Running an Ethereum L2 was historically very expensive. L2s had to pay millions in data availability costs to the L1.

All that changed with the Dencun hardfork (EIP-4844) in March 2024. It introduced an expansion of blockspace called “blobs” for L2s to post batched data extremely cheaply to the L1. Blob space sits in a separate fee market from the L1. It’s about an order of a magnitude cheaper than L1 blockspace, making it a critical aspect of Ethereum’s rollup-centric roadmap.

To illustrate that point, Base paid $9.34 million in expenses for Q1 2024, which saw a sharp drop to $699k in Q2 2024 and $42k in Q3 2024, based on TokenTerminal data.

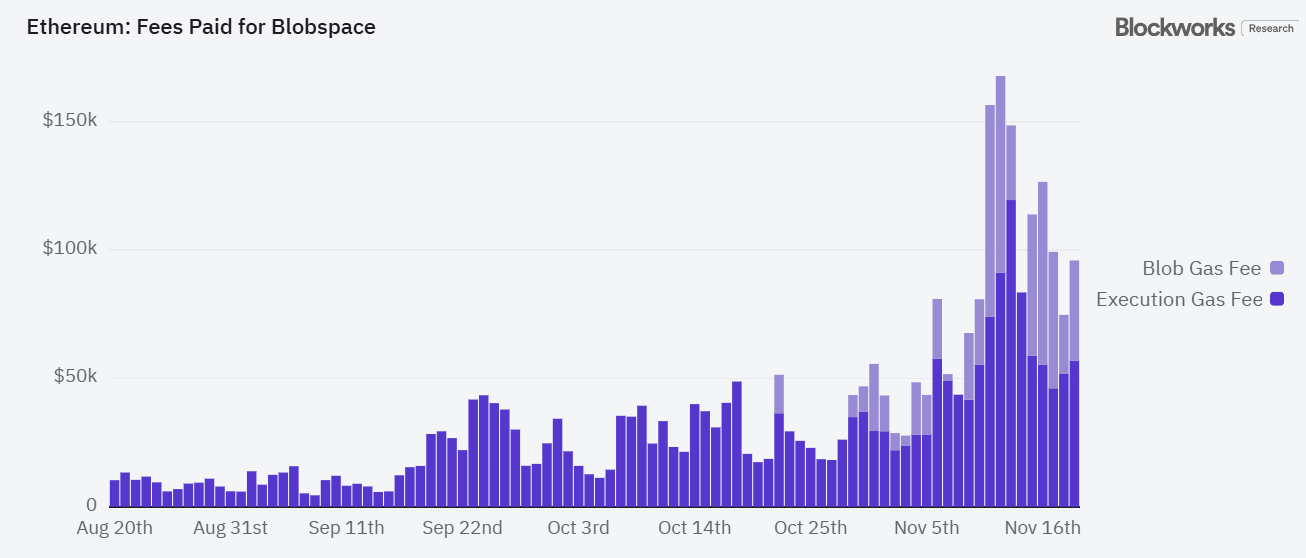

The bad news (or good?) is that blobspace is getting somewhat pricey again as onchain activity picks up in the bull market.

Blobs today are limited to six per mainnet block. When blob usage hits a target limit of 50%, or three, a base fee is introduced to regulate demand usage by hundreds of L2s. When usage hits four blobs, base fees are further increased by up to 12.5% for the next block.

That is exactly what is starting to take place over the past several weeks (see chart below).

In short, blobs aren’t free anymore and L2s need to start paying “rent.” Based on ultrasound.money, blob fee burn is coming up to about 212 ETH in the last 30 days, and has generated substantial blob fees to Ethereum mainnet.

So blobs are generally great. L2s are cheaper to operate, and that’s nice for L2 users.

But people (read: ETH holders) aren’t happy because it looks like L2s are getting away with paying barely any expenses to the L1, which thereby accrues less value to ETH the asset.

This complaint centers around pessimism that blob usage will be high enough to return value to the L1 for two key reasons:

- L2s are fundamentally a business. They will opt for a cheaper data availability provider like Celestia or EigenDA, or worse still, a centralized data availability committee (DAC) with weaker security properties.

- L2s will simply delay posting data back to the L1 when blob markets get expensive, as we have seen Scroll and Taiko do in the past.

In a debate around blobs at Devcon, Ethereum researcher Ansgar Dietrichs acknowledged the misaligned incentives of L2s but counter-argued that Ethereum’s DA would matter more in the long term with more L2 networks coalescing around it as trust bottlenecks emerge around bridging.

There was also the “blobs is a loss leader” argument by Blueyard’s Tim Robinson. He notes that while blobs do not generate much revenue at present, they would do so very quickly due to the economics of blob design, and pay massive dividends for Ethereum in the future. According to Robinson’s blob simulator, a hypothetical Ethereum L1 processing 10,000 TPS with a 16 MB blob size (blob sizes are 125 KB today) would burn 6.5% of ETH a year.

This potential value accrual for ETH is why blobs would be fundamentally good for Ethereum in the long run. Throttling blob limits or raising blob fees to extract more value from L2s in the short run would basically be a bad “rent-seeking” idea.

And Ethereum researchers are putting their money where their mouth is. In an Ethereum Research post published two days ago, Toni Wahrstätter called for either a conservative increase to 4/6 blobs or a higher 6/9 blob count.

In ACDE #197, Vitalik also proposed a 33% increment of blob space in the next Pectra hard fork, which he cautioned was essential. Otherwise, users would leave to other chains.

In sum, the complex debate around blobs boils down to the question of whether Ethereum wants to prioritize the average L2 user and its “Ethereum-aligned” L2 ecosystems, or prioritize value accrual to ETH the asset.

Ethereum researchers believe that prioritizing the latter may cause an exodus of users and developers to cheaper chains, and are doubling down accordingly on scaling blob space for the long term. However, that damages the perception of ETH as an economic asset, which in turn angers ETH token holders in the short run.

It’s a tricky situation for Ethereum either way, one which requires the mammoth task of crystal-balling into the future and accounting for a myriad of “what-ifs.” Time will tell which path is correct.

Read the full article here