Bitcoin price surged past $82k, marking a new all-time high that has sparked excitement in the cryptocurrency world. This latest price rally comes as President-elect Donald Trump’s pro-crypto stance gains traction. With hopes of a more favorable regulatory environment, driven by Trump’s policies and a pro-crypto Congress, Bitcoin and the broader crypto market are seeing record-breaking growth. This price surge is not only a victory for Bitcoin but has also driven significant gains for altcoins like Solana, Cardano, and Dogecoin. This article will explore the key factors behind Bitcoin’s meteoric rise, including Trump’s influence on the crypto market, MicroStrategy’s bold Bitcoin strategy, and what lies ahead for Bitcoin’s future price trajectory, highlighting its major key levels to watch out for next.

Bitcoin Price Surge Ahead of Trump’s Pro-Crypto Policies

Bitcoin price climbs to new heights above $82k is largely attributed to the growing optimism surrounding Donald Trump’s re-election and his pro-crypto policies. Trump’s commitment to making the U.S. a global leader in digital assets has sent waves of optimism throughout the market. During his campaign, Trump promised to position Bitcoin as a key strategic reserve asset, similar to gold, and to build a U.S. Bitcoin stockpile. Additionally, his efforts to appoint pro-crypto regulators and push for legislation like the Bitcoin Act have further fueled investor confidence.

Following Trump’s re-election, the crypto market has witnessed a surge in investments. Bitcoin’s market capitalization soared to over $1.6 trillion, and the total market valuation reached $2.8 trillion. This increase in Bitcoin’s value is reflective of a broader trend of institutional and retail interest in cryptocurrencies, especially Bitcoin, which is seen as the flagbearer for digital assets.

