Bitcoin price movements are at a critical level this June. With mixed technical signals, on-chain data, and heavy exchange inflows, the question arises—will Bitcoin price fall below $100K or push beyond $110K?

Recent whale activity, resistance zones, and key historical patterns indicate a tense period ahead for crypto traders and investors.

Bitcoin Whale Deposits Raise Market Concerns

The Tether Lending Collateral Custody wallet transferred 200 BTC to Binance on June 7, 2025. The amount, worth around $20.88 million, adds to the total of 1,650 BTC this wallet has deposited since May 9.

That date marked the return of Bitcoin price above $100,000. These movements are raising concerns about potential sell-offs.

On-chain data from Lookonchain shows that Binance received 3,200 BTC in net inflows over the past week.

This consistent pattern points to growing liquidity on exchanges. When large holders move assets to platforms like Binance, it usually precedes increased volatility. Traders and institutions often watch such activity closely for market signals.

Source: X

The current Bitcoin price stands at $104,300 as of June 7. With this level still below strong resistance, analysts are now watching whether recent inflows will lead to more downside.

Bitcoin Price Faces Rejection at Key Resistance as Bearish Pattern Unfolds

Crypto analysts remain divided over the short-term direction of the Bitcoin price. Well-known chartist Carl Moon recently stated,

“Bitcoin has almost reached the target I was talking about a few days before the dump!”

His technical analysis focused on a breakdown from a rising channel, followed by a failed retest of the lower boundary near $105,600. This zone, previously a support level, is now acting as strong resistance.

Carl’s chart highlights a bearish flag pattern that developed after the breakdown. This structure typically results in a downward continuation.

The flag was rejected at $105,600, reinforcing a short-term bearish trend. From that point, Carl projected a 5.25% drop, which would bring the Bitcoin price close to $100,000—a key psychological and technical support level.

Source: X

If this level fails, the next potential support is around $96,000. The rejection at a prior support turned resistance and the lack of bullish follow-through suggest sellers are currently in control of market momentum.

Macro Trends and Institutional Activity Still Supportive

Despite the short-term bearish patterns, institutional interest has remained steady. On June 5, the Bitwise Bitcoin ETF recorded $15 million in inflows. This suggests some large investors continue to accumulate despite exchange deposits by whales.

Crypto-related equities have also shown strength. On June 6, MicroStrategy shares rose 3%, and the Nasdaq gained 1.2%.

Bitcoin’s 30-day correlation with the Nasdaq Composite remains around 0.7, suggesting both are influenced by global risk sentiment.

