Consensus for headline inflation year-over-year is expected to increase by 0.2% to 2.6% — the first year-on-year increase since March 2024.

Bitcoin’s 30-day implied volatility spiked to as high as 90% past week, and could see further volatility when U.S. inflation data is announced.

The U.S. inflation report set to be released on Wednesday has the potential to stir up bitcoin (BTC) price volatility, ending the 48-hour period of calm.

Its been a whirlwind week for cryptocurrencies, with Donald Trump winning the U.S presidential election on Nov. 6. As a result, the total cryptocurrency market jumped from $2.2 trillion to $3 trillion back down to approximately $2.8 trillion, according to TradingView.

While bitcoin (BTC), the largest cryptocurrency by market capitalization, touched $90,000 on Nov. 12 just before U.S. equity markets closed.

U.S. inflation data is not squashed

Per FXStreet, the U.S. consumer price index (CPI) due at 8:30 ET, is expected to show that the cost of living increased 2.6% year-on-year in October, having risen 2.4% in the preceding month. This would be the first year-on-year increase since March.

The issue of embedded inflation is not from headline but from core inflation, year-over-year. Early this year, we saw core come down from 3.9% to 3.2%. However, it turned higher in September to 3.3%, presenting a challenge to the Fed.

The concern of inflation not being slayed can be shown in the U.S. yields, which have only soared since the Federal Reserve started the rate-cutting cycle with a 50bps rate cut, followed by a further 25bps rate cut. Since the first rate cut on Sep. 16, the U.S. 10Y has jumped from 3.6% to 4.4%. With the U.S. 3-month treasury yield trading at 4.6%, which follows the effective federal funds rate, it’s suggesting that no more than 25bps of rate cuts will occur over the next three months, as the current target rate is 450 – 475.

So, with a spike in implied volatility and an expected increase in headline inflation YoY, could bitcoin see a dramatic price swing later today?

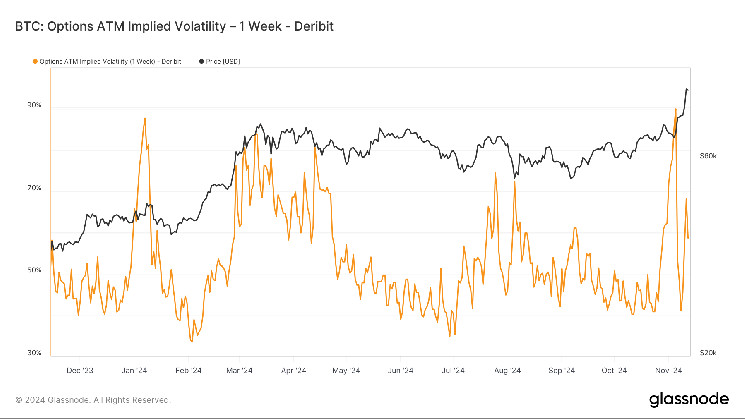

Implied volatility has risen

Implied volatility for options contracts expiring one week from today has spiked from 40% to as high as 90% due to bitcoin’s climb to $90,000, an increase of more than $20,000 since Nov. 6. Glassnode defines implied volatility as the market’s expectation of volatility. Viewing At-The-Money (ATM) IV over time gives a normalized view of volatility expectations, which will often rise and fall with realized volatility and market sentiment.

How has bitcoin fared on previous U.S. CPI releases?

Inflation data releases brought downside volatility to bitcoin in the first quarter. It performed negatively as inflation remained almost double the inflation target. For example, bitcoin fell as much as 7.5% on Jan. 12 when the U.S. reported a hotter inflation figure for December.

However, as the year progressed and headline inflation YoY continued to slow, this became more of a bullish event for bitcoin, eventually registering a 6.7% price increase on Jul. 15 as an example.

As inflation slowed, the market became more efficient and produced three consecutive 0-1% price movements. Now, inflation is expected to rebound again.

Read the full article here