Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Altcoin season might not have officially started — but there are signs.

In October alone, 20 of the top 500 cryptocurrencies by market cap reached new price records, including sui, mantra and fasttoken.

There’s also whitebit, the native token for the Ukrainian crypto exchange of the same name, which has ballooned to a $2.5 billion market cap from under $500 million in February.

And okay, 14 of the all-time highs were set by memecoins — some of which were launched quite recently, like goat and sudeng — so they don’t count as much.

The same goes for tokens for restaking protocol eigenlayer and Sui-native decentralized CLOB deepbook, which also started trading in October.

Each circle on the chart above represents a different cryptocurrency, plotted against the total capitalization of the market. Their position on the chart shows when that coin last hit an all-time high.

The darker the circle, the further away that coin is from an all-time high. So, the brighter circles — generally the coins that set price records more recently — are closest to those records right now.

Dampening the good vibes are the 166 coins which hit all-time highs during the bull market (between mid-2020 and mid-2022) still far below those marks.

They’re down 89% on average and the median is down 92%. Crypto exchange Gate.io’s native token is the closest of the coins with decent market caps, 31% below its record high as of this weekend, followed by SOL (39% below) and ETH (46%).

The real point of contention is whether the next altcoin season would truly favor hot coins of the previous cycle. Most would need to multiply in value many, many times over from here to see new price records.

Something tells me we could be in for a very different altcoin season.

— David Canellis

Data Center

- All eyes are on BTC and whether it can break $70,000 for the first time since June (BTC: $68,294; ETH: $2,707).

- APE, DOGE and MEW lead the front page for weekly gains with 100%, 30% and 29%, respectively.

- Ethereum mainnet handled about 8.5 million transactions last week, per Blockworks Research data, the most since the local top in March.

- Solana has now flipped Tron for TVL: $7.72 billion to $6.89 billion after adding 16% overnight. That last happened in April 2022.

- Token presales for Trump-linked World Liberty Financial have slowed to a crawl, now at $13.79 million, or almost 5% of the goal.

What a weekend.

For a moment there, it looked like bitcoin was trying for $70,000 — a level we haven’t seen since this summer (in case you somehow forgot, it was just a few months after we last carved out an all-time high).

Right now, we’re in a bit of an odd situation as we play out the wait-and-see game. The election is acting as a blockade, keeping folks at bay from token launches — which could be a mixed bag for crypto — and potential all-time highs.

“We are at an inflection point with prices just shy of $70,000, so with the US election cleared and further rate cuts on the horizon BTC is positioning to potentially move higher and test all-time highs,” FalconX’s Ivan Lim told me.

Adding to that, FalconX’s David Lawant thinks that, until election day, we’re going to continue to see implied volatility — though it will be “muted” leading up to the election itself. After the election? Well, there’ll be an “interesting set-up.”

“A top-side heavy positioning suggests investors are relatively more willing to use the options market to capture additional price upside,” he added.

ETC Group noted that last week saw a pick up in both bitcoin futures and perpetual open interest. Specifically, perpetual funding rates hit their highest level yesterday since June of this year after remaining positive throughout last week.

Here’s the deal: “When the funding rate is positive (negative), long (short) positions periodically pay short (long) positions.”

Basically, a positive funding rate can be a sentiment read and it’s generally a sign of bullishness in the perpetual futures markets.

To give us some idea of overall sentiment, ETC Group’s Cryptoasset Sentiment Index hit its highest level since March 2024, signaling a bullish vibe at the moment.

