024, where the altcoins with the best prices started a reversal in a similar area and recorded a rise of 40% over two weeks.

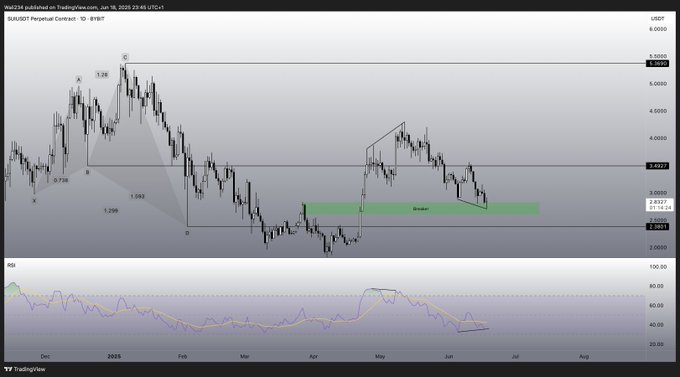

SUI Price Breaker Block Validates Zone

Adding to this configuration, analyst Waleed Ahmed pointed to a long-term breaker block of $2.30 to $2.80. SUI price is currently resting at the top of that block, which in March 2025 had served as resistance. This zone is now being retested as support.

Source: Waleed Ahmed, X

The daily RSI has dipped below 40, historically marking reversal points in prior SUI coin price cycles. As long as a price stays with this breaker block and RSI recovers above the 50 line, it may cause the next impulsive movement.

Volume indicators also indicate diminishing pressure in the sell side, which is normally an indicator of a trend reversal. Should the bulls re-enter around $2.70, then a move to the $3.40 resistance line is a feasible target.

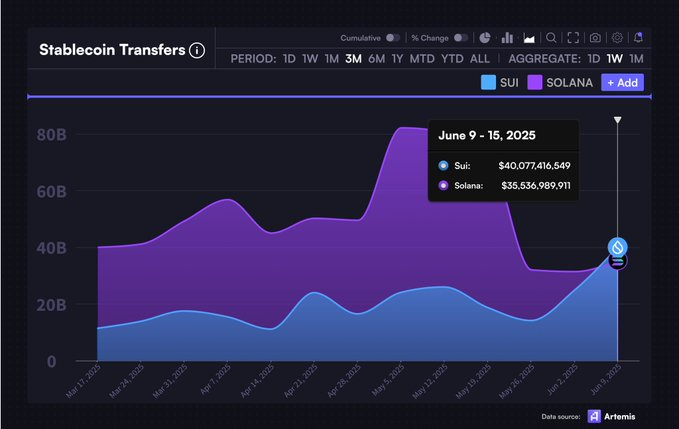

SUI Surpasses Solana in Weekly Stablecoin Transfers

Beyond technical analysis, on-chain metrics reveal strong underlying growth. According to Artemis data, SUI processed $40.07 billion in stablecoin transfers from June 9–15, overtaking Solana’s $35.53 billion for the same period. This marks the first time SUI has led in this category.

Source: Artemis Data

Stablecoin transfer volume is the key metric that measures actual network usage. Sui rise is an indication of an increasing interest in its DeFi uses and high-speed Layer 1 network.

Liquidity is being progressively moved to SUI by developers as the fees and smooth throughput are enticing.

This on-chain strength supports price stability even during corrections. A higher usage of stablecoin points to an increase in TVL value in protocols based on the Sui network.

This, combined with a roadmap of scaling, will put SUI in a competitive position as a Layer 1 during the subsequent bullish cycle.

Market Metrics Show Resilience

Meanwhile, SUI coin reached the 12th place in market capitalization to $9.57 billion, and 24-hour trade volume amounts to $965.8 million.

Its fully diluted valuation (FDV) stands at $28.17 billion, with a circulating supply of 3.39 billion out of 10 billion total tokens. A Vol/Mkt Cap ratio of 10.18% indicates that there is moderate valuation trading activity.

Although the SUI price fell by 16% in the last 7 days, it is still contained within the longer-term consolidation range.

SUI price reached a high of over $4.40 in April 2025, but it is currently at a possible retracement stage and showing signs of re-accumulation.

Read the full article here