Despite Maple Finance’s impressive growth—nearing $1 billion in active loans and expanding its footprint to Solana—the platform’s native token, SYRUP, is showing signs of fatigue.

After a staggering 355% rally from its April lows, the token has stalled, with on-chain data pointing to slowing user adoption and diminished whale interest. While the protocol’s fundamentals appear strong, technical indicators such as a bearish double-top pattern and weakening network activity suggest that SYRUP’s recent momentum may wane.

At last check Sunday, Maple (SYRUP) price was trading at $0.40 — a few points below this month’s high of $0.4637.

On-chain data shows that SYRUP’s network growth has plunged. It moved from 1,085 on May 9 to 37 today. This metric looks at the number of new accounts created each day.

More data reveals that the daily active addresses have dropped from 285 on May 9 to 422. These numbers mean that the SYRUP token is not growing as it did in May, when it surged.

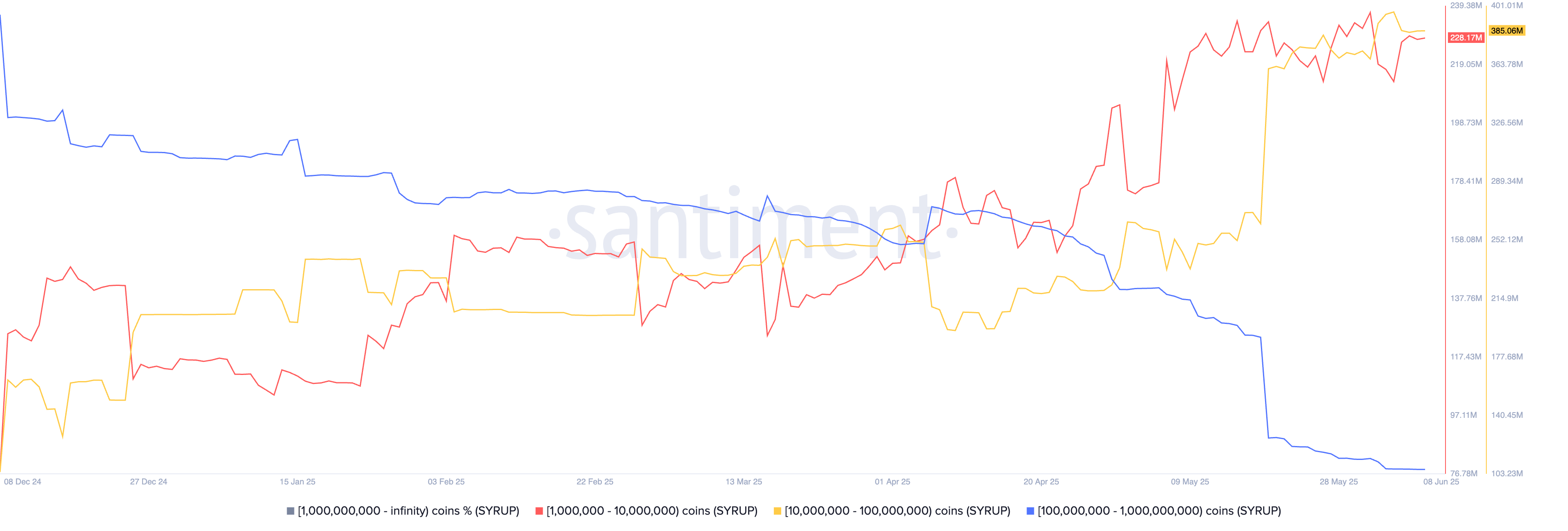

SYRUP on-chain metrics | Source: Santiment

Meanwhile, whales are also not buying the coin. Addresses holding between 10 million and 100 million SYRUP tokens now hold about 384 million, down from last week’s high of 395 million.

Similarly, those holding between 1 million and 10 million tokens hold 228 million tokens, while those with between 100 million and 1 billion tokens have 458 million coins, down from 803 million in March.

Maple Finance whale activity | Source: Santiment

You might also like: Flipping Uniswap, Flopping on Price: PancakeSwap Paradox

Maple Finance nears $1b in active loans

On the positive side, Maple Finance’s network is growing. Active loans jumped to $998 million, meaning that they could hit $1 billion soon.

This is a big increase since these loans stood at $220 million on Jan. 1. It also achieved $2 billion in assets under management.

$2B AUM.

In just 6 months, Maple’s gone from rebuilding, to resurgence, to the leader in onchain asset management.

Here’s to the next $2B and beyond. 🥞 pic.twitter.com/eIQx4XiS8y

— Maple (@maplefinance) June 7, 2025

Maple Finance’s growth may continue after the network expands in Solana (SOL) by leveraging Chainlink’s oracle.

This integration has already started bearing fruit as the amount of syrupUSDC in circulation on Solana jumped by 35 million within the first 24 hours.

SYRUP price technical analysis

Maple price chart | Source: crypto.news

The eight-hour chart shows that the SYRUP token peaked at $0.4595 in May, forming a double-top pattern with a neckline at $0.3184. A double-top is a common bearish reversal pattern.

Maple Finance’s Relative Strength Index has formed a bearish divergence pattern. As its price rose, this divergence took the form of a downward channel.

Therefore, the token will likely continue falling as sellers target the neckline at $0.3184, its lowest point on May 31, and 22% below the current level.

Read more: Bitcoin price stalls as spot ETFs bleed for second week

Read the full article here