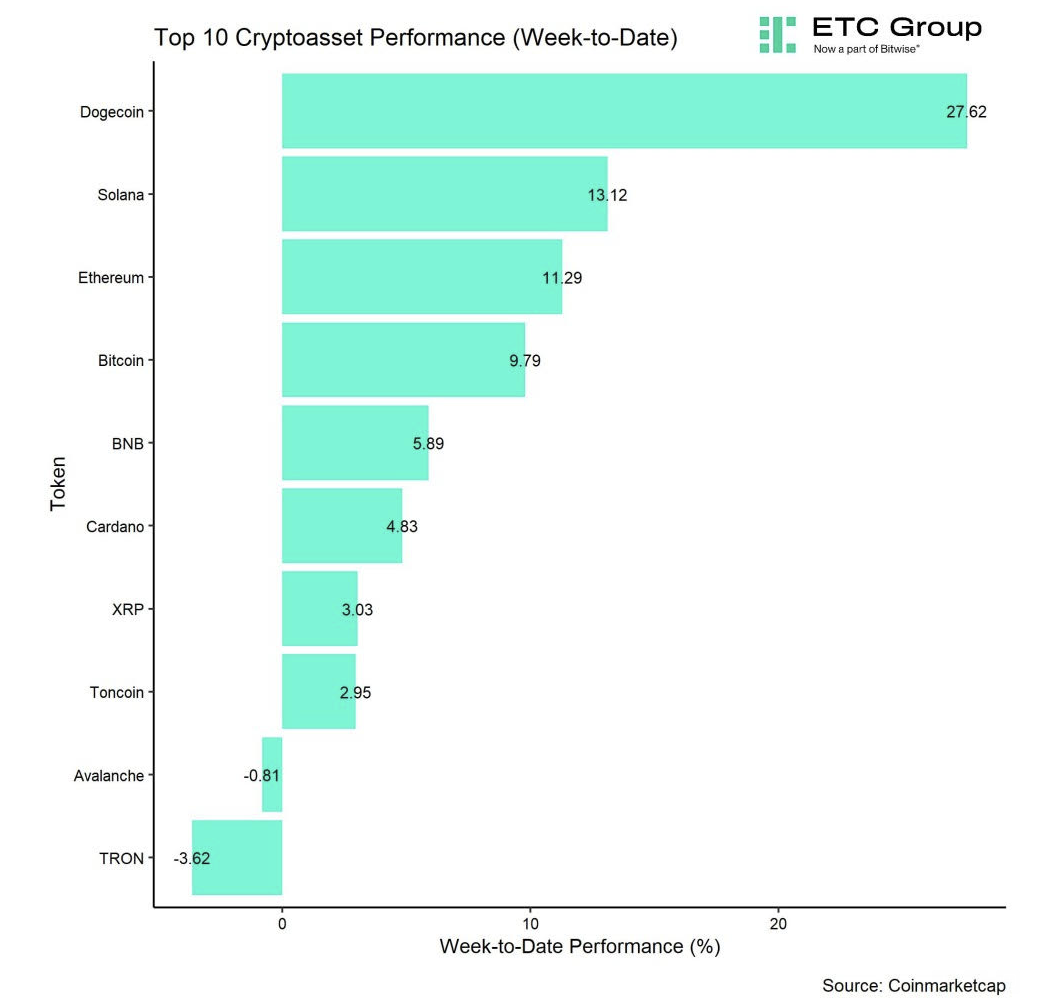

And it’s not just bitcoin’s party. Ether managed to outperform bitcoin last week, ETC Group noted. Dogecoin and solana also led the top 10 outperformers.

Source: ETC Group

“In general, increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin outperformance still signals a decrease in risk appetite at the moment,” ETC Group analysts wrote.

Brb, gonna get my popcorn ready for the next few weeks.

— Katherine Ross

The Works

- Crypto PACs continue to focus on political spending, backing a number of Republican candidates, Axios reported.

- Stripe’s deal for stablecoin platform Bridge is “done,” with the payments company acquiring the stablecoin platform for a cool $1.1 billion, according to TechCrunch founder Michael Arrington.

- A handful of whales are skewing Polymarket odds for the US presidential election.

- Pump.fun’s team teased a potential token launch “in the future” during an X Spaces.

- ICYMI, crypto firm Copper welcomed a new CEO last week, and exchange OKX added a chief risk officer to their ranks.

The Riff

Q: Could we carve out new all-time highs before the election?

Never say never, I guess, but I do think that it’s unlikely.

There’s a reason why the traditional markets tend to hate uncertainty. Because of that, we sometimes see what could be read as an overreaction to events that give some, well, certainty to a situation. Unfortunately, bitcoin may very well be in the same boat.

My conversations with analysts and folks around crypto have shifted to focus on how bitcoin reacts after the election, no matter who’s in the office.

And I have to say, the overall feeling is quite bullish. We’ll just have to see if that plays out.

— Katherine Ross

Read the full article here