Stablecoins have become an essential part of the blockchain space, offering stability in a highly volatile market. Although there are dozens of stablecoins with different collateral available to investors today, Tether’s USDT remains the to-go choice for most crypto users.

In this article, we explore the importance of stablecoins, focusing on USDT and its unconditional dominance.

The Need for Stability

Stablecoins are digital assets designed to maintain a stable value by being pegged to a reserve asset, such as the US dollar, euro, or even commodities like gold. They achieve this stability through various mechanisms, including fiat-collateralized, crypto-collateralized, and algorithmic stablecoins. Fiat-collateralized stablecoins, the most common type, back each token issued with reserves of the corresponding fiat currency, ensuring support by a real-world asset.

While many crypto investors enjoy a bit of volatility, the level seen in most crypto assets can make it difficult to use them for payments or trading. Stablecoins address this issue by offering a stable and reliable alternative, facilitating their use in a wide range of applications, including base trading pairs, remittances, and decentralized finance (DeFi).

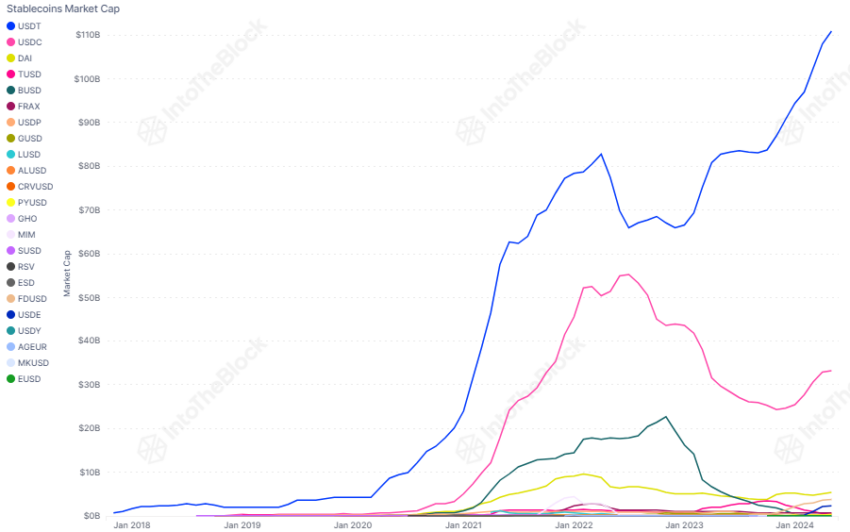

This has resulted in substantial growth for stablecoins, now boasting a combined market capitalization of $161 billion. The chart below highlights this significant increase, which began in 2020.

Read more: How to Buy USDT in Three Easy Steps – A Beginner’s Guide

Stablecoins Market Cap. Source: IntoTheBlock

“While some of this growth is due to the rising interest in cryptocurrencies, it is primarily driven by the growing importance of DeFi and the crucial role stablecoins play in DeFi primitives like lending protocols and automated market makers (AMMs),” Vincent Maliepaard, Marketing Director at IntoTheBlock, told BeInCrypto.

USDT: The Undisputed Market Leader

Despite strong competition, Tether (USDT) has established itself as the most important stablecoin in the cryptocurrency market. Launched in 2014, USDT is pegged to the US dollar, with each token purportedly backed by an equivalent amount of fiat currency held in reserve.

Data from IntoTheBlock shows that USDT, with a market cap of $111 billion, accounts for just over 70% of the total stablecoin market capitalization. In contrast, the second largest stablecoin, USDC, accounts for just 21%.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

Stablecoins Comparison by Market Cap. Source: IntoTheBlock

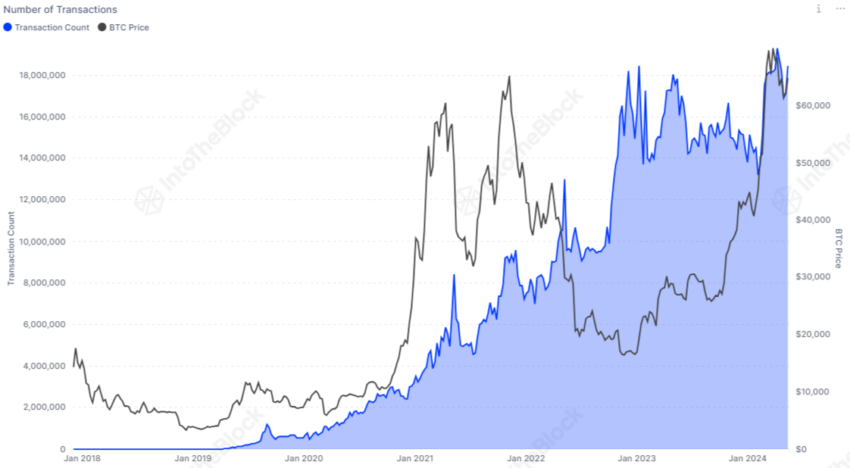

Furthermore, there is no sign that this growth is slowing down soon. The number of USDT transactions has significantly increased since the start of the year and is approaching new highs.

Number of USDT Transactions. Source: IntoTheBlock

Maliepaard notes USDT’s dominance is attributed to several factors:

- Liquidity and Accessibility: USDT boasts the highest trading volume among stablecoins and is available on most centralized and decentralized exchanges as a base trading pair.

- Integration with DeFi: Many DeFi protocols and platforms use USDT for transactions, lending, and borrowing, enabling participation without exposure to price volatility.

- Cross-Border Transactions: USDT facilitates fast and cost-effective cross-border transactions, offering an efficient alternative to traditional banking systems.

