The approval of spot Bitcoin (BTC) exchange-traded funds (ETFs) in January, and Ethereum (ETH) ETFs in May brought forth a new chapter for cryptocurrency adoption as it helped ease exposure to the crypto market for many more traditional investors.

The moves also generated a new debate – which cryptocurrency will see its proposed spot ETFs approved next, with the most frequent answer seemingly being Solana (SOL).

There is a mix of arguments with regard to a SOL ETF with it, on the one hand, likely to generate the most interest once BTC and ETH are excluded. On the other, the fact that the SEC already indicated Solana to be a security in its filings against the crypto exchanges Coinbase (NASDAQ: COIN) and Kraken could prove a major hurdle.

Nonetheless, with the excitement about the two rounds of spot crypto ETF approvals within months after many years of waiting, Finbold decided to ask if the most advanced model of OpenAI’s flagship artificial intelligence (AI) platform – ChatGPT-4o – agrees that Solana is next, and what impact might an approval have on the price of SOL.

ChatGPT identifies the most likely next crypto ETF

Rather than immediately pinpointing Solana as the most likely cryptocurrency to have an ETF approved, ChatGPT identified the five most likely candidates: Cardano (ADA), Polkadot (DOT), Binance Coin (BNB), Ripple (XRP), and, indeed, SOL.

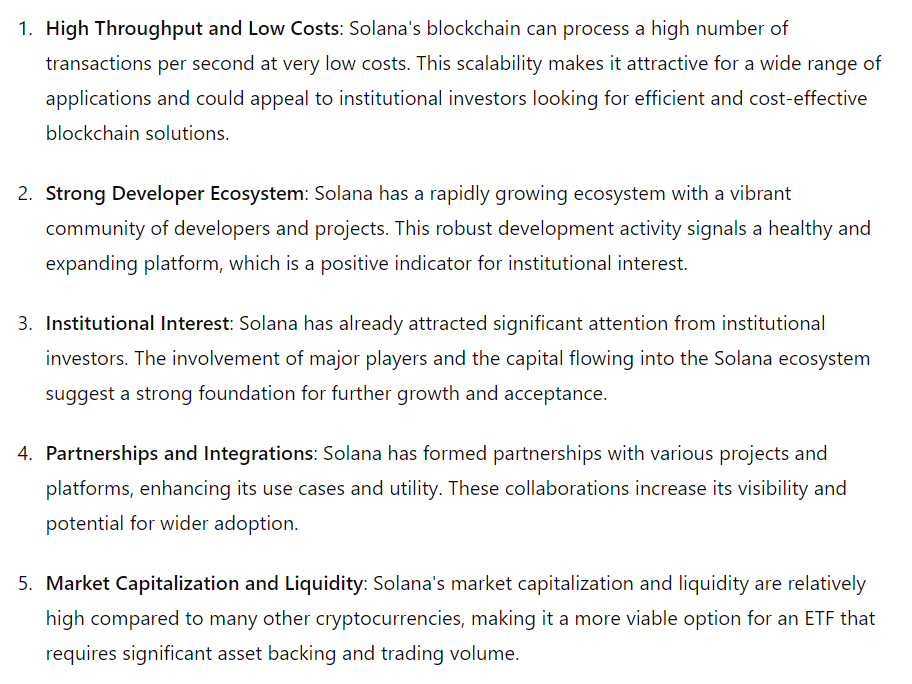

Nonetheless, when asked which of the five is the most likely, the AI conceded that it is Solana, given that it benefits from its size, high throughput and low costs, integrations, and widespread interest.

ChatGPT estimates impact of ETF approvals on Solana price

Though the timing of approval of SOL ETFs is, at the time of publication, completely unknown, unknowable even, ChatGPT agreed to estimate the likely price movements caused by such an event.

Using both its knowledge about Solana and its own unique circumstances, but also the precedents set by ETH and BTC ETFs, ChatGPT estimated that SOL would rise to a range between $180 and $200 in the immediate aftermath of an approval but then rocket to between $250 and $300 in the subsequent months.

