A sharp divergence has emerged in the exchange token sector over the past two months, highlighting a market that is increasingly rewarding utility and sound tokenomics while punishing perceived risks. An analysis of five prominent exchange tokens shows that while Binance Coin (BNB), Bitget Token (BGB), and OKX’s OKB posted respectable gains, Bybit’s Mantle (MNT) and GateToken (GT) trailed with significant losses.

According to CryptoRank data, an investor holding $10,000 in any of five prominent exchange tokens BNB, BGB, OKB, MNT, and GT would have seen significantly different returns depending on their pick.

💰 Holding $10K in Exchange Tokens: Who Came Out Ahead?

Here’s how $10K in native tokens performed across 5 major exchanges over 2 months:

• Binance $BNB: +10%

• Bitget $BGB: +7%

• OKX $OKB: +6%

• Bybit $MNT: -12%

• Gate io $GT: -13%$BNB, $BGB, and $OKB held up well… pic.twitter.com/baOzT07H6L— CryptoRank.io (@CryptoRank_io) June 10, 2025

The Winners’ Circle: BNB, BGB, and OKB Lead the Pack

BNB led the group with a 10% increase, boosted by consistent buying pressure and clear bullish structure on daily charts. The token hovered around $661.21 recently, testing the $668 resistance.

Source: CoinMarketCap

Volume surged 20%, pointing to growing interest among traders. With its full circulating supply in play and no inflation risk, BNB remains a solid asset in the exchange token space.

Related: Analysis Platform Reveals The Top Blockchains By Monthly Revenue

Close behind, BGB rose 7%, not only showing price appreciation but also offering top-tier farming rewards. It hit $4.80 amid rising momentum and whale accumulation signals. Volume jumped nearly 29%, suggesting that the token is gaining traction.

Source: CoinMarketCap

Support held strong at $4.6764, while resistance at $4.84 showed traders locking in profits. BGB’s relatively low liquidity means it remains sensitive to large trades, but that hasn’t stopped its steady climb.

Related: Binance Is the Top Performing IEO Launchpad: Analysis Platform

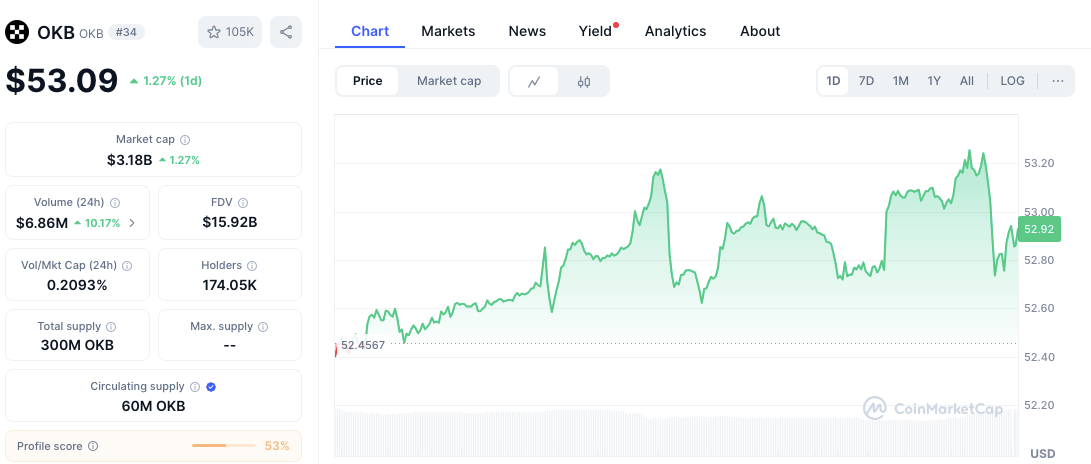

OKB followed with a 6% gain, displaying mild bullishness but less conviction than its peers. Priced at $52.85, the token hovered near resistance at $53.20.

Source: CoinMarketCap

Though its volume growth was modest, the limited circulating supply (60M vs. 300M total) hints at controlled inflation a possible edge for long-term holders.