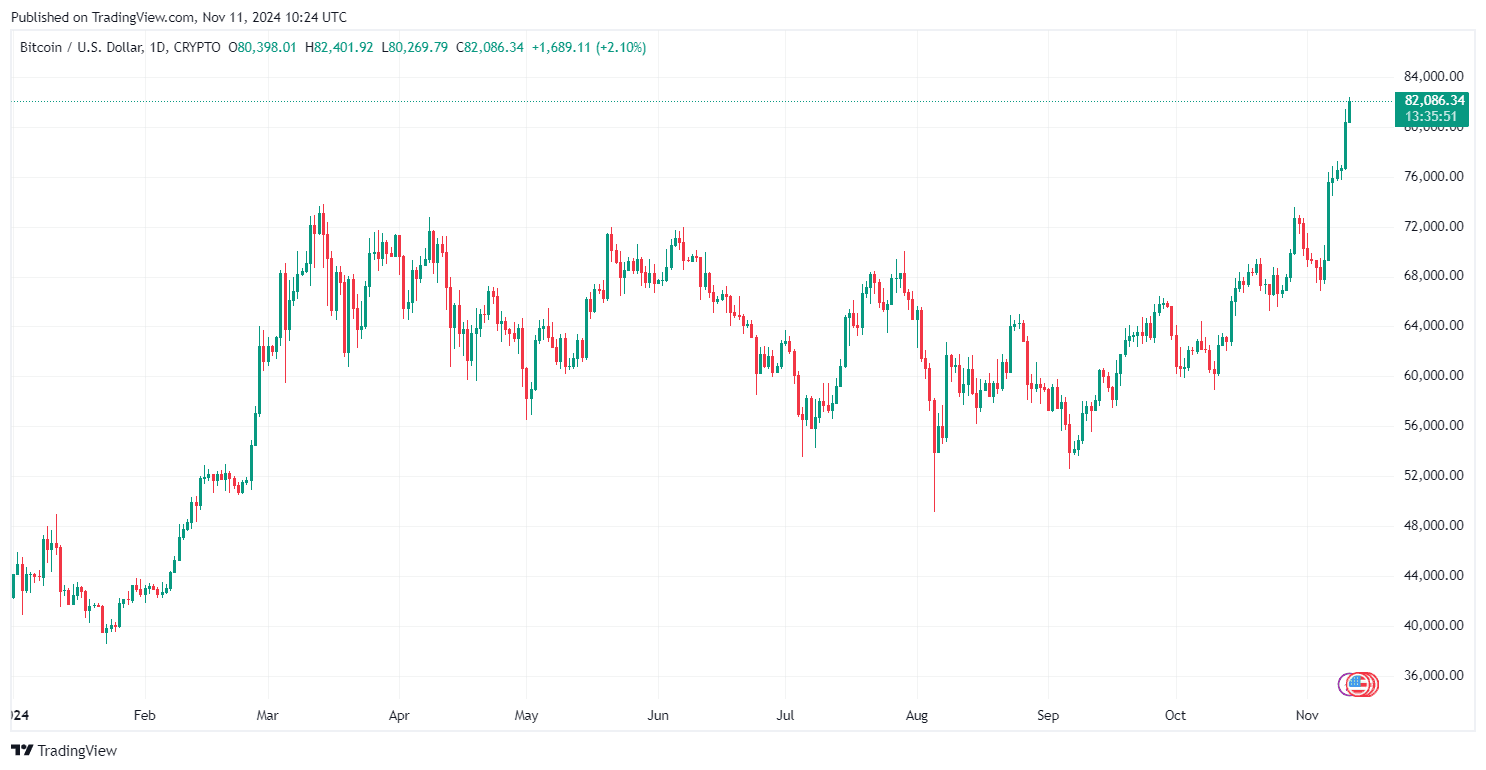

By TradingView – BTCUSD_2024-11-11 (5D)

MicroStrategy’s $20 Billion Bitcoin Portfolio Impact on the Market

Another major development contributing to the rise in Bitcoin prices is the continued investment by MicroStrategy, a business intelligence company led by Michael Saylor. MicroStrategy has been a significant Bitcoin buyer, amassing over 252,000 BTC in its portfolio, worth over $20 billion at today’s prices. This strategic move by MicroStrategy to hold Bitcoin as a corporate asset is part of its broader initiative to raise $42 billion through equity and securities for future Bitcoin acquisitions. As Bitcoin price rises, MicroStrategy’s stock has also surged, proving the interlinked growth of Bitcoin and traditional financial markets.

MicroStrategy’s bullish stance on Bitcoin has led to substantial unrealized gains, with the company’s portfolio seeing a 107% increase in value. This growing corporate embrace of Bitcoin positions the cryptocurrency as a legitimate asset in both corporate and personal investment portfolios, signaling the potential for wider adoption among institutional investors.

Record Bitcoin Gains and the Role of Bitcoin ETFs

In addition to Trump’s pro-crypto policies and institutional investments like those of MicroStrategy, Bitcoin’s price gains have been driven by the rising interest in Bitcoin exchange-traded funds (ETFs). Following Trump’s re-election, Bitcoin ETFs have seen significant inflows, with $2.28 billion pouring into Bitcoin ETFs since November 6. The increasing popularity of Bitcoin ETFs reflects growing institutional interest in Bitcoin as a store of value and a hedge against inflation.

With Bitcoin’s price pushing past $82,000, analysts are predicting that Bitcoin could reach $100,000 by Trump’s inauguration day on January 20, 2025, based on trends in ETF accumulation and historical market data. Bitcoin ETFs are now holding over 1 million BTC, an indication of increasing institutional confidence in the cryptocurrency market.

By TradingView – BTCUSD_2024-11-11 (YTD)

