Coinbase took a loss in its latest Supreme Court argument on a very narrow point about arbitration.

Bad news for Coinbase doesn’t translate directly to anything in the digital assets sector.

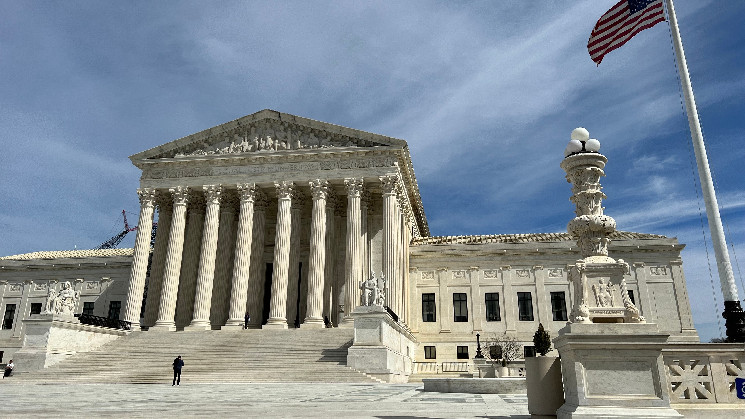

The U.S. Supreme Court ruled against Coinbase Inc. (COIN) in its dispute over which legal agreement should hold sway when parties are under two distinct contracts and the first of them calls for arbitration, finding the company’s case was “unpersuasive” and that the courts need to work those questions out when they arise.

The matter was far removed from the company’s cryptocurrency business, but arbitration issues have been increasingly important in the technology sector in general. This particular case arose over a dispute about whether an arbitration clause in an initial contract should have controlled what happened in a subsequent contract tied to a Dogecoin (DOGE) sweepstakes competition the exchange held in 2021

“The question whether these parties agreed to arbitrate arbitrability can be answered only by determining which contract applies,” according to the Thursday opinion written by Justice Ketanji Brown Jackson. “When we home in on the conflict between the delegation clause in the first contract and forum selection clause in the second, the question is whether the parties agreed to send

the given dispute to arbitration – and, per usual, that question must be answered by a court.”

That wasn’t what Coinbase had hoped to hear. The company didn’t immediately respond to a request for comment on the ruling.

“Coinbase contends that our approach will invite chaos by facilitating challenges to delegation clauses,” Jackson wrote in the court’s opinion. “We do not believe that such chaos will follow.”

The loss in this second highly technical case leaves Coinbase with a mixed record at the Supreme Court, having won its previous dispute over another arbitration matter.

Because the scenario outlined in this case is narrow and unusual, it “will have limited applicability in arbitration-related jurisprudence going forward,” said Richard Silberberg, an arbitration lawyer with Dorsey & Whitney and a director of the New York International Arbitration Center. “The unanimous SCOTUS decision that a court, not an arbitrator, must decide whether the parties’ first agreement was superseded by the second was hardly surprising,” he added, because previous rulings had pointed in that direction.

Bottom line, according to Rollo Baker, a founding partner with Elsberg Baker & Marur:

“The decision makes clear that where parties have two agreements, one that calls for arbitration and a later-executed agreement that calls for court resolution, it is not ‘unmistakably’ clear that the parties intended arbitrability to be resolved in arbitration,” he said in an emailed statement.

While this case wasn’t at the core of crypto, the Supreme Court is widely expected to eventually resolve the industry’s legal battles with U.S. regulators, though it may take years for any of these cases to even appear before the high court.

Read More: Coinbase Argues an Arbitration Case in U.S. Supreme Court as Crypto Makes Its Debut

Read the full article here