The Laggards: MNT and GT Weighed Down by Supply Concerns

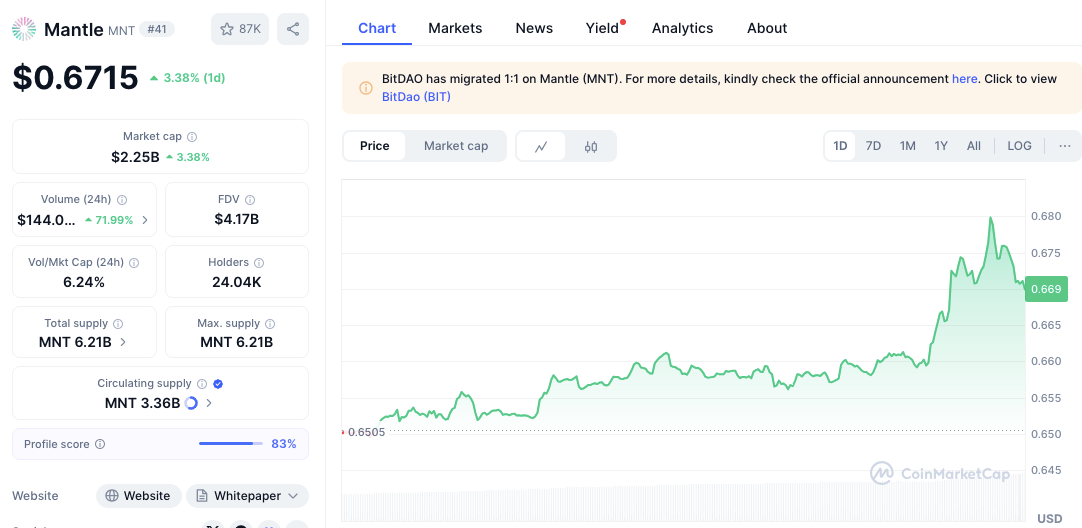

Source: CoinMarketCap

Not all exchange tokens enjoyed a bullish run. Mantle (MNT) dropped 12%, despite a short-term rally to $0.6707. Strong volume indicated active trading, but looming supply dilution cast a shadow. While liquidity was high, the risk of token unlocks remains.

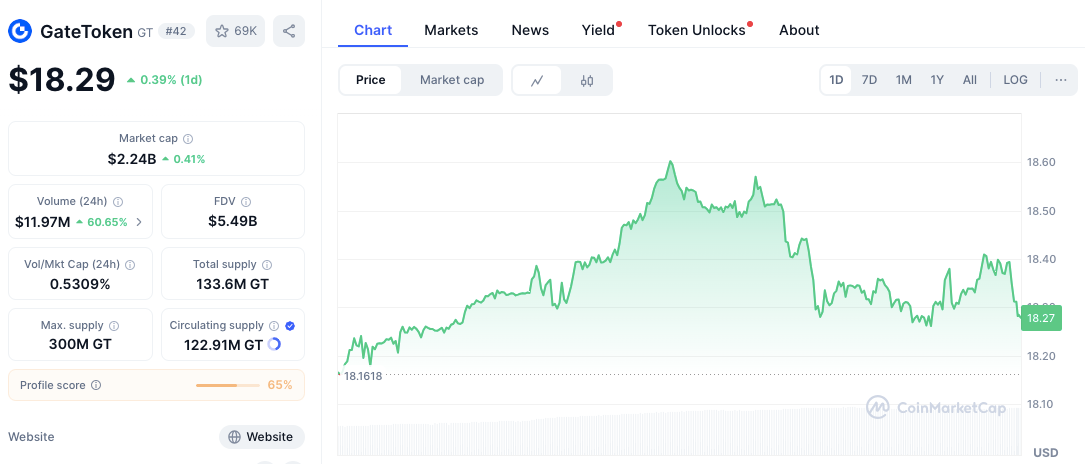

Source: CoinMarketCap

GateToken (GT) fell 13%, the worst among the five. Its price hit $18.28, pulling back after failing to break $18.65.

Despite a 60% volume spike, its chart showed more consolidation than momentum. With less than half of its total supply in circulation, inflation risk could be holding it back.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Read the full article here