The XRP price is currently trading around $2.20, making it at a critical crossroads. Analysts predict varied trajectories for the XRP price, ranging from a potential rally to $10 and beyond by 2025 to a decline below $2 to key support levels like $1.96 and further lower. This article delves into the recent XRP performance, critical support and resistance levels, whale accumulation trends, and the factors that could influence its next big move, for the most probable XRP price prediction.

By TradingView – XRPUSD_2024-12-23 (YTD)

XRP Price Analysis

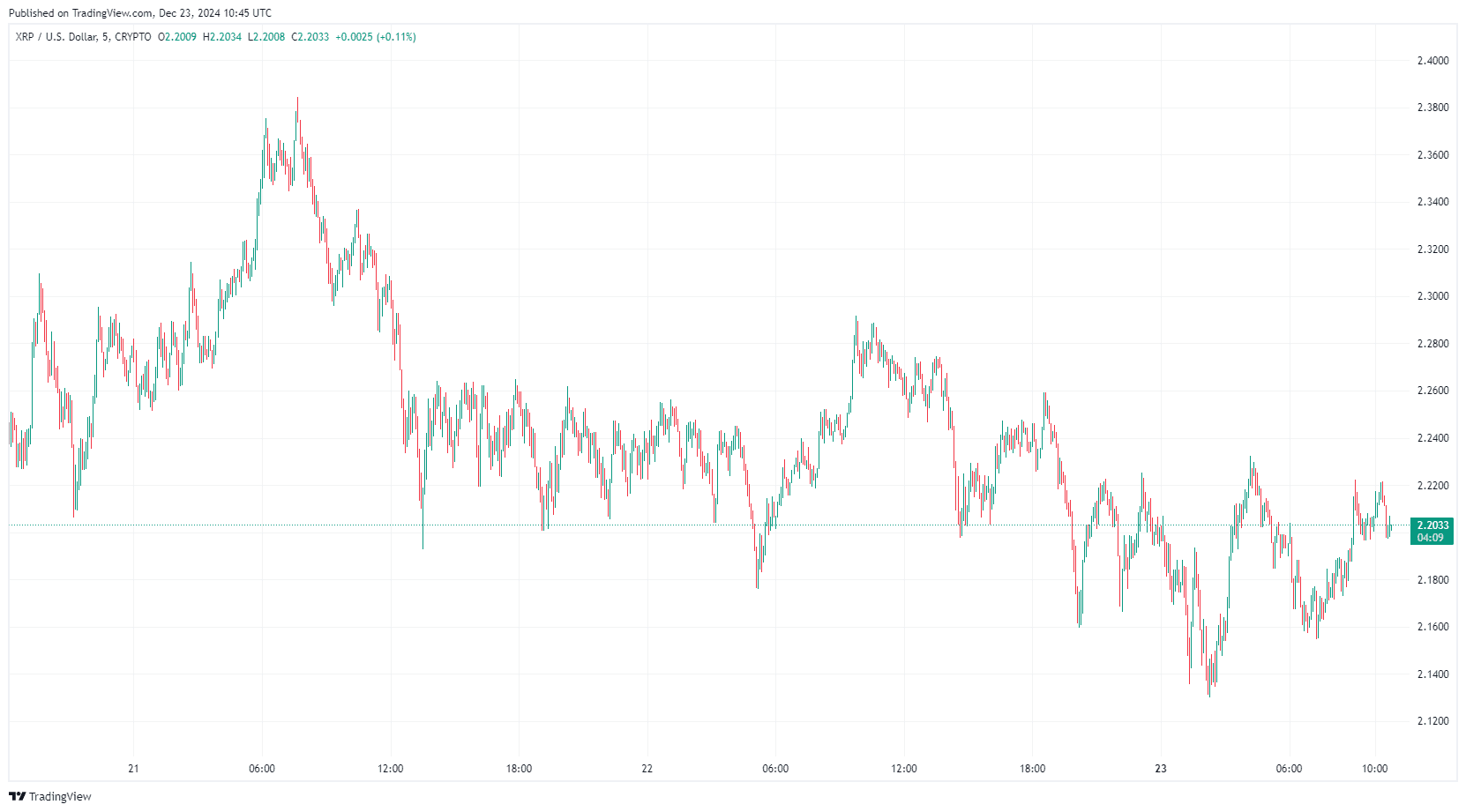

XRP Resistance and Support Levels

Despite bullish projections, XRP faces immediate challenges. Resistance zones at $2.25 and $2.30 have proven difficult to surpass. A bearish trend line at $2.25 and trading below the 100-hourly Simple Moving Average indicate that XRP may struggle to break higher in the short term.

On the downside, support at $2.20 is pivotal. A break below this level could lead to a decline toward $2.05 or even $1.96, marking a critical test for XRP’s bullish outlook. Conversely, holding above $2.20 could position XRP for a consolidation phase and an eventual rally toward $2.70, with a potential push beyond $3 in the coming weeks.