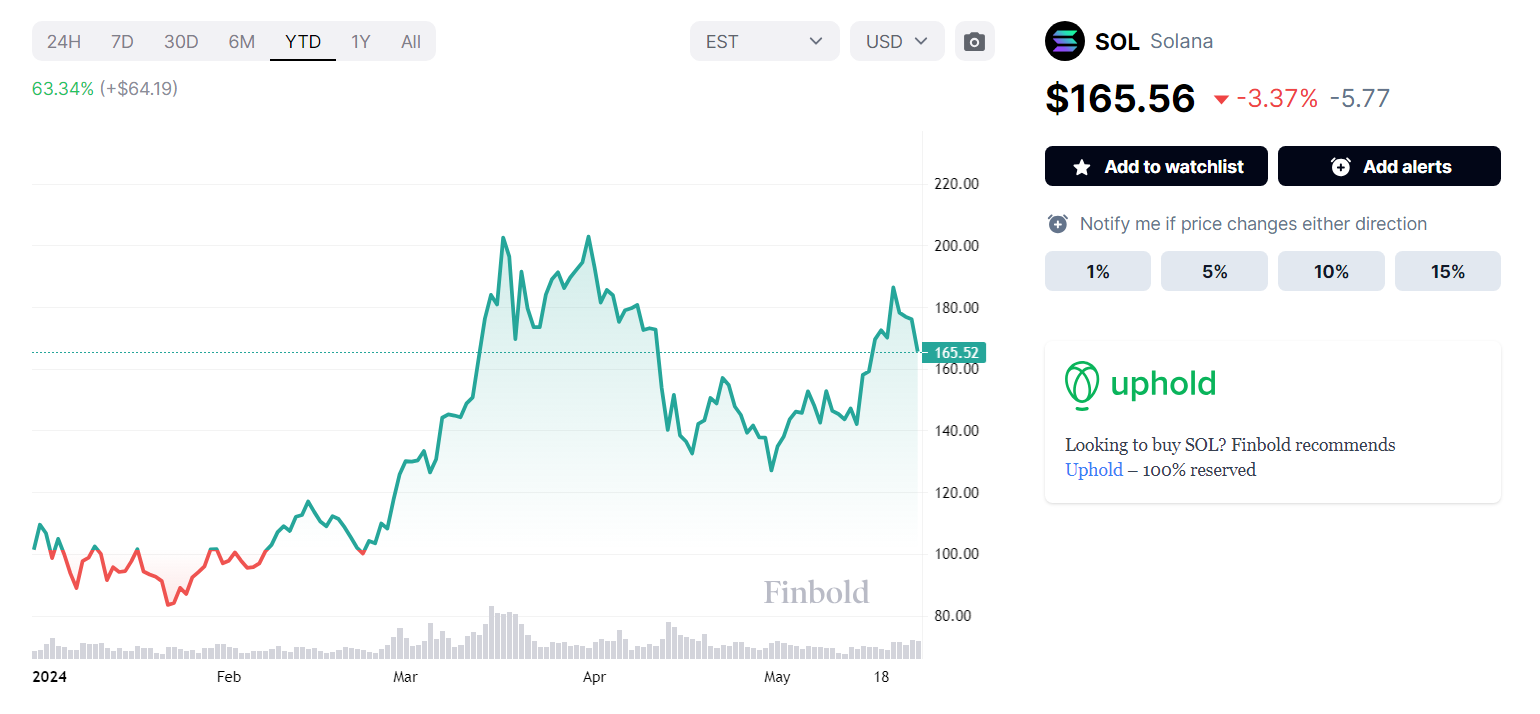

Still, it is worth noting that such an estimated price target is intrinsically linked to Solana’s price today – $165.56 – and its recent performance, it would perhaps be more useful to express the likely price movements in percentages.

Indeed, under the assumption that a SOL ETF approval would come in a bull market as it did for BTC and ETH – a likely scenario given SEC’s tendency to be quiet or dovish during a rally and hostile during a downturn – ChatGPT’s estimate indicates a movement between 8.72% and 20.80% in the immediate aftermaths, and between 51% and 81.20% over the course of several months.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Read the full article here