Ethereum, the second-largest cryptocurrency after Bitcoin, has experienced significant gains lately even as other digital assets retreat from the recent market rally. CoinaMarketCap‘s data shows that the token is trading at $3,635, up 5% and 10% in the past day and week, respectively.

This trend, coinciding with Donald Trump’s victory in the U.S. presidential election, has highlighted a growing appetite for risk assets and Ethereum’s potential to break key resistance levels. Amid the rise, the market is watching the next ETH price level of $4,000 with the current bullish technical indicators and strong fundamentals.

Among the factors boosting ETH is leveraged ETF products, which have reportedly experienced a substantial rise in demand since early November. The demand for VolatilityShares 2x Ether ETF rose 160% since November 5, Cointelegraph reported.

In the three weeks since the election, investor confidence in risk assets like Ethereum has surged, fueled in part by expectations of a more favorable regulatory environment. Although Bitcoin led the surge with new all-time high prices, Ethereum’s price has been steadily climbing, positioning it as a strong-performing cryptocurrency in the coming months.

Ethereum Weekly Chart, Source: CoinMarketCap

Ethereum moved from a low of $3,260 on Tuesday to a high of $3,685 on Thursday, representing a 13% increase in just 2 days. ETH’s gains are more substantial on the monthly chart. The token has surged 37%, with technical indicators like the Relative Strength Index (RSI) and moving averages suggesting strong bullish momentum.

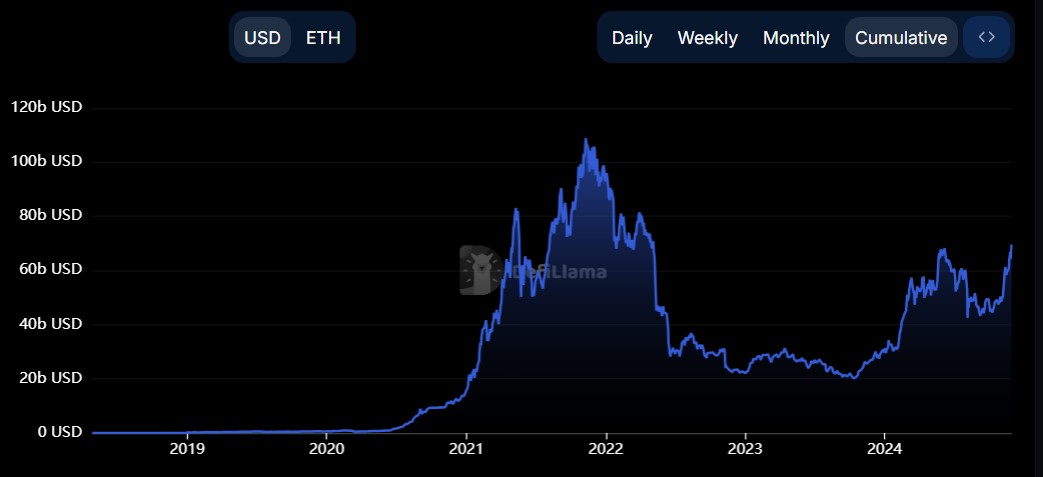

This optimism is further fueled by the network’s dominant role in decentralized finance (DeFi), where it commands over half the total value locked across all platforms. Data from DefiLlama shows that Ether has nearly $70 billion in TLV, although slightly lower from 2021’s, more than $100 billion.

Ethereum Total Value Locked, Source: DefilLlama

Ethereum’s fundamentals remain robust, with rising on-chain activity, new wallet creation, and increased revenue. Layer-2 scaling solutions also attract developers and users, enhancing the network’s scalability and competitiveness.

Bitcoin Factor

Bitcoin’s struggle to break past the $100,000 mark could inadvertently benefit Ethereum. Analysts speculate that Bitcoin’s range-bound trading may divert investor attention and funds toward Ethereum, pushing its price higher.

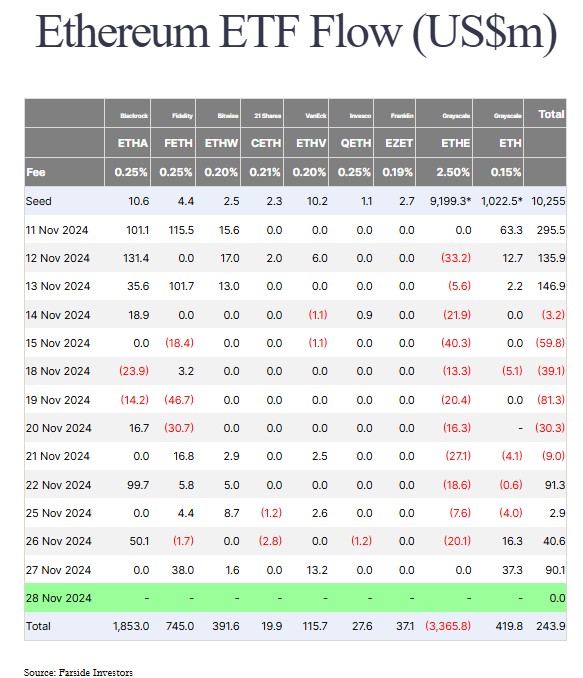

Additionally, Ethereum ETFs have logged consistent inflows, with $90 million added over four consecutive days, according to Farside data. Ethereum remains the backbone of the DeFi ecosystem.

Ethereum ETF Flows, Source: Farside Investors

Lido, Aave, and EigenLayer collectively hold a significant share of this value. Stablecoin activity on Ethereum has also surpassed Tron, with $60.3 billion in USDT now hosted on the Ethereum network, Coindesk reported.

The broader market sentiment around Ethereum has also benefited from Trump’s pro-crypto campaign promises. His administration has signaled a reduction in regulatory hurdles, sparking hopes of a DeFi resurgence in the U.S.

Read the full article here