What’s Next for BTC Price: Watch Out For These Key Levels

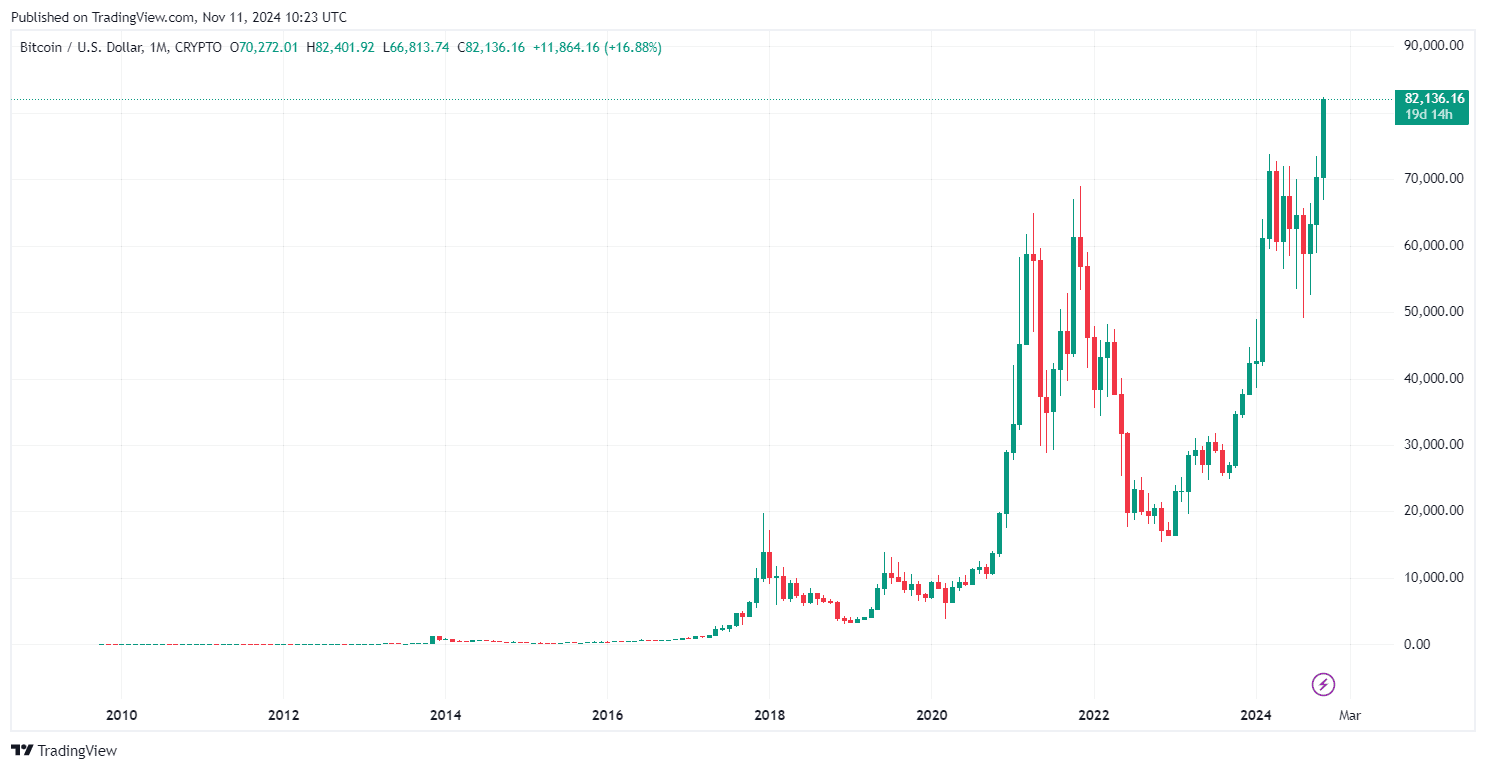

The outlook for Bitcoin remains bullish, with many analysts predicting further growth. A technical breakout from Bitcoin’s current price levels could signal a move toward $300,000 by 2026. Bitcoin is currently experiencing a giant inverse head-and-shoulders (IH&S) pattern, similar to the breakout seen in gold during the 2009-2010 period. If Bitcoin’s price breaks above the key resistance levels, it could spark a new bull run, making $300,000 a plausible target in the coming years.

For now, the combination of Trump’s pro-crypto policies, institutional investments, and the growing acceptance of Bitcoin by mainstream financial markets suggests that Bitcoin could continue to break records in the near future. With Bitcoin’s market capitalization now exceeding $2.7 trillion and an increasing number of pro-crypto policies in the U.S., the future of Bitcoin looks incredibly promising.