Source: X

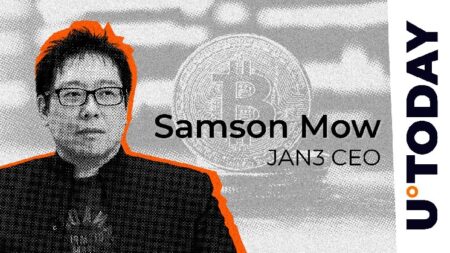

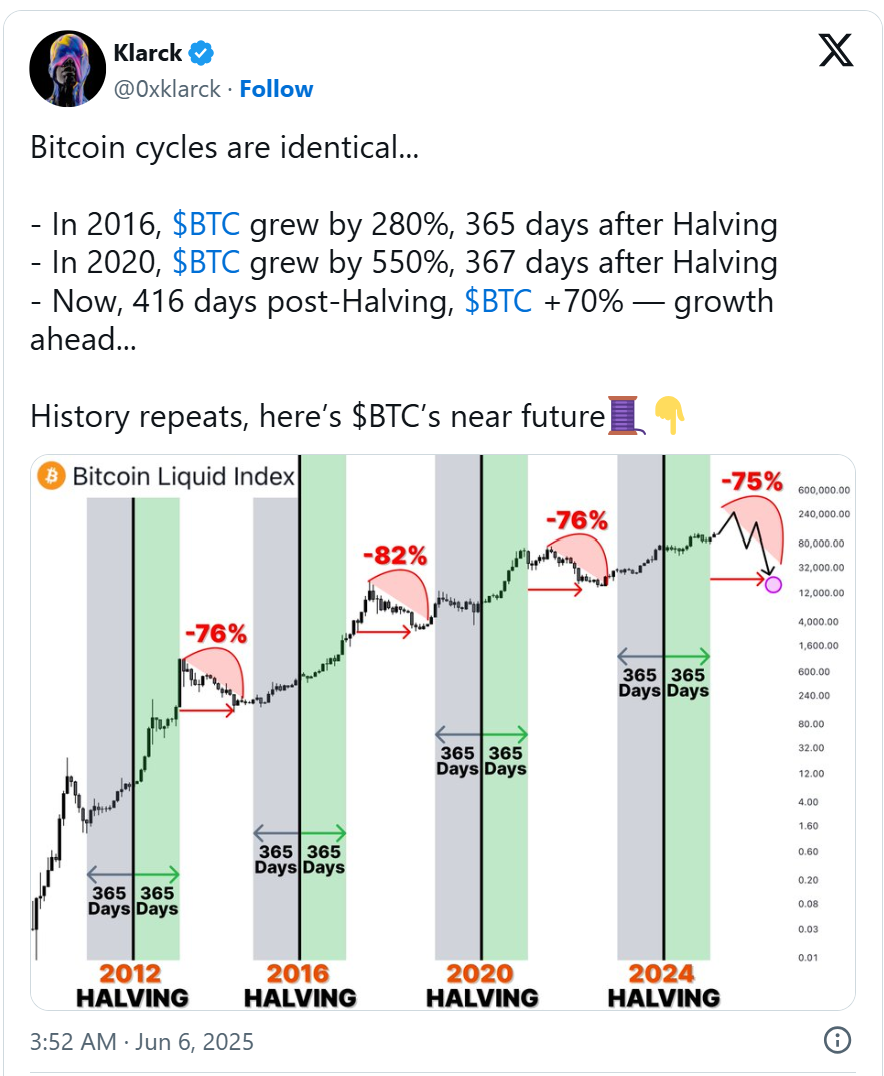

Historical patterns also support the idea of further upside. According to analyst Klarch, Bitcoin price has risen significantly in the months following past halving events.

He noted that Bitcoin gained 280% after the 2016 halving and over 500% following the 2020 event. So far, the post-2024 halving rally has reached only 70%.

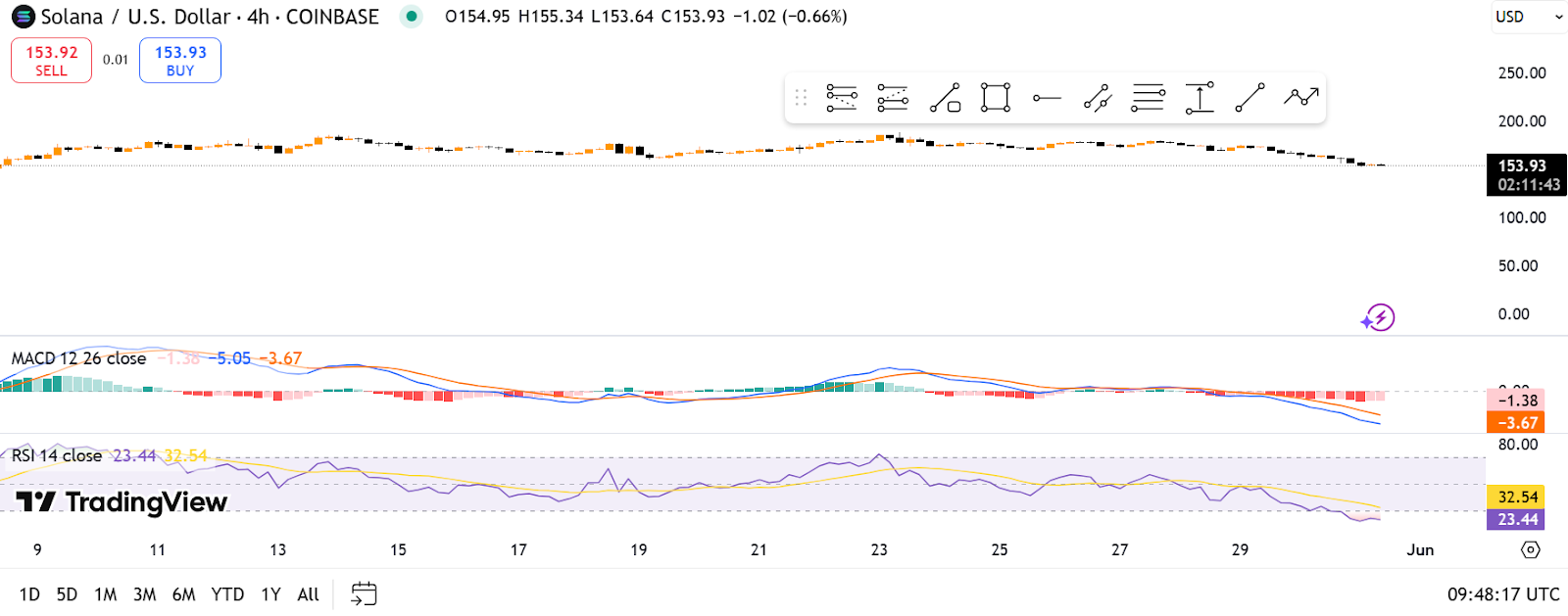

Bitcoin Price Technical Indicators Suggest Bearish Momentum

According to TradingView’s 4-hour chart, Bitcoin is at around $105,494, less than $1,000 away from the upper Bollinger Band at $106,589.

It indicates that the stock may be a little overbought in the near future. The bands have gotten wider, which shows that there is more volatility and the trend might keep going up.

At the current price, $104,352, the market is seeing strong support from the previous week’s transactions.

A strong bullish signal appears on the MACD 12, 26, 9 with the Moving Average Convergence Divergence line at +238 rising above the signal line at -13. A +252 reading on the histogram points to growing upward momentum.

A pattern like this is commonly followed by price rises in the next few to several weeks, especially when it appears after a recent dip in prices.

Source: TradingView

However, Bitcoin’s price continues to move within the boundaries of $101,000 and $110,000. A move below the middle Bollinger Band in Bitcoin might be an indication that consolidation is about to happen.

If Bitcoin moves higher than $107,000, it could show that bulls are in charge and make it possible for prices to rise more.

Read the full article here