Buoyed by the prospect of a friendlier regulatory environment, altcoins were the biggest advancers after crypto-friendly GOP candidate Donald Trump Tuesday evening won another term in the White House.

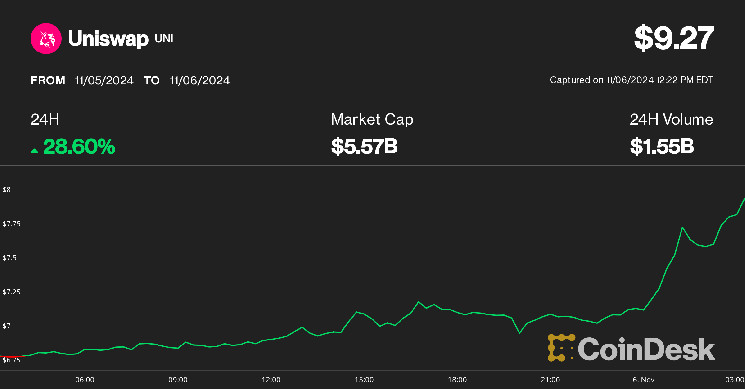

The largest gainer by a wide margin was Uniswap’s (UNI), which was higher by 28% over the past 24 hours. Open interest (OI) for the token has soared by 20% in over the past day, according to Coinglass data and over 18 million UNI tokens ($169 million) are now in OI contracts, the highest amount since April 2024. OI in the past 24 hours alone has seen an increase of over 3 million UNI tokens worth over $60 million. The last time UNI saw such an aggressive increase in OI was back in April as prices were quickly falling.

Additionally, funding rates for UNI have doubled over the last day from approximately 5% to 10%, with a positive funding rate meaning traders who are long have to pay short traders to keep their position open. Other things being equal, higher funding rates mean traders are anticipating further price advances.

The UNI advance is pacing an 8.2% gain for the CoinDesk 20 Index, outperforming bitcoin’s 6% rise to $74,600. Other notable movers from the gauge include Solana’s (SOL), up 10% and Avalanche’s (AVAX) and ChainLink’s (LINK), each ahead about 8.5%. Underperformers include Ripple’s (XRP) and Polkadot’s (DOT), each rising less than 4%.

Read more: Trump’s Triumph Is Also Crypto’s: Gensler, Regulatory Clouds Likely to Vanish

Uniswap in the past months has been a particular target of the U.S. regulatory apparatus, in April having received a Wells Notice of coming possible enforcement action by the Securities and Exchange Commission and in September agreeing to pay $175,000 to settle Commodity and Futures Trading Commission charges it offered illegal leveraged and margined commodities transactions.

Read the full article here