The overwhelming bipartisan passage of the U.S. Senate’s stablecoin bill, with a 68-30 final vote that saw a huge surge of Democrats joining their Republican counterparts on Tuesday, sets a new high-water mark of crypto policy efforts in the U.S. as the legislation now heads to the House of Representatives.

The major Democratic backing for the Guiding and Establishing National Innovation for U.S. Stablecoins of 2025 (GENIUS) Act helps give it momentum as it lands in the other chamber, where House lawmakers can either vote on it as written or pursue changes that will require a final round in the Senate before it can head to President Donald Trump’s desk.

As written, the bill would set up guardrails around the approval and supervision of U.S. issuers of stablecoins, the dollar-based tokens such as the ones backed by Circle, Ripple and Tether. Firms making these digital assets available to U.S. users would have to meet stringent reserve demands, transparency requirements, money-laundering compliance and regulatory supervision that’s also likely to include new capital rules.

Ji Kim, the Acting CEO of the Crypto Council for Innovation, called it a “historic step forward for the digital asset industry,” in a prepared statement shared ahead of the vote

“This is a win for the U.S., a win for innovation and a monumental step towards appropriate regulation for digital assets in the United States,” said Amanda Tuminelli, executive director and chief legal officer of the DeFi Education Fund, in a similar statement.

While it has failed to convince some of the most vocal Democratic critics such as Senator Elizabeth Warren, who say it allows loopholes for foreign tokens such as Tether’s

USDT$1.00

, doesn’t deal with conflicts presented by the personal crypto involvement of President Trump and clears a path for technology giants such as Amazon to issue their own coins, the bill’s backers in her party have essentially argued that doing nothing isn’t an option.

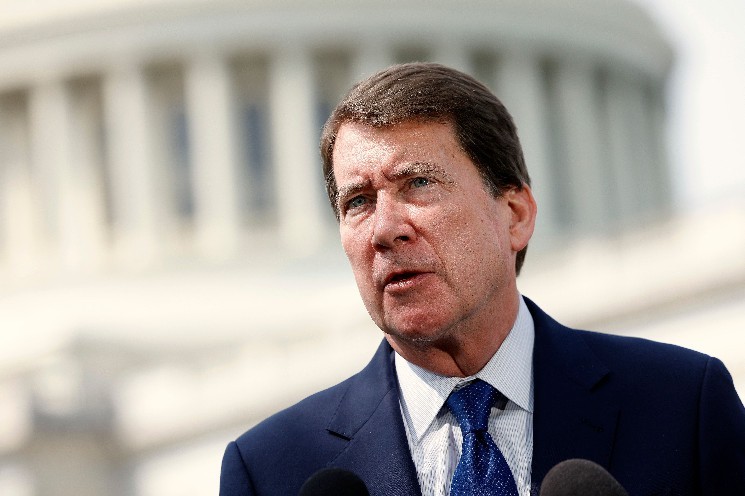

“With this bill, the United States is one step closer to becoming the global leader in crypto,” said Senator Bill Hagerty, the Tennessee Republican who sponsored the bill, as the Senate prepared to vote on Tuesday. “The value of stablecoins will be pegged to the U.S. dollar and backed one-to-one by cash and short-term U.S. Treasuries. This will provide certainty and confidence for more wide-scale adoption of this transformational technology.”

While this is the first significant crypto bill to clear the Senate, it’s also the first time a stablecoin bill has passed either chamber, despite years of negotiation in the House Financial Services Committee that managed to produce other major crypto legislation in the previous congressional session.

The destiny of the GENIUS Act is also tied closely to the House’s own Digital Asset Market Clarity Act, the more sweeping crypto bill that would establish the legal footing of the wider U.S. crypto markets. The stablecoin effort is slightly ahead of the bigger task of the market structure bill, but the industry and their lawmaker allies argue that they’re inextricably connected and need to become law together. So far, the Clarity Act has been cleared by the relevant House committees and awaits floor action.

The crypto industry’s lobbyists turn now to the House on both those issues. A new report on Tuesday from TRM Labs says that stablecoins represent more than 60% of current crypto transactions, and more than 90% of those coins are pegged to the U.S. dollar — dominated by USDC and USDT.

“Although TRM estimates that 99% of stablecoin activity is licit, their speed, scale, and liquidity have made them appealing for illicit uses, including ransomware payments, fraud, and terrorist financing,” the analytical organization noted.

Illicit finance represents one of the major complaints of critics in Congress.

Read More: Can Tether’s Dominance Survive the U.S. Stablecoin Bill?

Read the full article here