- Stable Store of Value: In regions experiencing hyperinflation or economic instability, USDT offers a reliable store of value.

Comparing Usage of USDT Across Different Chains

While USDT activity is booming across all chains, not all are created equal. Data suggests that users utilize stablecoins differently across various networks. By examining their behavior on different chains, we can see how USDT is utilized in diverse ways. Whether it’s for trading, transferring value, or acting as a stable store of value, USDT’s versatility is evident.

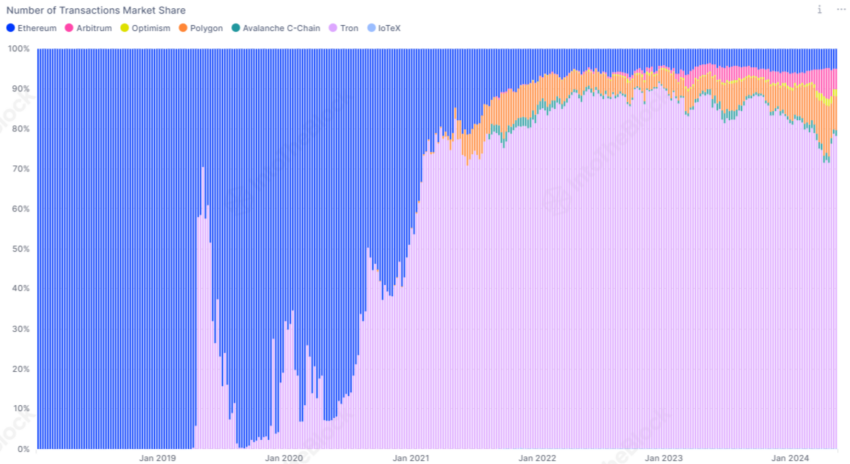

TRON Dominates USDT Transactions

TRON leads in transaction volume with a dominant 78% share. The chart below highlights its superiority compared to other blockchain networks.

This prominence is primarily due to TRON’s low transaction costs and high availability for deposits and withdrawals on major centralized exchanges, making it the preferred option for cross-border Tether’s USDT transactions. Surprisingly, the runner-up isn’t Ethereum but Polygon, which has over 8% of the total USDT transactions.

USDT Market Share by Chain. Source: IntoTheBlock

Transaction Volume Comparison

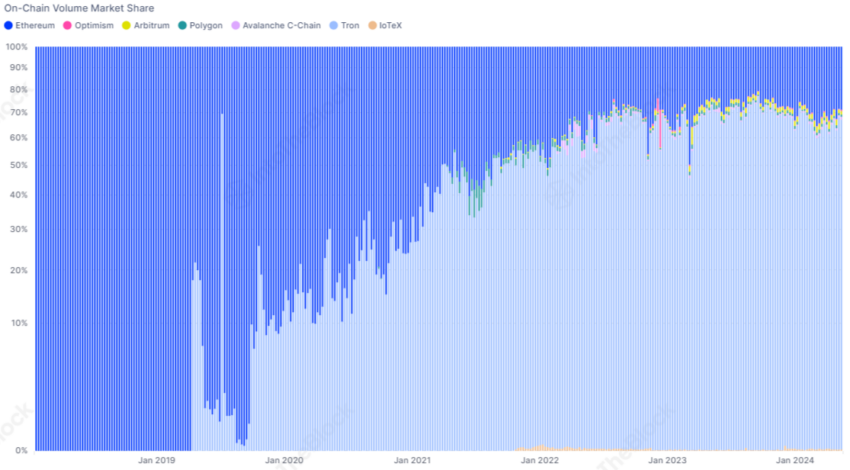

Examining the stablecoin’s volume market share reveals that Ethereum’s transaction volume far exceeds its number of transactions, highlighting its role in facilitating higher-value transfers. In contrast, chains like Polygon, Optimism, and Avalanche have a higher number of transactions but contribute less to the overall volume, indicating their use for smaller, more frequent transactions.

USDT On-chain Volume Market Share. Source: IntoTheBlock

Holding vs. Transacting

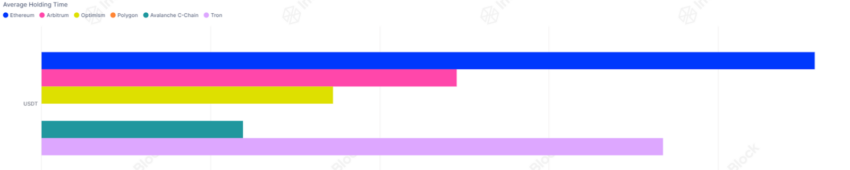

The average holding time of USDT on each chain further supports this finding. Data shows that Ethereum users typically keep USDT for 228 days, nearly three times longer than holders on Optimism. TRON addresses also maintain USDT for an extended period, averaging 183 days.

Average holding time. Source: IntoTheBlock

These insights indicate that on Ethereum and TRON, USDT is primarily held to mitigate market volatility, serving as a stable store of value. Conversely, on chains like Optimism and Arbitrum, USDT is frequently used for transactions, likely in DeFi-related applications where quick access to liquidity and transfer speed are crucial.

The Future of USDT

Stablecoins, particularly USDT, play a vital role in the blockchain industry by providing stability and enhancing the utility of digital assets. The recent growth of USDT across various blockchain networks solidifies its position in the cryptocurrency market. As the industry widens, the importance of stablecoins will likely grow, driven by their role in DeFi, trading, and bridging the gap between traditional finance and blockchain.

Read the full article here