The price of Toncoin (TON) is currently exhibiting a sideways movement, remaining in a state of consolidation.

This phase can either lead to a rally or a correction, leaving the future direction of the altcoin in question.

Toncoin at a Crossroads

Investors in Toncoin are at a crossroads, especially with the price trading above the $5.00 mark, which is seen as a positive development for most. This optimism is largely due to the Global In/Out of the Money (GIOM) metric.

It indicates that about 2.12 million TON, valued at over $10.9 million, would enter a profitable state once the altcoin surpasses the $5.33 threshold.

Toncoin Support and Resistance. Source: IntoTheBlock

Despite the potential for significant profits, which could suggest a further rally or even a new all-time high, the reality may differ due to the predominance of short-term holders in the TON supply.

Read More: What Are Telegram Bot Coins?

These short-term investors, who typically hold their assets for less than a month, are prone to selling, creating a volatile environment for the altcoin. Currently, they account for about 37% of the total circulating supply.

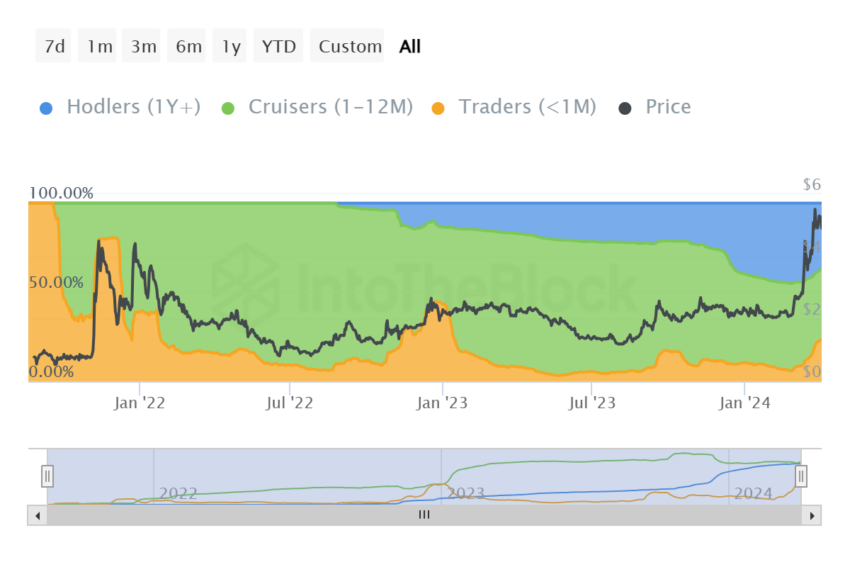

Toncoin Supply Distribution. Source: IntoTheBlock

Therefore, a price increase could lead to a wave of profit-taking, which might cause the price of Toncoin to fall again.

TON Price Prediction

Considering these factors, the price of Toncoin is likely to fluctuate back to around $4.80, maintaining its consolidation phase. However, significant selling pressure could push the price below the $4.80 support level, potentially dropping it to $4.48.

Read More: Which Are the Best Altcoins To Invest in April 2024?

Toncoin Price Chart. Source: TradingView

Conversely, if investors hold back from selling during a price rally, Toncoin has the opportunity to overcome the $5.44 resistance mark. Achieving this could pave the way for the cryptocurrency to reach a new all-time high, thereby challenging the bearish outlook.

Read the full article here