Ethereum (ETH) finally broke past the $4,000 resistance after months of consolidation below the level, and on-chain metrics are signaling that the asset is poised to hit new record highs.

Specifically, the second-ranked cryptocurrency by market capitalization is showing minimal resistance on the way up while maintaining strong support.

To this end, ETH is facing modest resistance around $4,540, with the asset recording a strong demand zone at $3,560, offering a solid foundation for a possible price breakout, according to on-chain data sourced from IntoTheBlock as shared by cryptocurrency analyst Ali Martinez in a December 7 X post.

“There is nothing preventing Ethereum from reaching new all-time highs. The only modest resistance zone ahead is around $4,540,”Martinez said.

The analysis is based on ‘Ethereum’s In/Out of the Money Around Price,’ which shows that about 89% of ETH holders are ‘in the money’ at the current price of around $3,990. A demand zone between $3,535.55 and $3,588.88 supports stability and includes over 11.6 million ETH purchased by 1.3 million addresses.

On the other hand, the resistance zone around $4,540 to $4,579 is relatively small, involving just 600,936 ETH held by fewer than 61,000 addresses. This suggests that once Ethereum surpasses $4,540, it could move rapidly toward new highs, with limited opposition from sellers.

Ethereum’s path to $10,000

At the same time, on December 7, a cryptocurrency analyst with the pseudonym Captain Faibik suggested that technical indicators show Ethereum has broken out of a massive triangle pattern on the weekly time frame, signaling the start of a potential 2025 bull run after a prolonged consolidation phase.

If this move is sustainable, the analyst suggested that Ethereum might face a possible midterm target of $10,000.

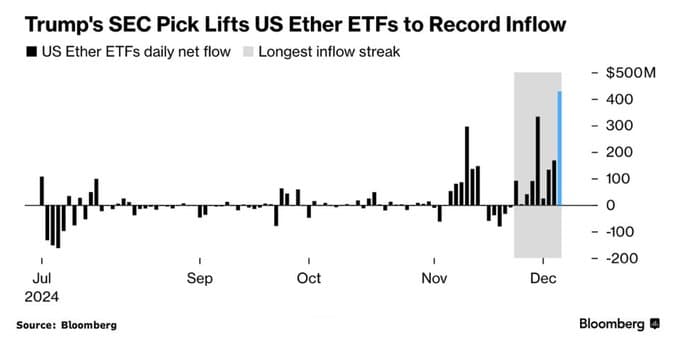

Part of Ethereum’s bullish sentiment is tied to the general crypto market rally initiated by optimism around Donald Trump’s election and his anticipated pro-crypto policies. At the same time, the cryptocurrency spot exchange-traded fund (ETF) is also witnessing record capital inflows.

Notably, on December 5, Ethereum ETFs recorded a historic $428 million inflow—the largest single-day inflow ever. This surge points to growing institutional confidence in Ethereum.

Besides the technical aspects, Ethereum’s price growth will likely be influenced by ongoing network development. In this case, Ethereum’s All Core Developers approved EIP-7691: Blob Throughput Increase, advancing plans for Pectra (Prague-Electra), the network’s most significant upgrade since The Merge.

EIP-7691 is anticipated to boost scalability by increasing blobs per block, which is essential for layer-2 solutions. After the 2025-2026 upgrade, the target and maximum blobs will rise to six and nine, potentially enhancing Ethereum’s efficiency and data capacity.

Ethereum price analysis

Ethereum was trading at $4,002 by press time, rallying almost 2% in the last 24 hours. On the weekly chart, the asset is up about 10%.

At the current valuation, Ethereum is showing bullish momentum both in the short and long term, as highlighted by the fact that ETH is trading above its 50-day ($3,029) and 200-day ($2,927) simple moving averages (SMA). However, momentum indicators, led by the relative strength index (RSI), signal overbought conditions, suggesting a potential short-term pullback.

Featured image via Shutterstock

Read the full article here