VIRTUAL price has surged 15% in the last 24 hours following Donald Trump’s $500 billion investment in AI infrastructure, reigniting interest in AI-related cryptos. Despite this strong performance, VIRTUAL is still working to regain its momentum in 2025 after a sharp 55% correction between January 2 and January 13.

Indicators like RSI and BBTrend suggest a cautious recovery, with sentiment showing signs of improvement but not yet fully supporting a sustained uptrend. As VIRTUAL navigates key resistance and support levels, the coming days will be crucial in determining whether this rally marks the start of a stronger trend or another short-lived surge.

VIRTUAL RSI Is Currently Neutral

VIRTUAL Relative Strength Index (RSI) is currently at 51.1, slightly down from its earlier peak of 56 but marking a recovery from the previous four days when it fluctuated between 35 and below 50.

This movement into the neutral zone suggests a shift in market sentiment, with buying and selling pressures now more balanced. The recent rise above 50 indicates the possibility of building momentum, though it remains to be seen whether this can lead to sustained bullish activity.

RSI is a momentum indicator ranging from 0 to 100, used to measure the speed and magnitude of price movements. Values below 30 typically signal oversold conditions and potential price rebounds, while values above 70 suggest overbought conditions and possible corrections.

With VIRTUAL RSI at 51.1, the market sentiment appears neutral, showing no strong bias in either direction. If the RSI begins to rise further above 60, it could signal increasing bullish momentum, whereas a drop back below 50 might indicate a return to weaker conditions.

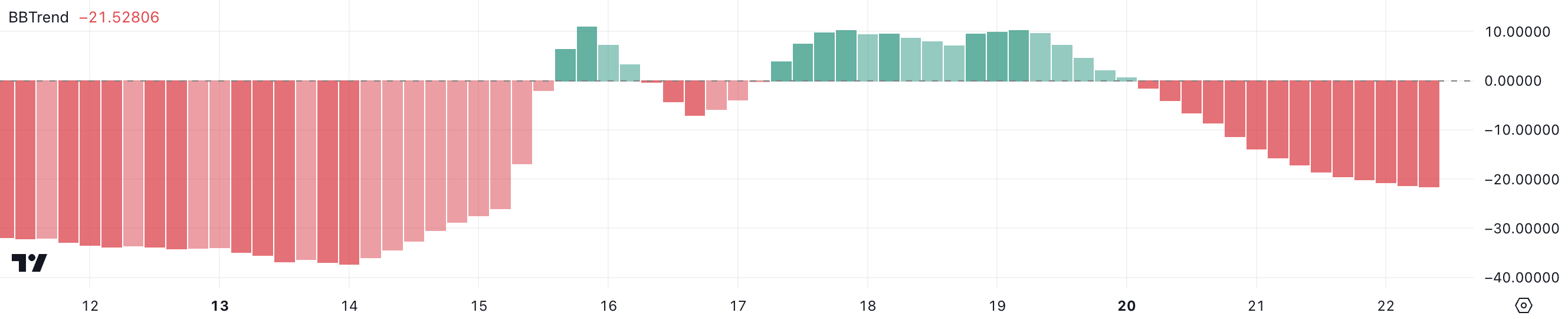

VIRTUAL BBTrend Stays Low Despite Recent Price Surge

VIRTUAL’s BBTrend is currently at -21.5, its lowest level in a week, despite the ongoing price surge fueled by Donald Trump’s $500 billion investment in AI infrastructure. Just two days ago, BBTrend stood at -1.49, highlighting a sharp decline in trend strength.

This suggests that while the price is rising, the underlying momentum may not be strong, raising questions about the sustainability of the current surge.

BBTrend, derived from Bollinger Bands, measures the strength and direction of a trend. Positive values indicate a bullish trend, while negative values suggest bearish conditions. With VIRTUAL’s BBTrend at -21.5, it signals weak or potentially reversing momentum, even in the face of recent bullish price action.

This could mean that the price surge is driven by short-term sentiment rather than strong underlying support, leaving VIRTUAL vulnerable to a potential retracement if momentum around AI cryptos does not improve.

VIRTUAL Price Prediction: Will the Current Uptrend Continue?

VIRTUAL’s EMA lines remain in a bearish setup, with recent data suggesting its revenue is down 99%. The short-term lines are rising, indicating improving momentum and the potential for a golden cross — a bullish signal where short-term averages cross above long-term ones.

If this occurs, VIRTUAL price could see a surge in price, testing resistance levels at $3.27 and $3.73. A breakthrough beyond these levels could lead to a test of $4.13, signaling a strong recovery.

On the downside, if the current momentum fades, VIRTUAL could retrace to test support at $2.81. A break below this level would expose it to further declines, with $2.22 as a potential lower target, threatening VIRTUAL’s position as the leading crypto AI agent coin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here