Chainlink announced today that it’s partnering with Mastercard, allowing billions of cardholders to purchase crypto directly on-chain. The companies’ new infrastructure will indirectly interface clients with multiple DEXs.

In addition to these two leaders, several other companies, such as ZeroHash, Swapper Finance, Shift4, and XSwap, are joining the endeavor. Uniswap has agreed to participate as a DEX directly interfacing with the platform.

Chainlink and Mastercard Combine Forces

Chainlink, a decentralized blockchain oracle network, has recently integrated with several payment services to broaden market access to crypto.

By partnering with Mastercard, Chainlink will be able to turbocharge this overarching strategy. Essentially, this will combine an industry standard for interoperability with billions of potential users:

To be clear, these companies are formidable, but Chainlink and Mastercard can’t build this kind of infrastructure on their own.

The two firms have partnered with several ancillary companies, like Swapper Finance, Shift4, Zerohash, and more to provide liquidity, execute smart contracts, power the underlying platform, and perform other such functions.

As a result, these companies’ combined result is quite formidable. As Chris Barrett, Chainlink’s Head of Communications, put it, Mastercard clients will be able to integrate with major decentralized exchanges.

Uniswap is already participating in the program. This will give Mastercard’s enormous user base access to a very broad range of available cryptoassets.

Mastercard has ventured into the crypto industry before, but this Chainlink partnership is on a whole new level. Raj Dhamodharan, the firm’s Executive Vice President of Blockchain and digital Assets, called the new infrastructure a way to “revolutionize on-chain commerce” and drive global crypto adoption.

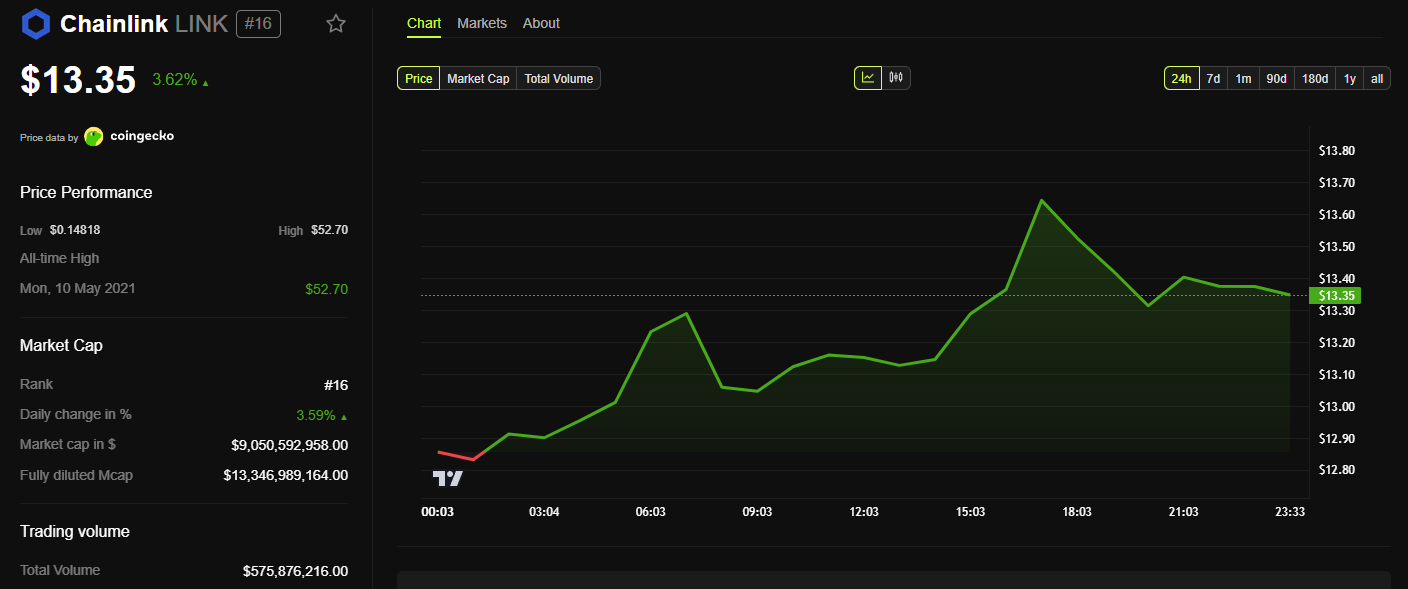

Although Chainlink’s LINK token isn’t directly involved in the Mastercard partnership, it still stands to benefit. Despite hitting a monthly low earlier this week, the token’s price has skyrocketed in the last few hours, recovering around 8% since yesterday.

The platform for this massive crypto expansion is already live, allowing users to experiment with this new infrastructure layer. Chainlink and Mastercard have their work cut out for them, setting some extremely ambitious goals.

If even a fraction of the credit card company’s users participate in the program, it could enable truly massive crypto adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Read the full article here