Tokenized real-world assets (RWAs) have evolved from a niche concept to a mainstream use case of institutional finance, with private credit leading the charge as investors pursue programmable yields.

That was one of the main takeaways from RedStone’s H1 2025 RWA Market Overview, co-authored by DeFi protocol Gauntlet and data platform RWA.xyz.

Excluding stablecoins, the tokenized RWA market has grown by as much as 380% since 2022, reaching a combined $24 billion in value.

Although much of the discourse has centered on tokenized Treasury bills, with BlackRock and Franklin Templeton entering the fray, private credit now accounts for over half of the RWA market, reaching $14 billion, he report said.

Private credit, also known as direct lending in investment circles, provides RWA investors with yields ranging from 8% to 12%, the report said, while highlighting products like Apollo’s ACRED fund.

As alternative asset manager FS Investments observes, investors have long turned to private credit for its “yield premium” over public credit markets. According to RedStone, tokenization is now enhancing settlement speed and liquidity, lowering barriers to entry and enabling fractional participation — capabilities that private credit markets have historically lacked.

Related: Midas launches tokenized T-Bill on Algorand

Ethereum remains the dominant tokenized RWA platform

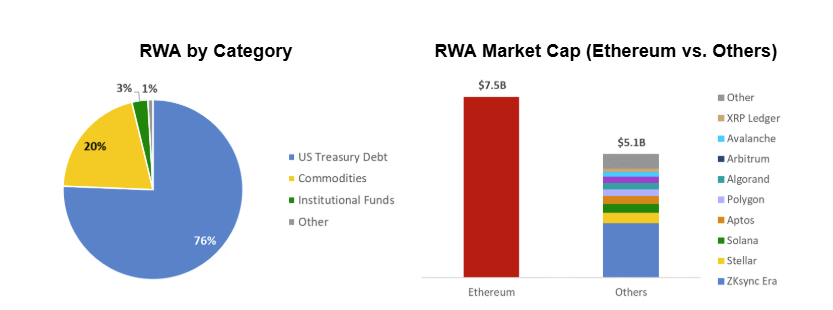

While Ethereum’s dominance has been eroded in recent years by faster and more scalable blockchains, it remains the premier network for tokenized RWAs, RedStone said. By mid-2025, the Ethereum network hosted roughly $7.5 billion in tokenized value across 335 products, accounting for 59% of the total market.

“While Ethereum’s decentralized governance has historically limited its institutional outreach, the launch of Etherealize in January 2025 marked a strategic pivot,” the report said, referring to the Ethereum Foundation’s marketing effort to bring more institutional participation onchain.

However, the report called Solana a “high-performance challenger” for its growing role in the tokenized Treasury market.

As of June, Solana hosted roughly $351 million of tokenized assets.

Aptos has also seen increased RWA deployment, hosting $349 million in tokenized assets as of June. Notably, Aptos was the first non-Ethereum Virtual Machine network for BlackRock’s BUIDL fund.

Elsewhere, Avalanche now hosts $188 million in tokenized assets, including KKR’s tokenized fund, while XRP Ledger has emerged as a “regulated newcomer” with $157 million in tokenized RWAs, according to the report.

Related: Solana Foundation, Bitget Wallet join Ondo Finance’s ‘market alliance’

Read the full article here