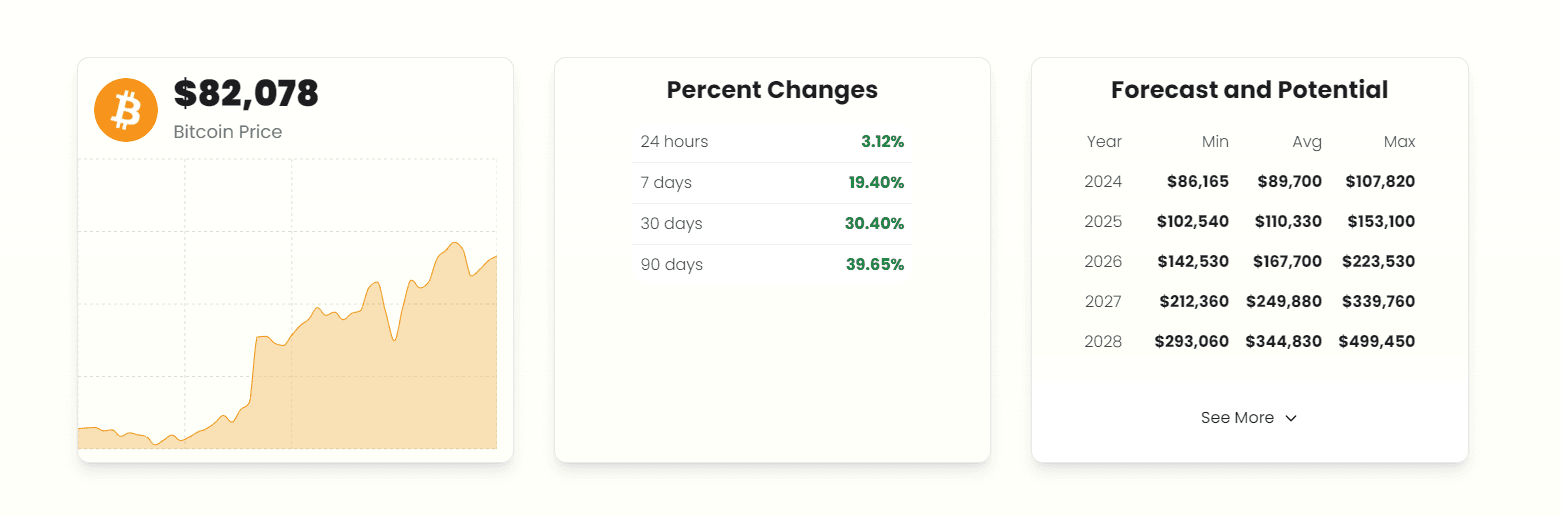

By CryptoTicker – Bitcoin Price Prediction

So, in the short-term Bitcoin Price Prediction, key resistance levels to watch would be: $83k $85k, and $89k. A success surpassing these levels could launch BTC price to over $90k. And if this Bitcoin surge continues stronger, it is very likely to see Bitcoin price over $100k, but the major resistance level would have to be around $99k and $101k. These would be for November and December 2024.

But when Trump is back in office, higher levels could be expected for BTC price in early 2025. So based on Bitcoin price performance and levels reached these November and December can set the path of Bitcoin price in the future after Trump’s return to the White House officially. Analysts’ opinions are divided in the long run, some expect Bitcoin price rally to slow down in early 2025, while others expect it to skyrocket fueled by the adoption of cryptos and Bitcoin in particular worldwide reaching the digital era highly awaited sooner than expected.

By TradingView – BTCUSD_2024-11-11 (All)

Key Takeaways: Why Bitcoin Price Surge Matters

- Trump’s Pro-Crypto Policies: Trump’s election has sparked optimism for Bitcoin’s future with promises of a Bitcoin stockpile and pro-crypto regulatory reforms.

- MicroStrategy’s Strategy: MicroStrategy’s aggressive Bitcoin acquisitions have not only added billions to its portfolio but also helped establish Bitcoin as a corporate treasury asset.

- Institutional Adoption: Bitcoin ETFs and growing institutional interest are major catalysts for Bitcoin’s price surge, reflecting broader acceptance of digital assets.

- Bitcoin’s Future: With analysts predicting that Bitcoin price could hit $100,000 by the time Trump is inaugurated and potentially $300,000 by 2026, the bullish trend is expected to continue.

As Bitcoin price pushes new highs, the crypto community is closely watching the market’s next moves, which will likely be influenced by ongoing regulatory changes and broader economic conditions.

Read the full article here