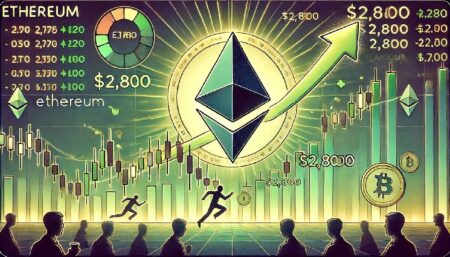

Ethereum is once again capturing attention across the market, and for good reason. On the daily chart, ETH has just confirmed a sustained move above the 200-day EMA, which is traditionally seen as a critical threshold between bearish and bullish cycles. This breakout could be laying the foundation for a broader push toward $3,000, with the current level near $2,500 acting more like a pit stop than a ceiling.

Recent price action shows ETH consolidating above multiple EMAs, and despite some choppy candles, bulls are holding their ground. The bounce from the 200 EMA was swift and backed by a noticeable uptick in volume, typically a sign of renewed market interest. The RSI is steadily climbing again from neutral territory, indicating there’s room for further upward momentum without immediately triggering overbought conditions.

The second chart, IntoTheCryptoverse’s long-term moving averages, gives this breakout even more significance. ETH is now sitting well above its 200-week SMA ($2,450), which historically has acted as a launchpad during bull cycles. Add to that the price being squeezed between the 50W and 100W SMAs, and it’s easy to see why a breakout above $2,700 could lead to a rapid acceleration toward the $2,800-$3,000 range.

However, there’s still a critical resistance barrier around $2,700. It’s not just a psychological level, it also aligns with the 50W SMA and previous price congestion zones from early 2024. If ETH manages to convincingly break through this wall, we are likely looking at the early stages of a medium-term bullish rally.

Ethereum is sending strong technical signals. The 200 EMA flip, robust support near $2,450 and alignment with historical long-term moving averages point to a potentially explosive upside, if the $2,700 resistance gives in. This chart does, in fact, explain everything.

Read the full article here