Tether’s USDT user growth saw its best quarter in Q3 and has increased by 9% on average over the last 12 months, cushioning the firm’s possible expansion into more traditional finance markets.

Tether reported that 36.25 million new on-chain USDT (USDT) wallets and users engaged with the largest crypto stablecoin in 2024’s third quarter, marking a new quarterly high for the digital payment titan. The USDT operator clarified that off-chain users, primarily on centralized platforms like Binance or Coinbase, were excluded from the analysis.

An Oct. 16 report revealed that tens of millions of USDT users exist on centralized exchanges and other off-chain venues, citing private data shared with Tether by partner firms.

Last quarter’s influx set a fresh record for USDT’s all-time wallet count for on-chain accounts. More than 300 million addresses have received Tether’s stablecoin, almost equaling the entire population of the United States.

USDT user growth per quarter

Ethereum L2s and Telegram’s TON driving Tether boom

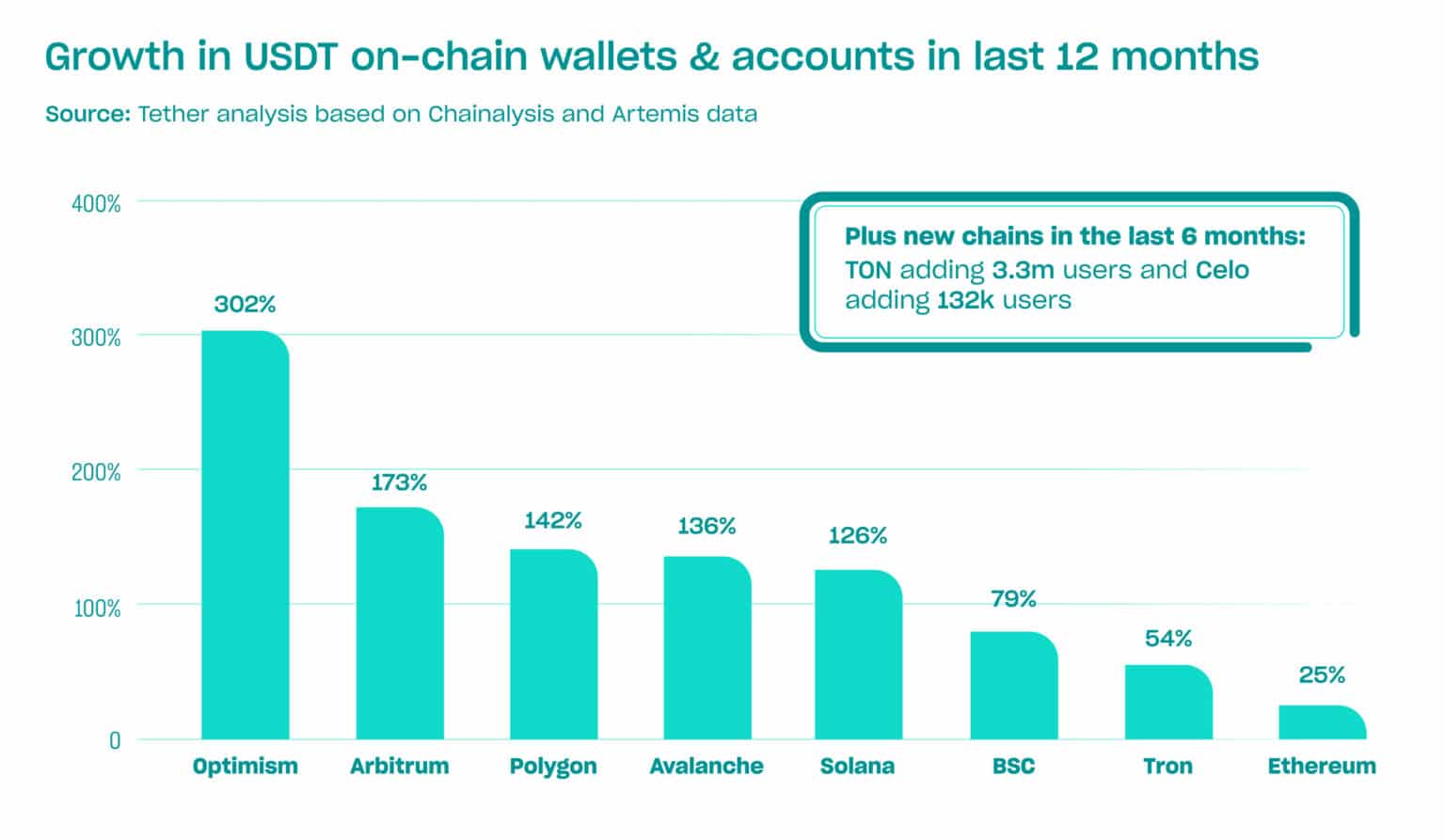

As the largest stablecoin on the market, several tier 1 blockchains like Binance Smart Chain, Ethereum (ETH), and Tron (TRX) support USDT. Tether noted that Ethereum-based layer-2 scaling networks contributed the most to USDT user growth in Q3.

Optimism (OP), Arbitrum (ARB), and Polygon (POL) onboarded the most USDT users in the last year. Avalanche (AVAX) and Solana (SOL) helped swell Tether accounts.

The firm said The Open Network on Telegram also showed “explosive growth” since USDT went live on TON in April. TON has added 3.3 million users in six months, according to Philip Gradwell, Head of Economics at Tether. TON accounted for 1% of all USDT on-chain accounts as of writing.

USDT growth on blockchains

With its USDT business reaching new highs, the digital payment service provider expanded its gaze to other endeavors through its investment arm. The company was said to be exploring lending billions from its record profits to traditional finance and commodities trading firms.

Read the full article here