XRP Whale Activity and Market Sentiment

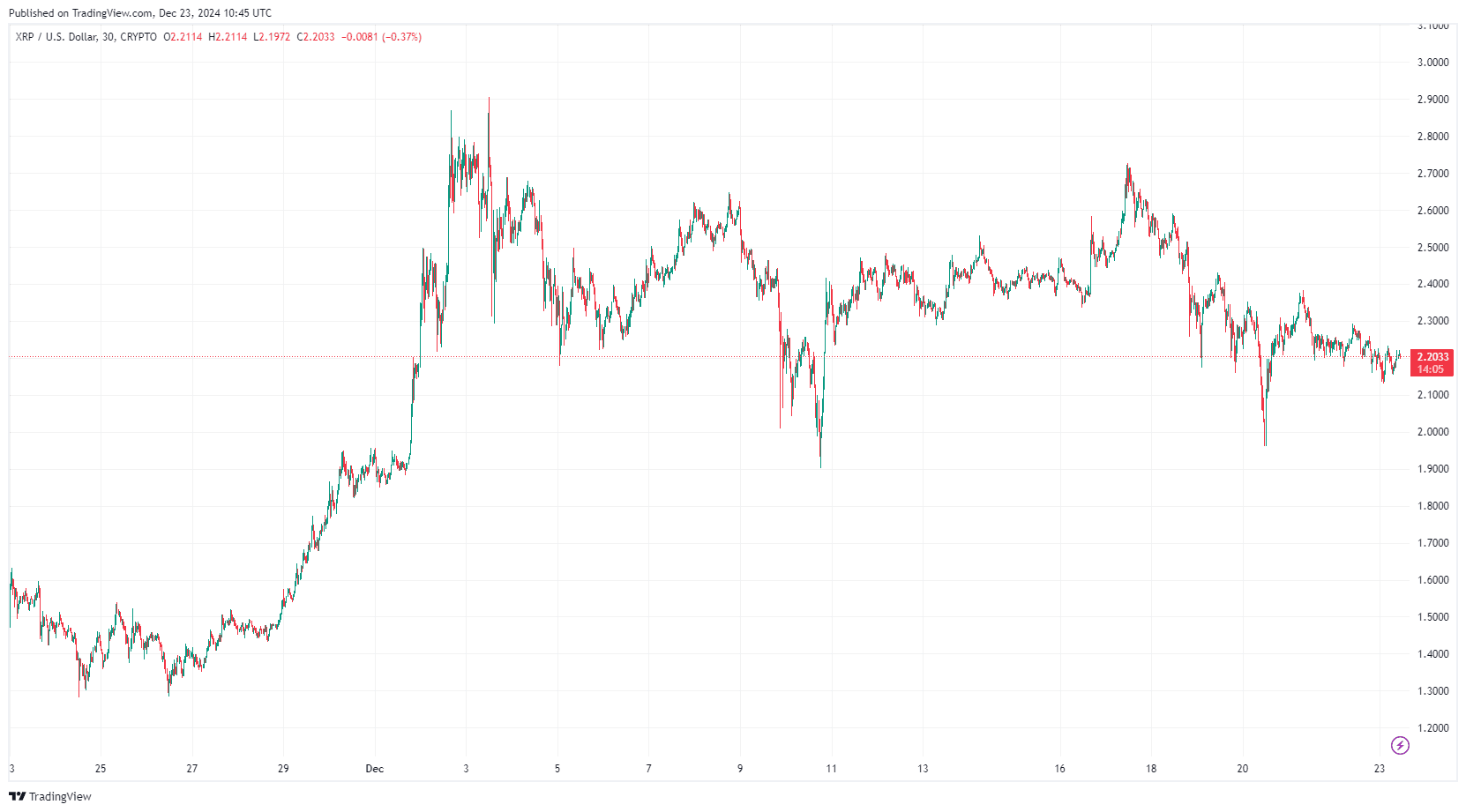

Recent on-chain data shows increased accumulation by whales holding between 1 million and 10 million XRP coins. Since December 17, these wallets have added 80 million XRP, signaling confidence in the token’s long-term potential. Whale accumulation during market downturns often supports price stability and recovery, providing a strong foundation for XRP’s next bullish wave.

Additionally, Elliott Wave analysis suggests that the recent XRP dip below $2 might mark the end of its corrective phase. If this holds true, a bullish impulse wave could begin soon, setting the stage for significant price gains.

By TradingView – XRPUSD_2024-12-23 (5D)

XRP Price Prediction: Surge to $10 or Drop to $1?

