Donald Trump and the Republican Party at large had a strong 2024 election, winning the presidency, Senate and House. This almost certainly guarantees crypto legislation will advance and become law sometime in the next two years. It also heralds a potentially softer approach from regulators toward the sector.

Taking stock

The narrative

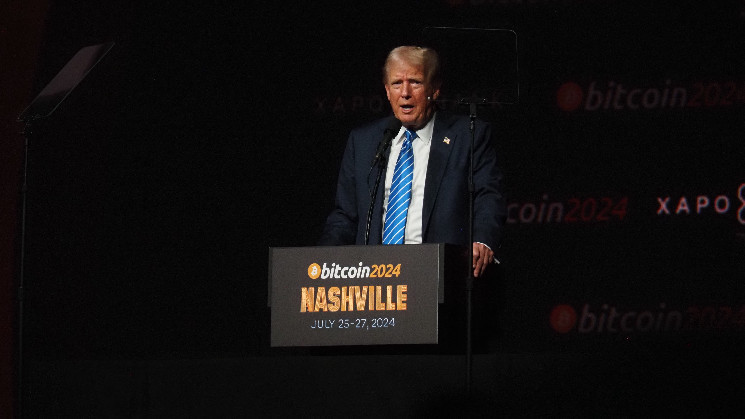

Last week Donald Trump won his second presidential race in three tries.

During his campaign, Trump said the U.S. would become the crypto capital of the planet. Soon we’ll see whether and how he’ll deliver on those promises. So far, his only official announcement since the election that has any — even weak — sort of crypto tie is appointing X/SpaceX/Tesla CEO Elon Musk and former Republican presidential candidate Vivek Ramasway to head up the “Department of Government Efficiency,” some sort of advisory panel tasked with reducing government costs. DOGE, of course, is the ticker symbol for the popular memecoin. Trump is selling shirts with the DOGE dog, or at least a lookalike, as well as his and Musk’s faces.

Why it matters

The U.S. — and global — crypto industry will be watching to see just how, exactly, Trump shapes policies and regulations around the sector and what that means for businesses.

Breaking it down

There are a few broad conclusions I think we can draw based on the results so far.

1. The crypto industry confirmed that in a post-Citizens United world, money talks.

Fairshake dumped $40 million into Senator-elect Bernie Moreno’s Ohio race against incumbent Senator Sherrod Brown. Brown ran ahead of Democrats’ presidential candidate, Kamala Harris, but ultimately still lost his seat amid Republicans’ broader sweep last week.

Overall, Fairshake has backed over 50 candidates who won their races, and may see just five candidates lose their general election races (as of press time, that number is three; California’s 45th district and Alaska’s at-large district are still counting votes).

We’ll have a deeper analysis on Fairshake and its track record soon.

2. The chances of some kind of crypto bill passing have gone up.

Republicans will hold the House, Senate and White House. While crypto probably won’t be priority number one, the chances of some kind of crypto legislation — whether that’s a new version of the Financial Innovation and Technology for the 21st Century Act (aka FIT21), a stablecoin bill, a Bitcoin strategic reserve bill or something else entirely — passing through the legislative process and becoming law have increased dramatically.

Just what that bill may actually be is less clear.

Industry groups are coordinating to get on the same page, said Kristin Smith, CEO of the Blockchain Association, a lobbying organization.

“This is the time to get the policy done. We’re really excited,” she said.

3. We still don’t know who may lead the Securities and Exchange Commission, Treasury Department or Commodity Futures Trading Commission.

These are probably the three entities most directly of interest to the crypto industry. Trump has named a number of his future Cabinet nominees, including Representative Matt Gaetz as attorney general, Robert F. Kennedy Jr. to run the Department of Health and Human Services and Pete Hegseth to run the Department of Defense

Former SEC Chair Jay Clayton, who set in motion much of Gary Gensler’s SEC crackdown on crypto, will be Trump’s pick to run the U.S. Attorney’s Office for the Southern District of New York — i.e. the Department of Justice branch best known for pursuing corporate crime. This is the team that prosecuted Sam Bankman-Fried and is prosecuting Roman Storm, Keonne Rodriguez, William Lonergan Hill, KuCoin and others.

While some names have floated around for some of these financial regulator roles, we don’t yet know who will actually receive the nods or how they’ll direct policy.

On the SEC front in particular, a new chair may not mean that the regulator’s active cases against exchanges like Coinbase, Kraken or Binance are immediately dismissed.

There are many ways the cases could be settled, Smith said, but “I don’t think it’s a guarantee” that they will be settled or settled quickly.

Former SEC attorneys and staff agree, Jesse Hamilton reported.

In the Treasury Department, both the head of the department itself, as well as the Undersecretary for Terorism and Financial Intelligence — the role now held by Brian Nelson — can affect crypto policymaking (recall that under Trump’s first term, Steven Mnuchin proposed having wallets collect know-your-customer information and oversaw the U.S.’s role in driving the Financial Action Task Force to implement the so-called travel rule for crypto).

And, of course, if Congress passes a bill directing the CFTC to become a primary market regulator for some digital assets, whoever heads that agency up will have a lot of sway over how exactly that happens.

Read the full article here