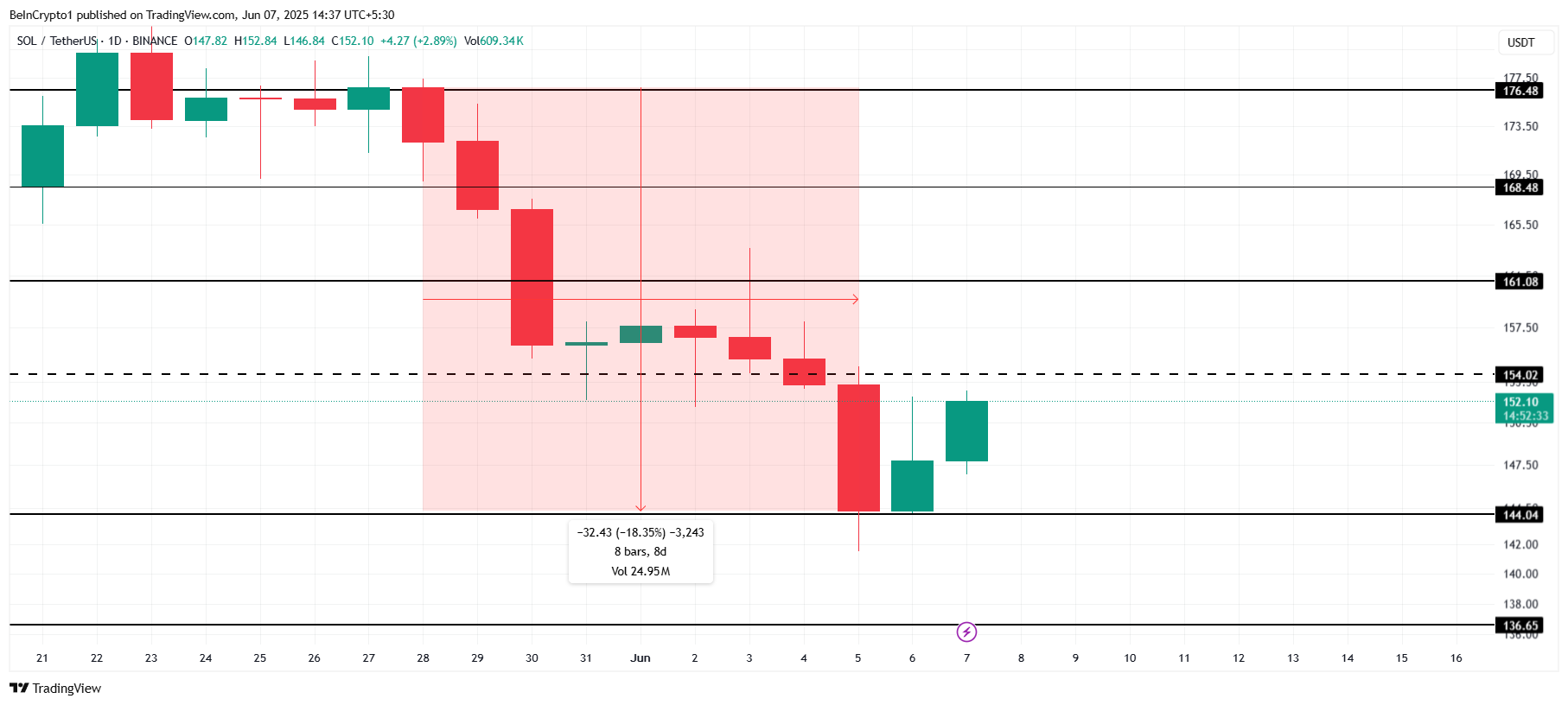

Solana (SOL) recently experienced a sharp decline, dropping from $176 to $141 in just eight days. After this significant downturn, many traders hoped for a recovery.

However, the altcoin’s path to regaining lost ground now faces challenges, mainly due to a shift in investor behavior that could slow down or prevent further price gains.

Solana Investors Are Selling

Long-Term Holders (LTHs) have shifted from being staunch buyers to becoming sellers. Outflows from LTH wallets have recently surged to a two-month high, a move that hasn’t been seen in the past month.

This change in behavior signals a significant shift in the market, as LTHs are often considered the backbone of an asset’s price stability.

The consistent selling from these investors raises doubts about Solana’s price stability in the short term. Since LTHs are generally seen as more patient investors, their decision to sell signals a potential loss of confidence.

The macro momentum for Solana remains concerning as key technical indicators continue to signal bearish market conditions.

The 50-day Exponential Moving Average (EMA) and 200-day EMA, which have been closely watched by traders, are showing signs of continued bearishness. The Death Cross, which began in March, is still in play.

Although the 50-day EMA came close to crossing over the 200-day EMA in late May, it failed to do so, indicating that recovery may not be imminent. This continued bearish trend puts Solana’s recovery in jeopardy.

If the Death Cross persists and the EMAs continue to diverge negatively, it could signal further price declines.

SOL Price Needs A Push

Solana’s price recently dropped by 18% in just eight days but saw a slight recovery, rising 5% in the last 24 hours. Currently trading at $152, SOL faces significant resistance at the $154 level.

This barrier is crucial for any potential bullish move in the short term. If the price fails to break through this resistance, further declines may be on the horizon.

Considering the current market sentiment and technical indicators, Solana’s price may struggle to breach the $154 resistance. Instead, it could see a pullback toward $144. If this support fails to hold, the price could drop further to $136.

However, if broader market conditions improve, Solana could experience a rally. A breakout above the $154 resistance would push the price towards $161. Reaching this level would end the Death Cross pattern, helping to restore investor confidence and invalidate the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here