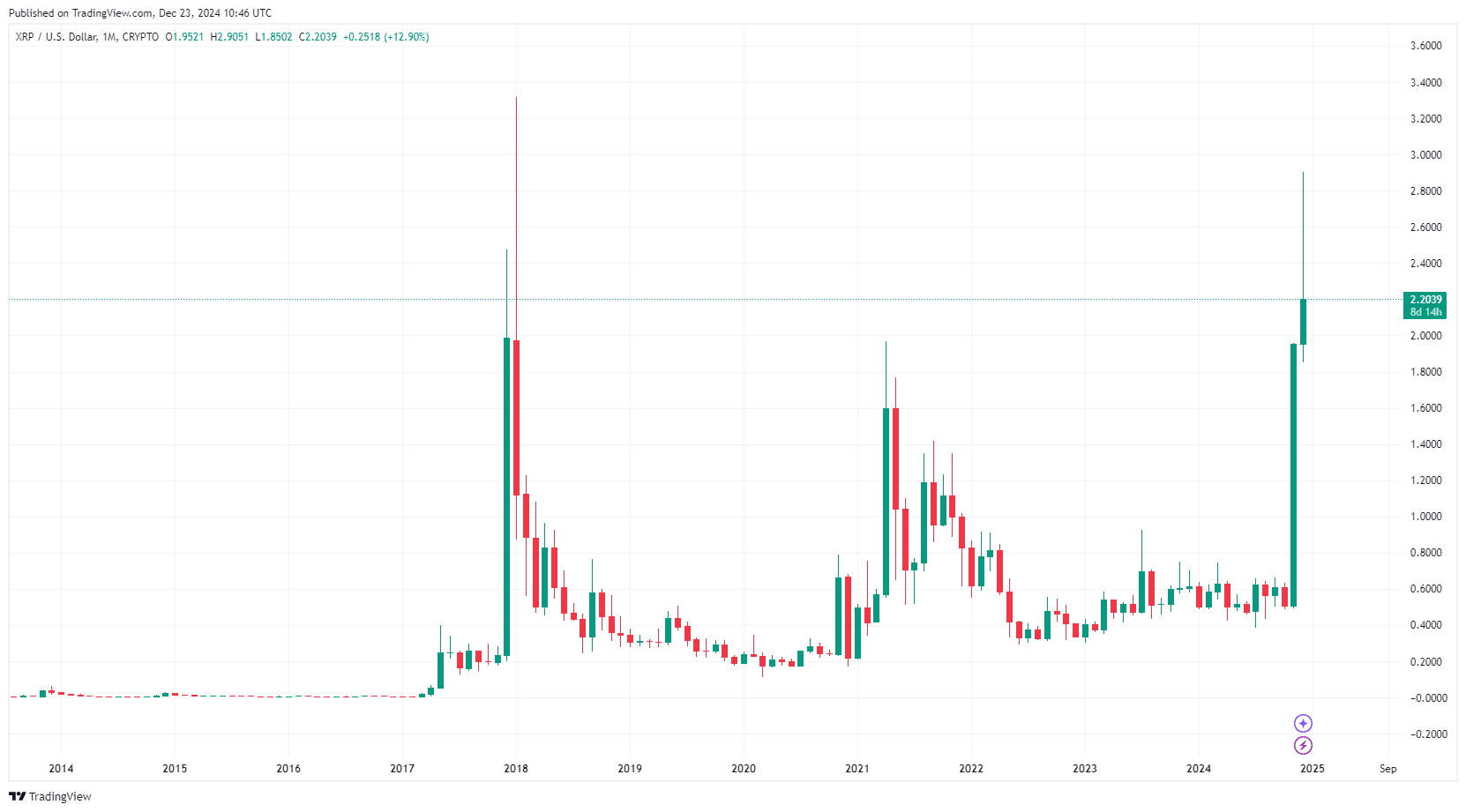

Technical analysis suggests that XRP may replicate its 2017 price pattern, which saw a monumental rally from below $0.0060 to its all-time high of $3.40. Analyst Cryptoinsightuk has outlined how XRP’s price action in 2023 mirrors its behavior from 2017, when a parabolic surge followed a period of consolidation.

If this trend continues, XRP could achieve a 460% breakout from its October 2024 range of $0.50, potentially reaching $10 by Q1 2025. Furthermore, if the “moon boy blow-off top” occurs as envisioned, XRP might hit $35 by late 2025, marking an impressive 1,505% gain from its current price of $2.20. However, reaching these targets hinges on several factors, such as institutional adoption, favorable regulatory developments, and broader market sentiment.

By TradingView – XRPUSD_2024-12-23 (1M)

Factors Driving XRP Future Performance

- Institutional Adoption: Increasing use of XRP in cross-border payments and partnerships with financial institutions could drive demand.

- Regulatory Environment: Expected regulatory clarity in 2025 might create a favorable backdrop for XRP’s growth.

- Market Trends: Bitcoin’s performance and overall market sentiment will likely influence XRP’s trajectory.

- Technical Indicators: Key levels, including the $2.30 resistance and $2.20 support, will determine short-term movements.

Could History Repeat Itself?

The XRP price is at a critical juncture. While analysts see the potential for a rally to $10 or even $35 by 2025, immediate challenges remain. Resistance levels at $2.30 and support at $2.20 will shape XRP’s short-term direction. Meanwhile, whale accumulation and historical patterns provide hope for bullish investors. As XRP battles to maintain its key support, traders and investors should monitor these developments closely.

By TradingView – XRPUSD_2024-12-23 (All)

Read the full article here