Ethereum (ETH) is charting a bullish course, with technical indicators hinting at a potential rally.

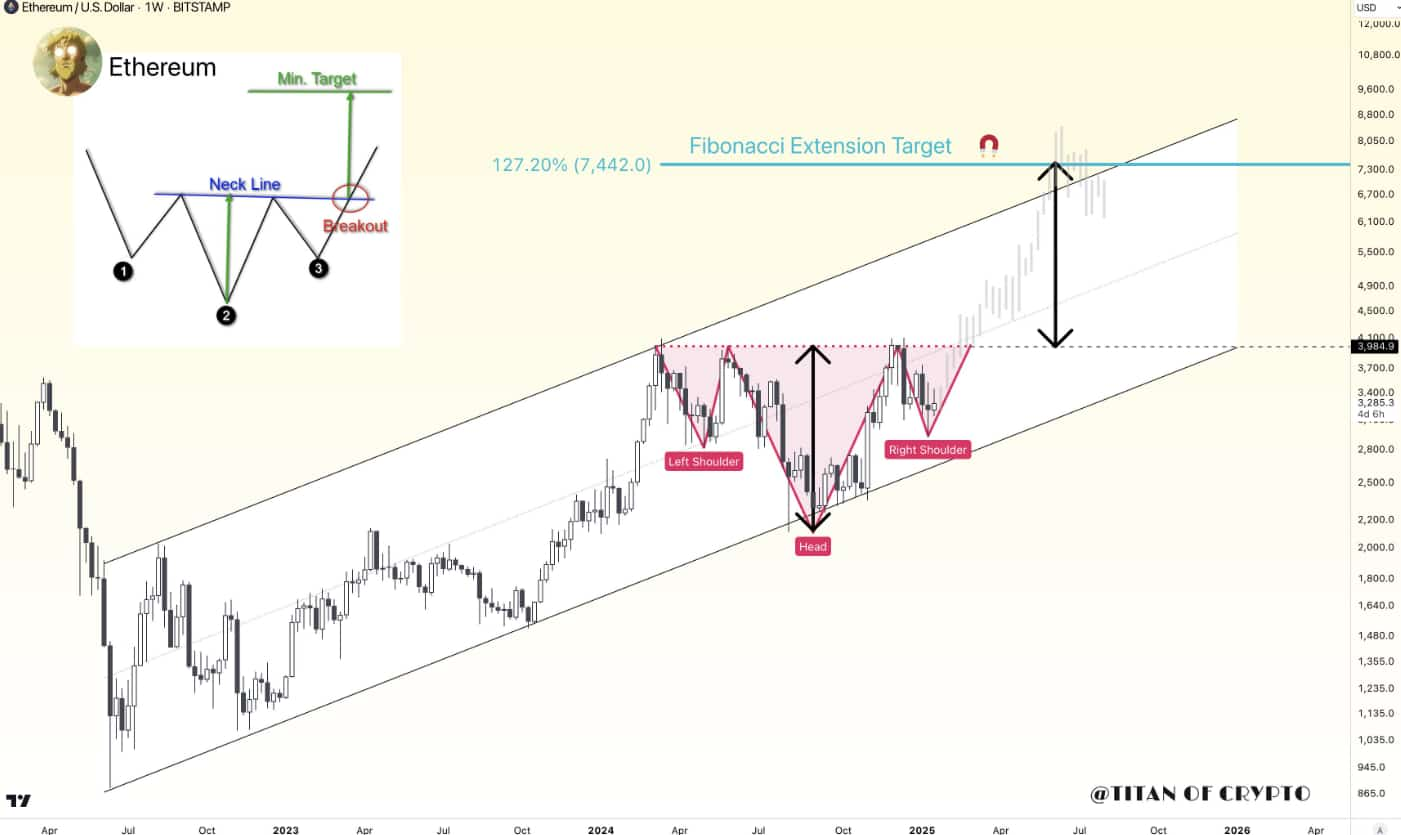

According to a recent analysis by Titan of Crypto, Ethereum appears to be forming a potential Inverse Head and Shoulders (H&S) pattern within an upward channel, with a target of $7,400 in sight.

If confirmed, this pattern could signal the beginning of a significant upward move in the coming months.

However, at press time, Ethereum is trading at $3,223, reflecting a daily decline of 1.96% and a weekly drop of nearly 3%, indicating the current market uncertainty.

Ethereum technical analysis paints a bullish picture

The inverse Head and Shoulders pattern, a widely recognized bullish reversal structure, is becoming increasingly apparent in Ethereum’s current price action. The neckline, which serves as a critical resistance level, is positioned above the current price near $4,000.

A decisive breakout above this neckline, backed by substantial trading volume, could validate the pattern and set the stage for a significant upward move.

Further supporting this bullish narrative, the Fibonacci extension at 127.20% points to a target of $7,442, aligning closely with the projection from the H&S setup.

Since early 2023, Ethereum has been trading within a well-defined upward channel, offering consistent support and resistance levels. This channel strengthens Ethereum’s broader bullish momentum, with the technical framework signaling the potential for further gains.

Ethereum’s bullish confluence with Ascending Triangle

Adding to the bullish case, long-term crypto investor Jelle identified that Ethereum is showcasing a compelling technical setup on the weekly chart, with two significant bullish patterns developing simultaneously.

Jelle noted that the inverse H&S pattern is forming with the neckline resistance around $4,000, within the broader structure of an ascending triangle, another bullish continuation signal.

A similar surge in April 2024 was followed by a price rally from $2,800 to $4,000, highlighting the strong correlation between network growth and price performance.

Looking ahead, artificial intelligence (AI) models forecast a near-term target for Ethereum at $3,750 by the end of Q1 2025, assuming continued market activity and strong demand.

Conversely, in a bearish scenario driven by macroeconomic pressures or reduced liquidity, Ethereum’s price could retrace to $3,000 showing the influence of external factors on its performance.

Meanwhile, investor sentiment has increasingly shifted toward altcoins and meme coins, which have posted notable gains in recent weeks, with Ethereum lagging behind in capturing the broader market’s enthusiasm.

Featured image via Shutterstock

Read the full article here